Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Shares in the owner of Primark, British Sugar, Twinings and Ovaltine, are up by around 30% over the past year.

This has been fuelled by a rally in the pound from last autumn’s lows, a fall in sea freight costs, and improved consumer sentiment, as all three have fed into improved trading at both the food and ritual arms. In a marked contrast to 2022, when a September trading alert drove the shares to a five-year low, Associated British Foods has upgraded expectations during 2023, most notably alongside June’s third-quarter trading update. The ongoing £500 million share buyback may also be helping (AB Foods had spent £319 million of that by the end of June).

The upgraded guidance provides the benchmark for this set of full-year results, although any guidance for the fiscal year to September 2024 is likely to be even more important. Despite voicing caution over the outlook for consumer spending, chair Michael McLintock and chief executive George Weston offered forecasts alongside the third-quarter update back in June that:

- Adjusted operating profit would come in “moderately ahead” of fiscal 2022’s £1.4 billion (compared to previous guidance of “broadly in line”) – analysts have pencilled in £1.47 billion, with an increase to £1.65 billion expected in fiscal 2024

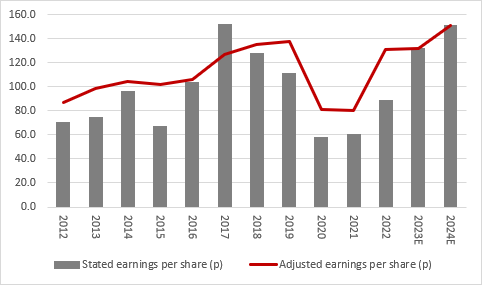

- A lower-than-expected tax charge would result in adjusted earnings per share exceeding prior guidance of a results “broadly in line” with 2022’s 131.1p – the consensus forecast for fiscal 2024 is looking for a healthy increase to 151p, bang in line with 2017’s all-time high for the company.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts. Fiscal year to September

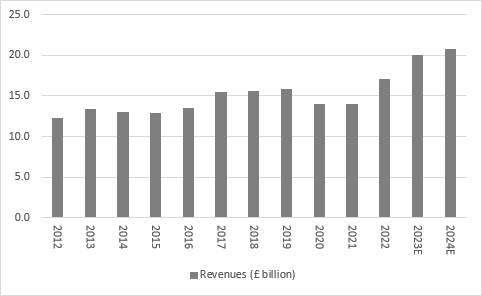

The first number to which analysts will look in this update is revenues. AB Foods generated sales of £17 billion in fiscal 2022 and for fiscal 2023 overall the consensus estimate is £19.9 billion, for year-on-year growth of 17%. For the year to September 2024, analysts expect a more modest 4% increase to £20.8 billion.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts. Fiscal year to September

Attention will then switch to the performance of the different divisions and growth in sales on an underlying and stated basis. All of the operations bar Agriculture showed double-digit percentage sales growth in the third quarter, as total group sales rose 16% year-on-year. Sales at Agriculture rose 4%, at Ingredients, Grocery and Retail by 10%-13% and at sugar by 51%.

| FY 2021-22 (£ million) | Guidance for fiscal 2022-23 in total | ||

|---|---|---|---|

| Sales | Adjusted operating profit | ||

| Grocery | 3,735 | 399 | Profits to be"ahead" |

| Sugar | 2,016 | 162 | Profits"down" |

| Agriculture | 1,722 | 47 | Profit"modestly ahead" |

| Ingredients | 1,827 | 159 | Profit"well ahead" |

| Food Ð total | 9,300 | 767 | In aggregate, higher sales and higher profits |

| Retail | 7,697 | 756 | Higher sales, H2 operating margin to be the same as H1Õs 8.3% |

| Total | 16,997 | 1,523 | Significantly higher sales, broadly in line operating profit |

Source: Company accounts

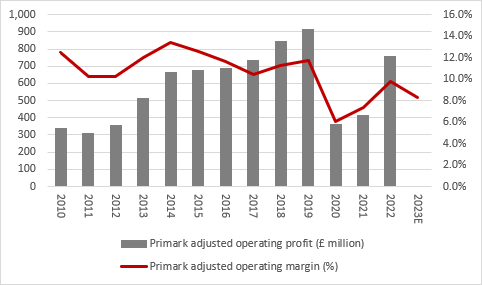

As usual, Primark will probably gather most of the attention. The retail business did better than expected in the first half, thanks to higher footfall, higher volumes and increased prices, while store openings added to the underlying momentum. Management does not wish to push pricing too far and although input cost inflation may be easing, AB Foods has so far stated that Primark’s operating margin in the second half will match the 8.3% made in the first six months of fiscal 2023. That represents an improvement on the 8% generated in the second half of 2022 but a year-on-year decline for 2023 as a whole, although the goal is to get back to 10% over time.

Analysts and shareholders will look for any comment on the extended click-and-collect trial across stores in the UK, as Primark dips its toe into online retailing and invests in its website, although physical stores remain the focus and new openings continue to be due across the estate, with a focus on Italy, France, Spain, Eastern Europe and particularly the US. Slovakia is Primark’s sixteenth country of operation and American selling space is set to double in 2023, thanks to three store openings in the first half and five in the second, while a push into the south of the USA is now underway, helped by the opening of a new warehouse and distribution centre in Jacksonville, Florida. Primark has also signed a lease on a first store in Texas. The long-term target is to get to 530 stores globally by September 2026, compared to 408 as of September 2022.

Source: Company accounts* Numbers before 2013 not directly comparable owing to 2014's IAS19 accounting rules change on employee benefits. ** Numbers before 2019 not directly comparable owing to IFRS16 accounting rules changes on leases. Fiscal year to September.

AB Foods is not in the habit of publishing detailed cash flows and balance sheet data at this third-quarter stage, but analysts will look for an update on both. The first half saw a net working capital outflow of £703 million, some £400 million more than the long-term average, and Mr Weston and outgoing chief financial officer John Bason had targeted a significant improvement here in the second half, thanks to lower inventory at Primark and also Sugar. Mr Bason’s successor, Eoin Tongue, may provide commentary here.

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06