Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

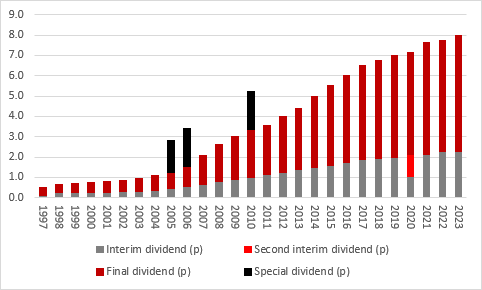

“Very few things can be relied upon in an uncertain world but an increase in the annual dividend from flooring specialist James Halstead is one of them,” says AJ Bell investment director Russ Mould.

“The AIM-quoted company has delivered again for the financial year that ended in June, with an increase in the final payment after an unchanged figure for the first half of the year. The 3.2% increase means the rate of advance has come in below 5% on five occasions in the past six years, perhaps a testament to how difficult the economic backdrop has been, but loyal shareholders will doubtless welcome the latest increment that adds to a growth streak in the ordinary dividend which began 46 years ago.

Source: Company accounts. Financial year to June

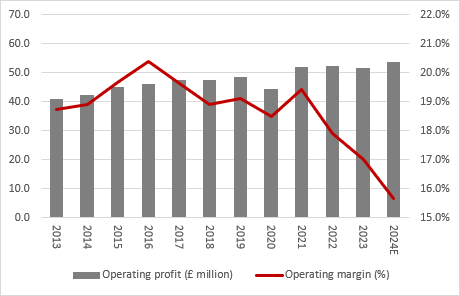

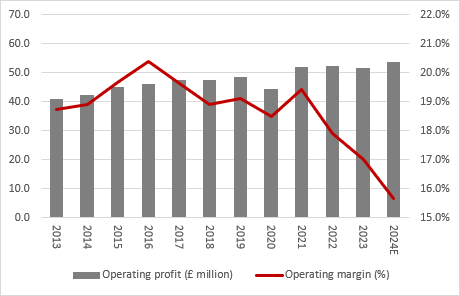

“A second consecutive drop in the full-year operating margin is also an indication of how management is having to confront many challenges at once. Analysts currently expect the return on sales to slide again in the new financial year to June 2024, despite price hikes, an easing in energy cost increases and improved shipping availability and rates.

“The caution may reflect the uncertain outlook for the UK economy in particular, even if two-thirds of sales come from overseas, and greater sales exposure to healthcare, education and retail infrastructure projects than residential projects.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts. Financial year to June

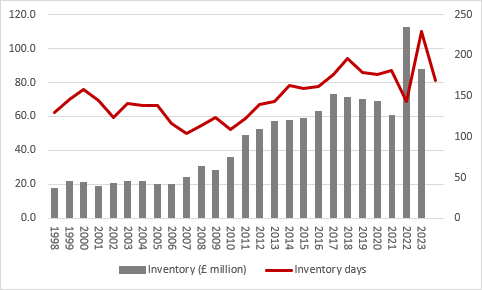

“One source of support for margins could come from the balance sheet.

“Twelve months ago, James Halstead entered the 2023 financial year with some £112 million in inventory, as the company held extra stock to reassure customers and ensure they were not disappointed at a time when global supply chains were stretched. That left the firm open to the danger that it would have slow output and accept lower capacity utilisation rates in its Bury and Teesside factories, if end demand had disappointed, to the potential detriment of overhead recovery and thus profit margins.

“An increase in sales of 4%, or £12 million, has helped here and James Halstead has managed to whittle down its inventory to £87 million, or 170 days, a level more in keeping with the company’s recent history.

Source: Company accounts. Financial year to June

“Shareholders will also draw comfort from another facet of the balance sheet, namely that James Halstead is well-resourced.

“The balance sheet shows £63 million of cash and no debt and lease obligations of £7.2 million, as well as a tiny pension deficit of £1.5 million. Such robust finances should see James Halstead through any economic squall and able to feast upon any weakness among its rivals. That in turn should boost its ability to set, and get, the prices it wants to receive rather than be forced to accept the prices its customers are willing to pay.

“Pricing power underpins the company’s mid-to-high-teens operating margin and therefore the cash flow that funds the dividend growth streak.

Source: Company accounts

“The total dividend of 8p for the year to June 2022 equates to a dividend yield of 3.8%. This may no longer beat inflation, or even match the yield on the ten-year government gilt (which is a wider issue for the UK equity market), but the secret to the investment case for James Halstead has, thus far, been dividend growth.

“The share price was 0.145p when the dividend growth streak began in 1977, so an 8p-a-year dividend payment on that in price looks truly amazing now.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05