Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

"For all of the noise about food groups ‘profiteering’ from inflation, shares in Unilever are unchanged over the past twelve months, even if one of the foundations for any investment case for the stock is the pricing power conferred by its powerful brands, which range from Dove to Domestos, Hellmann’s to Knorr, Sunsilk to Vaseline and Magnum to Marmite,” says AJ Bell investment director Russ Mould.

"The shares also still trade below the putative offer price from Kraft-Heinz when the American giant made a cash-and-stock bid for Unilever all the way back in 2017, so investors will be looking to new chief executive Hein Schumacher, a group-wide restructuring plan and an ongoing share buyback programme to provide a spark.

"When Unilever published its half-year results back in July, Mr Schumacher updated the guidance for the full year given by his predecessor Alan Jope in February. The three pointers he provided will form the benchmark by which the headline third-quarter numbers are initially judged:

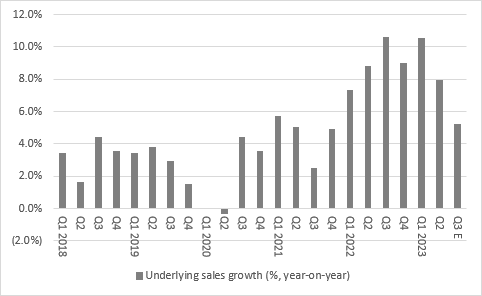

- First, the CEO flagged that underlying revenue growth for the year would come in above the top end of the long-term target range of 3% to 5%.

- Second, he added that price growth would moderate from the 9.4% seen in the first half while input cost inflation would ease too, adding €400 million to the cost base in the second half after a €1.6 billion increase in the first six months of 2023. That easing in price growth would suggest that even Unilever’s pricing power has its limits, which makes sense given the 0.2% drop in underlying volumes in the first half and the statement that 41% of brands were winning market share (which tacitly admits that 59% were holding or losing it).

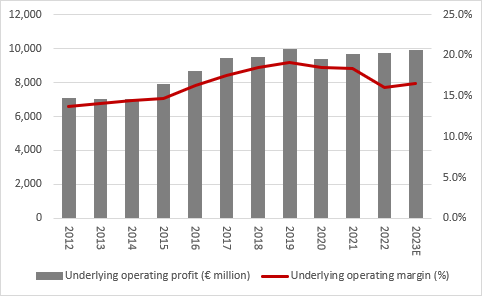

- Finally, Mr Schumacher flagged there would be a “modest” improvement in the group underlying operating margin for the year against 2022’s 16.1% – still a good degree below the long-term aim of 20%.

"In terms of the third-quarter numbers more specifically:

- Analysts are looking for a headline sales figure of €15.2 billion, up 4.2% on a stated basis and 5.2% on an underlying basis.

Source: Company accounts, analysts’ consensus forecasts, Unilever investor relations website

- In terms of the mix, analysts expect a 0.1% underlying increase in volumes and a 5.1% increase in prices. Investors will also look to volume and price trends by geography and in terms of the five-pronged business structure introduced after a reorganisation by Unilever in early 2022. The new business reporting units are Beauty & Well-being; Personal Care; Home Care; Nutrition; and Ice-cream.

Source: Company accounts, analysts’ consensus forecasts, Unilever investor relations website

- Unilever does not usually offer profit figures at the first quarter stage so it will be important to check if there is any change in underlying margin guidance for the first half or the full year. For the whole of 2023, the consensus forecast for underlying operating profit is €9.9 billion against €9.7 billion in 2022, for an underlying operating margin of 16.5%.

Source: Company accounts, analysts’ consensus forecasts, Unilever investor relations website

- Finally, attention will switch to cash returns. Unilever is running a €3 billion share buyback and the first three €750 million tranches of the programme have been completed. The fourth and final tranche, also worth €750 million, started on 8 September and is expected to complete just before Christmas.

"Analysts and shareholders will also look to the dividend. In 2022, Unilever paid out four straight quarterly dividends of €0.4268 for a total in sterling terms of 147.7p a share. It has paid out the same sum, €0.4268, for the first and second quarters of 2023, the equivalent of around 37p a share at current exchange rates. The analysts’ consensus is for a total payment in 2023 of €1.74 which implies a slight acceleration in the run rate in the second half."

Source: Company accounts, Marketscreener, analysts’ consensus forecasts

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05