Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Shares in Netflix are up by around 130% from 2022’s lows but they are down by more than a fifth from their 2023 high which is, technically, enough to put them back in a bear market and officially enough to place them 45% below their autumn 2021 peak. That slide owes much to a cocktail of higher interest rates, more competition, slower customer additions and, recently, investors’ worries over the twin threats of customer retrenchment when it comes to subscriptions and the screen writers’ strike.

Bulls will continue to champion the stock, given its strong slate of shows (both new and returning), ongoing momentum in net customer additions and plans to monetise the subscriber base more effectively thanks to advertising, paid sharing and also gaming.

Netflix added 5.9 million subs in Q2 2023, to put bad memories of the one million loss in Q2 2022 well behind it, and management has guided to a repeat performance of around 5.9 million net adds in this, the third quarter of 2023. Note that all four geographic regions – Americas, Europe Middle East & Africa, Latin America and Asia – all added over one million net subs in Q2, although this mix did weigh somewhat on average revenue per subscriber, which slipped 3% year-on-year in the April-to-June quarter. Latin America and Asia combined now have more subs than America.

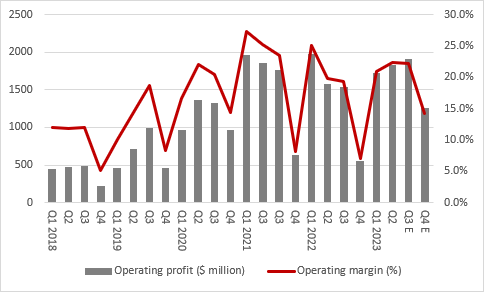

Source: Company accounts, management guidance for Q3 2023

However, Netflix’ real focus is longer subscriber growth for subscriber growth’s sake. The streaming wars and cost of content, plus falling share prices, have persuaded media executives to target growth in revenues, profit and cashflow instead. Netflix’s executive chair (and founder) Reed Hastings and co-chief executives Ted Sarandos and Greg Peters are no different. For the third quarter, they have guided the market towards:

- Sales of $8.5 billion, compared to $8.2 billion in Q2 and 8% higher than the $7.9 billion generated in Q3 2022. Should Netflix provide any guidance, current consensus for Q4 sales is $8.8 billion, for a further acceleration in growth to 12%.

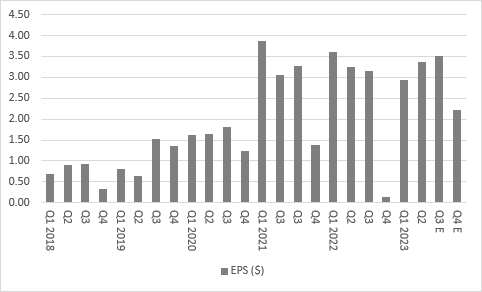

Source: Company accounts, management guidance for Q3 2023, Marketscreener, Zack’s, NASDAQ, analysts’ consensus forecasts

Operating profit of $1.9 billion, compared to the $1.8 billion made in Q2 and $1.4 billion in Q3 2022. That implies an operating margin of 22%, compared to the company’s long-term goal of 18% to 20%. Should management provide any guidance for Q4, the current analysts’ consensus for operating profit is $1.3 billion, for a 14% margin, thanks in part to the traditional late-year sales and marketing blitz.

Source: Company accounts, management guidance for Q3 2023, Marketscreener, Zack’s, NASDAQ, analysts’ consensus forecasts

In terms of the expected headline earnings per share (EPS) figure for Q3, the range of estimates is still quite wide, at $3.10 to $3.58, although the consensus figure lies toward the top end of that range at $3.49. The usual seasonal dip to $2.20 is expected for Q4, although that is still miles ahead of the $0.12 recorded in the equivalent three-month period in 2022.

Source: Company accounts, Zack’s, NASDAQ, analysts’ consensus forecasts

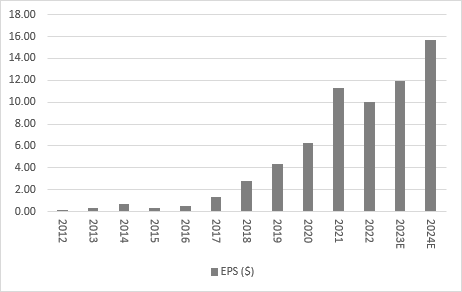

Current consensus estimates for the whole of 2023 are:

- Sales of $33.7 billion (7% higher than 2022’s $31.6 billion)

- EPS of $11.91 (20% higher than 2022’s $9.95)

Source: Company accounts, Zack’s, NASDAQ, consensus analysts’ forecasts

Note that Netflix continues to run a share buyback, its second such programme. Having returned $600 million to shareholders via this mechanism in 2021, Netflix has scope for a $5 billion buyback. It has already spent $1.6 billion of that but still therefore has $3.4 billion to go. Management says it is comfortable with a gross debt position between $10 billion and $15 billion and as Netflix continues to generate cash it may return further capital, especially as net debt is down to $6.4 billion.

Sceptics will point out the dangers that lie within the $2.5 billion of leases and $20.9 billion of contingent purchase obligations that come on top of that, but after 2022’s stumble the media firm seems to be winning this argument.

Source: Company accounts

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05