Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

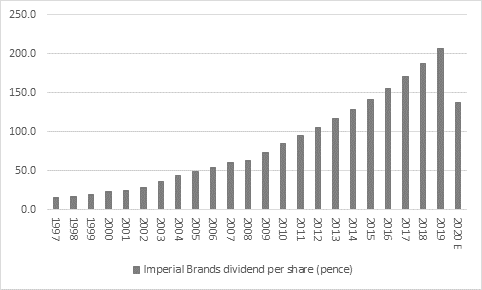

“And another one bites the dust. Imperial Brands' decision to cut its interim and full-year dividends by a third – the first time that the tobacco giant has even failed to increase its pay-out since it was spun out of the Hanson conglomerate in 1996, let alone cut it – takes the total of FTSE 100 firms to reduce, defer, suspend or cancel cash returns to shareholders to 46, with copper miner Antofagasta also joining the list today,” says Russ Mould, AJ Bell Investment Director.

Source: Company accounts, management guidance for 2020. Financial year to September. Adjusted for rights issues of 2002 and 2008.

“Shareholders will have been hoping for support from the dividend from the sale of the cigar business for just over £1 billion before tax in April, even if the sum received was below the asset value published of just under £1.3 billion in the annual report.

“However, the warning signs had been there. Like Shell, Centrica and others before it, Imperial Brands had, on paper at least, been offering a double-digit dividend yield, a figure which looked generous in the extreme at a time when the Bank of England base rate is 0.1% and the UK Government 10-year Gilt yield is 0.24%.

“Moreover, cash flow cover for the £1.8 billion annual dividend payment had been getting progressively thinner as operating performance disappointed and the stand-in executive team of Dominic Brisby and Joerg Biebernick has decided to call time on Imperial Brands’ golden run of dividend increases. Regulatory pushback against smoking, increased public health awareness and a failure to make a major impression on the next-generation product market with its blu vapour offering all continue to pressure operating profit and therefore cash flow.

| £ million | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|

| Operating profit | 1,988 | 2,229 | 2,278 | 2,407 | 2,197 |

| Depreciation & amortisation | 940 | 1,244 | 1,364 | 1,266 | 1,316 |

| Net working capital | 328 | 138 | 67 | (11) | 50 |

| Capital expenditure | (238) | (217) | (235) | (327) | (409) |

| Operating Cash Flow | 3,018 | 3,394 | 3,474 | 3,335 | 3,154 |

| Tax | (408) | (401) | (570) | (407) | (522) |

| Interest | (449) | (540) | (537) | (491) | (473) |

| Pension contribution | (50) | (111) | (157) | (60) | (72) |

| Free Cash Flow | 2,111 | 2,342 | 2,210 | 2,377 | 2,087 |

| Dividend | 1,259 | 1,386 | 1,528 | 1,676 | 1,844 |

| Free Cash Flow Cover | 1.68 x | 1.69 x | 1.45 x | 1.42 x | 1.13 x |

Source: Company accounts. Financial year to September.

“Net debt will be another reason behind the decision to cut the shareholder payment. A total net liability of £12.2 billion, adjusting for pension assets and liabilities and assets for sale, dwarfed shareholders’ funds of £4.9 billion, for a gearing ratio of 250%.

Source: Company accounts

“Imperial’s cut, added to that of Antofagasta, is another blow for income-seekers as they look for returns on their cash at a time of rock-bottom interest rates and bond yields that are being manipulated lower by central banks.

“Imperial Brands had been the tenth-biggest dividend payer in cash terms in the FTSE 100, based on 2019 numbers. Although Antofagasta had only ranked forty-second, the miner’s view to cut its previously-announced second-half payment by 70% thanks to a Covid-19 outbreak in Chile shows that little can be taken for granted at the moment, especially as shareholders here may have been hoping that copper’s move back over the $5,000-a-ton mark will have boosted cashflow and supported the dividend.”

20 biggest dividend payers in the FTSE 100 in 2019 – last dividend announcements for 2019 or 2020, since COVID-19 crisis broke

| 2019 Dividend (£ million) | 2019 % of FTSE total payment | 2020 ? | ||

|---|---|---|---|---|

| 1 | Royal Dutch Shell | 11,612 | 15.7% | Cut Q1 |

| 2 | BP | 6,491 | 8.8% | Held Q1 |

| 3 | British American Tobacco | 4,826 | 6.5% | Holding pay-out ratio |

| 4 | HSBC | 4,755 | 6.4% | Passed Q1 |

| 5 | GlaxoSmithKline | 3,991 | 5.4% | Held Q1 |

| 6 | Rio Tinto | 3,729 | 5.0% | |

| 7 | AstraZeneca | 2,866 | 3.9% | Paid H2 2019 |

| 8 | Vodafone | 2,340 | 3.2% | Held H2 2019 |

| 9 | BHP Group | 2,190 | 3.0% | |

| 10 | Imperial Brands | 1,955 | 2.6% | Cutting 2020 |

| 11 | National Grid | 1,710 | 2.3% | |

| 12 | Unilever | 1,668 | 2.3% | Paying Q1 2020 |

| 13 | Diageo | 1,628 | 2.2% | Paid H1 2020 |

| 14 | Reckitt Benckiser | 1,239 | 1.7% | Increased H2 2019 |

| 15 | Anglo American | 1,168 | 1.6% | Paid H2 2019 |

| 16 | Legal and General | 1,048 | 1.4% | Paying 2019 H2 |

| 17 | Prudential | 939 | 1.3% | Paying 2019 H2 |

| 18 | Tesco | 896 | 1.2% | Increased H2 2019 |

| 19 | RELX | 886 | 1.2% | Paying 2019 H2 |

| 20 | Evraz | 845 | 1.1% |

Source: Company accounts

For more information on UK-listed companies which have cut, suspended, or deferred dividend payments, take a look at our Dividend tracker.

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06