Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“After more than doubling from 2022’s lows, shares in Netflix are back to where they were in summer 2020, although they are still a third below their autumn 2021 peak” says AJ Bell Financial Analyst, Danni Hewson.

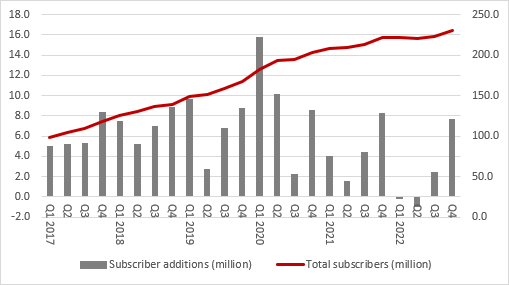

“Bulls will argue the rally is justified because the initial fall was out of proportion to two quarters of missed subscriber growth estimates in the first half of 2022. They will also point to the rich catalogue of content and strong slate of shows, the launch of a new, discounted, ad-funded price package designed to win new subscribers, and improved net customer additions in the second half of last year – Netflix added 7.7m subs in Q4 2022, well ahead of management’s guidance of 4.5 million, and another 1.75 million in Q1 2023.

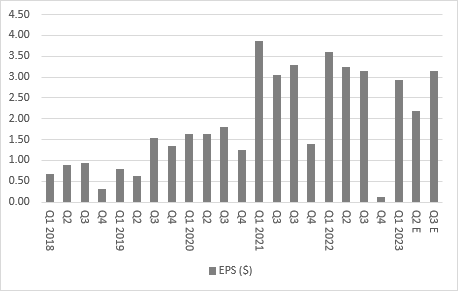

“Bears will point to increased competition; the surging cost of content production; spotty cash flow; a balance sheet that carries not just $7.3 billion of net debt but more than $2 billion in leases and more than $20 billion in guaranteed content purchase obligations (although ratings agency Moody’s did upgrade Netflix’s debt to investment grade with a Baa3 rating in the spring). Moreover, a $195 billion market cap still puts the stock on around 40 times earnings for 2023 and 30 times for 2024, even though analysts believe earnings per share will grow at a low-teens percentage rate this year. That puts a lot of emphasis on the 30%+ EPS growth expected in 2024.

“The first number that analysts and shareholders will look for is net subscriber additions. After shedding 203,000 net subscribers in Q1 2022 and 969,000 in Q2 (and that was much less than management’s forecast of an initial loss of two million) Netflix added a better-than-expected 2.4 million in Q3 and then a strong 7.7 million in Q4, to leave the company with 230.7 million paying subs at the end of last year. It then added 1.75 million in Q1 2023 to take the total to 232.5 million. Note that Europe, Middle East and Africa (77.4 million) and the combination of Asia and Latin America (80.7 million) were both bigger than the USA (74.4 million) by the end of Q1 2023.

Source: Company accounts

“Netflix no longer provides guidance for subscriber additions and focuses instead on revenues, operating margin and cashflow. But the management team - executive chairman (and founder) Reed Hastings and co-chief executives Ted Sarandos and Greg Peters - did suggest that adds growth would be “modest” in Q1, thanks in part to the strong Q4 and the possible impact of paid sharing, which management believes will lead to US, Asian and European cancellations, based on their experiences in the Latin American markets. Adds are expected to come in higher in Q2 than in Q1 (which would be unusual for the seasonality shown by the business to date).

Source: Company accounts, management guidance for Q4 alongside Q3 results

"Alongside the Q1s, management forecast the following for Q2:

- Revenue growth of 3% on a stated basis to $8.2 billion, and 6% higher adjusting for currency movements. This would be broadly flat on a sequential basis.

Source: Company accounts, management guidance alongside Q1 2023 results, Zack’s, NASDAQ, analysts’ consensus forecasts

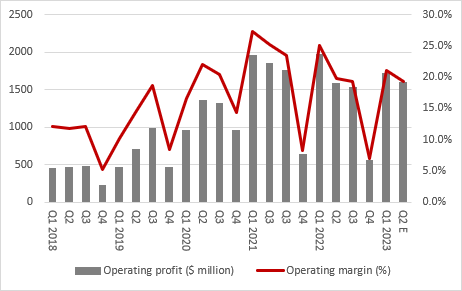

- A second-quarter operating margin of 19%, compared to 20% in Q1 2023 and Q2 2022. The slight dip in margin is expected to be the result of the strong dollar. That implies an operating profit of around $1.6 billion, again flat against the second quarter a year ago. The long-term goal remains an operating margin of 19% to 20% and management still expects 18% to 20% for this year, taking into account currency movements.

Source: Company accounts, management guidance for Q2 2023 alongside Q1 2023 results

- In terms of the expected headline earnings per share (EPS) figure for Q2, the range of estimates is very, very wide, at $2.46 to $2.96. The consensus is $2.81 compared to $3.20 a year ago. According to Zack’s, there have been two upgrades and one downgrade of estimates for Q2 in the last month.

Source: Company accounts, Zack’s, NASDAQ, analysts’ consensus forecasts

"Should management give any guidance for Q3 (and they usually do), then the current consensus forecasts are as follows:

- Sales of $8.6 billion (versus the consensus estimate of $8.3 billion in Q2 and $8.0 billion in Q3 2022)

- EPS of $2.93 (versus the consensus estimate of $2.81 in Q1 and $3.20 in Q2 2022)

Source: Company accounts, Zack’s, NASDAQ, consensus analysts’ forecasts

"Current consensus estimates for the whole of 2023 are:

- Sales of $34.2 billion (8% higher than 2022’s $31.6 billion)

- EPS of $11.28 (13% higher than 2022’s $9.95).”

Source: Company accounts, Zack’s, NASDAQ, consensus analysts’ forecasts

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05