Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Investors in silicon wafer-maker IQE are clearly disappointed by the company’s cautious outlook for 2023, as the shares are taking a hammering, but this earnings setback could also have wider implications for the global economy and financial markets, even if the company’s market cap is barely £400 million,” says AJ Bell investment director Russ Mould.

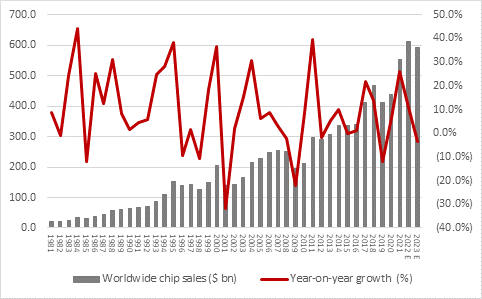

“This is because IQE cites an inventory bulge at customers across the $600 billion-plus global semiconductor industry, which is a fair proxy for worldwide economic activity and, if past performance is any guide, a useful measure for stock markets’ risk appetite.

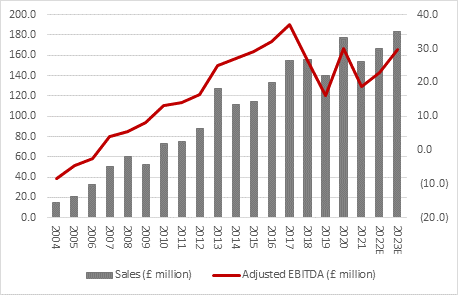

“IQE’s forecast of 8% sales growth on a stated basis to £166 million for 2022 represents a tiny miss relative to analysts’ consensus forecasts of £169 million, although sales are expected to be flat once the positive effect of currency movements are stripped out.

“Worse, the Cardiff-headquartered company is flagging a slowdown in 2023, especially in the first half. This leaves consensus estimates of 10% sales growth, and an increase in profit, looking exposed on the downside.

Source: Company accounts, company guidance for 2022 sales, Marketscreener, consensus analysts’ forecasts

“Industry specialists are already forecasting global semiconductor sales for 2023 of $590 billion, a 3% drop from 2022’s record-high levels, so perhaps analysts had been a little overconfident.

Source: WSTS, SIA, Gartner, Statista

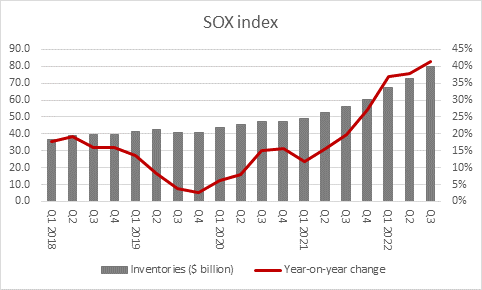

“But it is the company’s warning of a slowdown in demand from existing customers due to a need to work down excess inventory that will concern industry watchers and stock market investors.

“Whether IQE is referring to excess piles of unsold end-product or unused semiconductors is not clear, but a study of the balance sheets of the 30 companies which make up the Philadelphia Semiconductor index, or SOX, suggests there is a back-up in the supply chain somewhere – and this is a big change from the last two years, when chip shortages and calls for increases to supply have been the dominant themes.

“We are about to enter the fourth-quarter results season for most of the SOX’s constituents so we will get more information when those figures are released, but the third-quarter statements from the autumn made for sorry reading.

“Yes, aggregate sales for the 30 SOX stocks rose 8% year-on-year, but net profit dropped 12% as chip and chip equipment makers began to wrestle with an inventory bulge of their own. Supplies of unsold product on their balance sheets swelled by 73% quarter-on-quarter and 42% year-on-year.

Source: Company accounts in aggregate for all 30 SOX index members

“That took inventory days to 131 compared to just 99 in Q3 2021. Either the chip makers have increased capacity too much too quickly, or end demand is slowing, or the truth lies somewhere in between.

Source: Company accounts in aggregate for all 30 SOX index members

“But unless these inventories are worked down quickly – and that needs strong demand from key markets like wireless devices, computing, consumer electronics, automotive, telecoms networks and industrial robotics, then 2023 estimates for the SOX’s members and the global chip industry could prove optimistic.

“As we enter the fourth-quarter reporting season, aggregate analysts’ forecasts are looking for a 2% drop in sales from the SOX’s 30 members to $462 billion and a 12% drop in net profit to $109 billion for 2023 overall.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts, in aggregate for all 30 SOX index members

“If IQE’s warning means that there are piles of unsold mobile phones, tablets, computers, cars and other gadgets lying around on top of unsold chips, then the industry may have a problem on its hands, especially if forecasts of a global economic slowdown prove accurate.

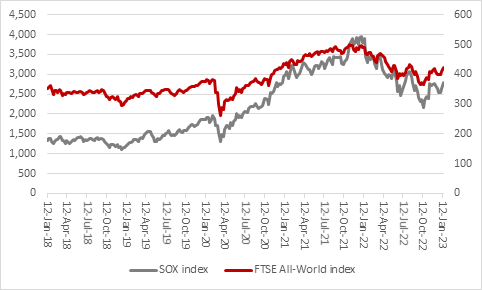

“And this matters to investors because the SOX index can be a good guide to investors’ risk appetite and global equity markets, at least judging by the past two to three decades.

“History is by no means guaranteed to repeat itself, but the SOX topped out six to nine months before the S&P 500 and FTSE All-World did so in 2000 and 2007, to herald two thumping bear markets, and then bottomed out before those headline indices did in 2002 and 2009, to signal the start of a new bull market.

“The SOX almost halved from peak to trough in 2022 but it has rallied by 30% from the autumn lows. Perhaps last year’s slump prices in a lot of bad news already, although it may be that earnings forecast upgrades are needed if the SOX is to sustain its upward momentum.

Source: Refinitiv data

“IQE is not immune to global trends in the chip market, even if it tends to march to its own beat.

“This is partly because it does not make chips, but the wafers from which they are made.

“And it is partly because it does not provide traditional, pure silicon wafers. Instead, IQE makes wafers from more complex compounds, such as Gallium Nitride (GaN), Gallium Arsenide (GaAs) and Indium Phosphide (InP).

“These so-called epitaxial wafers are then used as the basis for chips that are used in specialist functions and products, such as mobile handsets, mobile telecom network infrastructure, 3D imaging and sensing and photonics systems for fibre-optic telecoms networks.

“These target markets enjoy demand cycles all of their own, which are as much led by technology and the shift to next-generation products as the wider economic cycle. This is a little different from the broader silicon chip industry, which follows a more typical boom-and-bust pattern, related to swings in demand caused by the economic cycle and swings in supply as manufacturers cut or increase investment according to where they think demand is going next.

“It is talk of a slowdown in end-demand that is perhaps of the greatest concern today and after a weak statement from SOX-member Micron in December and a relatively muted one from TSMC earlier this month, investors will be looking to Texas Instruments and Wolfspeed when they kick off the fourth-quarter reporting season for chipmakers on 23 January.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05