Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

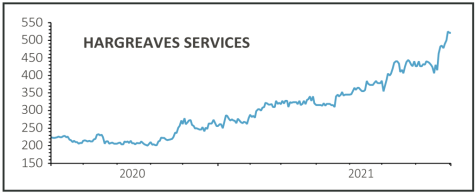

64% from this small cap since February and much more to go

AJ Bell is an easy to use, award-winning platform Open an account

We've accounts to suit every investing need, and free guides and special offers to help you get the most from them.

You can get a few handy suggestions, or even get our experts to do the hard work for you – by picking one of our simple investment ideas.

All the resources you need to choose your shares, from market data to the latest investment news and analysis.

Funds offer an easier way to build your portfolio – we’ve got everything you need to choose the right one.

Starting to save for a pension, approaching retirement, or after an explainer on pension jargon? We can help.

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The basis of our buy call in February was that the firm had reached a strategic turning point, divesting its coal assets and becoming a focused, self-financing industrial and property services group.

The cash received from the sale of inventories and the reduced working capital requirement thanks to exiting the coal business have transformed the firm’s finances, meaning it no longer has any bank borrowing and can fund itself from its own cash flows.

At the same time, having kept an 86% economic interest in its German joint venture HRMS, the firm cashed in on strong commodity markets with a significant rise in pre-tax profits in the year to May, leading to the reinstatement of the ordinary dividend plus a special dividend.

The service businesses – which comprise an environmental, logistics and minerals division, materials handling and mechanical and electrical engineering, and earthworks and infrastructure – have continued to deliver reliable and growing profits.

The land business – which provides sites for residential and commercial construction in northern England and Scotland – is benefitting from strong demand for houses and warehouses.

With the core businesses performing well and the option to monetise its stake in HRMS and release further capital there is still much to like about the stock.

SHARES SAYS: Keep buying.

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

The value of your investments can go down as well as up and you may get back less than you originally invested. We don't offer advice, so it's important you understand the risks, if you're unsure please consult a suitably qualified financial adviser. Tax treatment depends on your individual circumstances and rules may change. Past performance is not a guide to future performance and some investments need to be held for the long term.

magazine

magazine