Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“There can be no doubting that times are getting tougher for the house-builders after a near-ten-year boom and Barratt Developments’ second cautious trading update provides clear proof of that, with a further sharp decline in the net reservation rate per site,” says AJ Bell investment director Russ Mould.

“Management is now starting to hedge its bets on its target for housing completions too, but the shares are not falling as much as perhaps you might expect given the lack of visibility and after last year’s crunching declines and analysts’ swinging cuts to profit forecasts it may be that a lot of bad news is already factored into the housebuilders’ stock.”

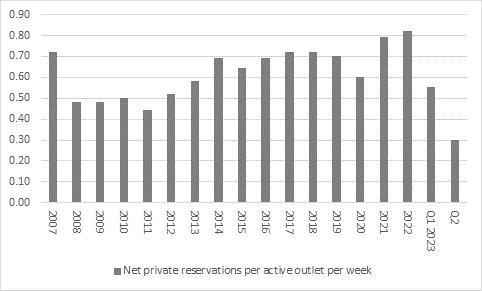

“Barratt’s admission that the net reservation rate per sales outlet had dropped to 0.30 per week between early October and the end of December, from 0.55 between July and early October and 0.82 in the twelve months to June 2022 is the clearest sign of the slowdown in the housing market.

Source: Company accounts. Financial year to June

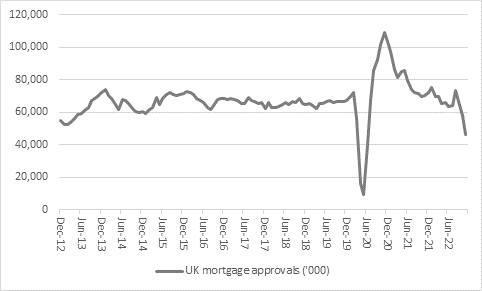

“This tallies with the latest monthly mortgage approvals data collated by the Bank of England from the major lenders, which showed a marked drop back to barely 46,000 in November, the sort of run rate we were seeing in 2012 (before Help to Buy) and way down from the 100,000-plus levels seen in early 2021.

Source: Refinitiv data, Bank of England

“The drop in demand for housing is due to higher interest rates, higher mortgage rates, lower mortgage availability post-Trussonomics, the end of Help to Buy, the end of the stamp duty tax break, the cost-of-living crisis and lower consumer confidence.

“It may also be due to affordability – the average UK house price is up by around 70% since Help to Buy started in 2013, while average UK wages are up by about half that amount over the same time frame. Help to Buy has stoked demand when supply was constrained and made prices go up even faster (as many predicted at the time).

“Nor do the builders’ woes end here. The builders are facing input cost inflation running at around 10% and have had to set aside more than £2 billion between them to cover the cost of cladding remediation.

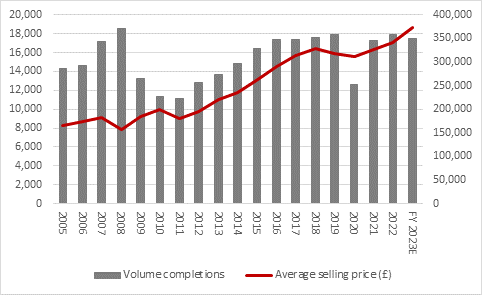

“Those costs would further complicate the effects of a slowdown in demand and Barratt is now raising the prospect that completions for the year to June 2023 could undershoot planned levels if sales do not pick up in spring.

“Having initially targeted some 18,600 completions, the board is now saying it remains comfortable with consensus of 17,475 (including 750 dwellings build by a joint-venture) and can see that going as low as 16,000 if spring does not provide the usual seasonal boost to sales. Inflation and a shift in mix toward London is at least helping to support prices.

Source: Company accounts. FY 2023 reflects guidance for completions alongside Q2 update and the ASP for the second quarter, as per the update. Financial year to June

“Given the apparent downside risk to volume completions, the shares are not down that much.

“This may be because Barratt’s shares halved from peak to trough last year, so they (and the other builders’ shares) are already pricing in a lot of bad news.

“Yes, business may get tougher but that does not necessarily mean the going gets tougher for share prices that have already plunged.

“Valuations relative to book, or net asset value, already price in drops in house prices judging by how the shares largely trade at a discount to net asset value. The shares are expecting a downturn and recession, for sure, although they have rallied a fair way from their autumn lows, so the Halifax’s forecast 8% house price drop for 2023 is probably factored in.

| Historic | 2023E | 2023E | 2023E | |

|---|---|---|---|---|

| Price/NAV(x) | PE (x) | Dividend yield (%) | Dividend cover (x) | |

| Vistry | 0.64 x | 8.2 x | 7.1% | 1.71 x |

| Bellway | 0.73 x | 10.2 x | 4.3% | 2.29 x |

| Barratt Develop. | 0.75 x | 10.2 x | 6.5% | 1.52 x |

| Crest Nicholson | 0.78 x | 9.8 x | 4.3% | 2.36 x |

| Taylor Wimpey | 0.88 x | 10.6 x | 8.5% | 1.11 x |

| Redrow | 0.89 x | 11.3 x | 3.9% | 2.26 x |

| Persimmon | 1.12 x | 9.7 x | 8.3% | 1.24 x |

| Berkeley Homes | 1.46 x | 11.8 x | 5.6% | 1.52 x |

| Average | 0.93 x | 10.2 x | 6.6% | 1.49 x |

Source: Company accounts, Marketscreener, analysts’ consensus forecasts, Refinitiv data

“Anything deeper than that could still cause some share price volatility, but analysts are already predicting a sharp decline in both profits and dividend payments in 2023, so the numbers will have to come in below those to knock share prices any further.

“Aggregate consensus estimates for the FTSE 100 and FTSE 250 housebuilders suggest net profits will fall by a third to £2 billion and that dividend payments will drop by more than a fifth to £1.5 billion in 2023.”

| £ million | 2022E | 2023E | 2022E | 2023E |

|---|---|---|---|---|

| Net income | Net income | Dividend | Dividend | |

| Barratt Develop. | 663.7 | 406.1 | 346.7 | 267.5 |

| Bellway | 402.4 | 242.4 | 153.8 | 105.8 |

| Berkeley Homes | 444.6 | 376.3 | 208.2 | 248.3 |

| Crest Nicholson | 33.3 | 66.7 | 41 | 28.2 |

| Persimmon | 670.4 | 418.2 | 568.2 | 338.4 |

| Redrow | 264.1 | 138.5 | 96.6 | 61.2 |

| Taylor Wimpey | 634.1 | 352.3 | 317.1 | 317.1 |

| Persimmon | 670.4 | 418.2 | 568.2 | 338.4 |

| Vistry | 387.2 | 290.4 | 242 | 169.4 |

| Total | 3,499.8 | 2,290.9 | 1,973.7 | 1,535.9 |

Source: Marketscreener, analysts’ consensus forecasts

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05