Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Shares in soft drink maker AG Barr are broadly unchanged over the past year and trade no higher than they did ten years ago, thanks to a succession of challenges thrown at the maker of the iconic Scottish favourite, IRN-BRU. These challenges include regulation on sugar content, covid and lockdowns, carbon dioxide shortages, input cost inflation and the uncertainty caused by Scotland’s proposed deposit return scheme (although this has now been delayed)” says AJ Bell investment director Russ Mould.

“The firm is also having to adapt to changes in consumer tastes and trends. Since the end of lockdowns, mixers, juices and lemonade have declined in volume and value, to reflect the normalisation of home consumption, while on trade volumes in bars and restaurants and hospitality venues has recovered steadily. Sports and energy drinks have shown robust growth. AG Barr’s acquisitions of Boost and oat milk maker MOMA are both designed to broaden its product portfolio.

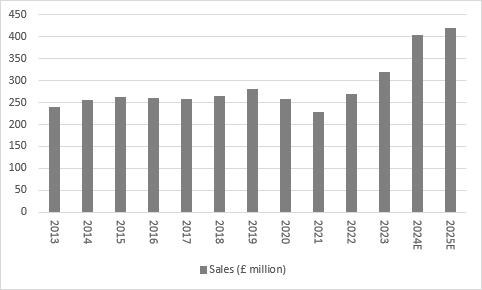

“August’s trading update was very solid, as outgoing chief executive Roger White flagged total sales growth of 33% in the six months to July 2023 to £210 million, thanks to last December’s purchase of Boost. Like-for-like sales growth was 10%. Analysts will look for further detail on growth across product segments and also the mix between volume and price. In the fiscal year to January 2023, the total UK soft drinks market saw volumes drop 2.2% and value rise by 8.8% (to imply price increases of some 11%).

Source: Company accounts, Marketscreener, consensus analysts’ forecasts. Fiscal year to January

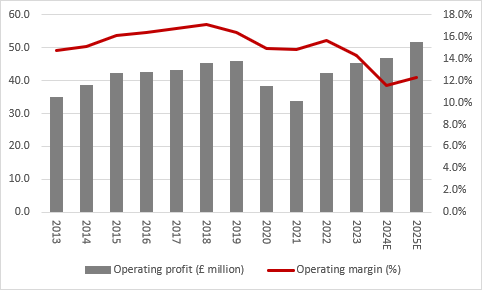

“AG Barr has flagged that profit margins will be lower this year, thanks to the sales contribution from the lower-margin MOMA and Boost operations, investment in brands and products and input cost pressures.

“For the year to January 2024 overall, analysts are looking for a 3% increase in operating profit to £46.7 million on the back of a 27% increase in total sales to £403 million. That equates to a drop in the operating margin to 11.6% from 14.3%. In the first half of last year, AG Barr recorded operating profit of £25.5 million for a margin of 16.1%.

“Note that operating profit has not advanced since 2018, which may be one reason for the flaccid share price performance, although analysts believe that the combination of investment in brand and product and the acquisitions will provide the launchpad for fresh increases from here.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts. Fiscal year to January

“At the time of the August update, the board suggested AG Barr was on track to slightly exceed analysts’ forecasts, despite a fairly wet summer.

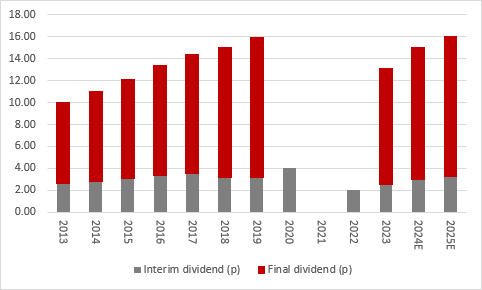

“Attention will then switch to the balance sheet. As of January 2023, AG Barr had a net cash pile of £49.4 million, a pension surplus, virtually no debt and only modest lease liabilities. This strong position, plus free cash flow, helps to fund the company’s dividend.

“After a hiatus during covid, AG Barr is once more paying dividends. In the year to January 2023, the company paid out 13.1p a share. Analysts are looking for a figure closer to 15p a share this time, so an increase on last year’s first-half payment of 2.5p a share is likely.”

Source: Company accounts, Marketscreener, consensus analysts’ forecasts. Fiscal year to January

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05