Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Central banks still seem more frightened of inflation than a recession, but financial markets are split on what to expect in 2023: equity analysts are still looking for earnings growth, stock markets are calling policymakers’ bluff by pricing in interest rate cuts and bond markets believe that a recession is coming soon,” says AJ Bell investment director Russ Mould.

“The so-called yield curve is inverted and growing confusion over 2023’s outlook is pulling the rug from under the strong rally in global share prices that began in early October, as investors wonder once more whether their portfolios are trapped between an inflationary rock and a recessionary hard place.

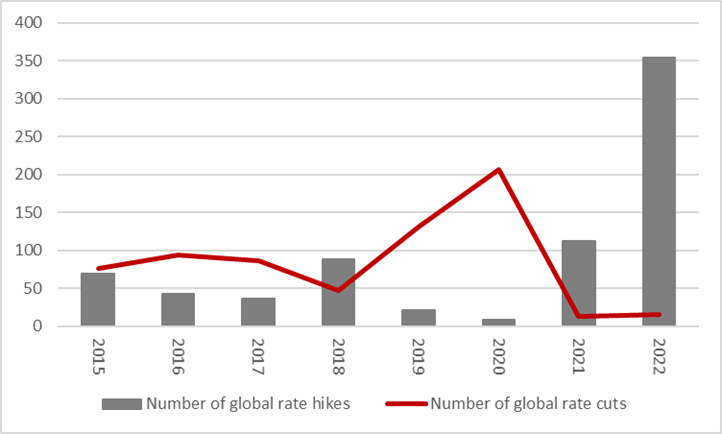

“The Bank of England, European Central Bank and US Federal Reserve grabbed the headlines last week as they tightened monetary policy once more, but twelve more central banks around the world raised interest rates, to take the total to 354 increases compared to just 16 cuts, according to the website www.cbrates.com.

Source: www.cbrates.com

“Even Japan is now starting to gently move away from ultra-loose policy as the Bank of Japan moves to permit a wider trading range for the yield on Japanese Government Bonds, in a tacit acknowledgement that bond vigilantes may have a case when it comes to worrying about inflation.

“This may be stoking fears that central banks are hiking rates and making money more expensive even as the world heads into a recession.

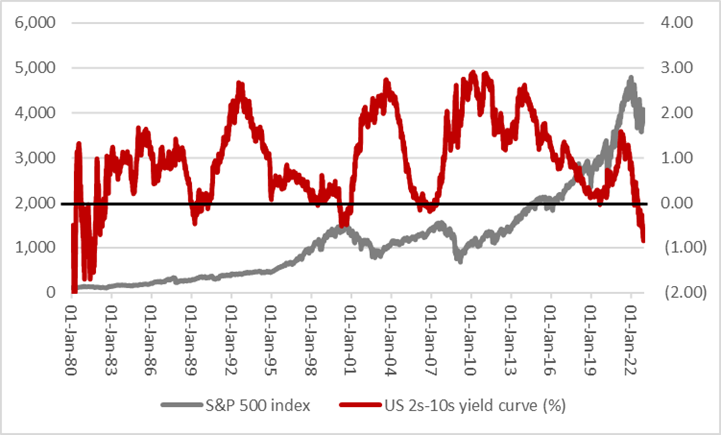

“Bond markets already look to be signalling a downturn, because the yield curve is inverted, using the 2s-10s curve as the benchmark.

“Usually, ten-year Government bonds will yield more than two-year paper simply because more can go wrong in the additional eight-year period. Investors will demand a higher yield as compensation for the added risk.

“But when markets sniff out a recession, they start to price in interest rate cuts. Reductions in headline borrowing rates set by central banks will usually drag down yields on Government bonds in sympathy and that is what we are seeing now. Since the 12 October stock market low, the yield on US two-year Treasuries is pretty much flat at 4.25% but the yield on ten-year bonds is down 32 basis points (0.32%) to 3.56%.

Source: Refinitiv data

“As a result, the US yield curve is deeply inverted, in fact more deeply than since the twin recessions of the early 1980s when then Fed chair Paul Volcker was also jacking up interest rates to crush inflation.

Source: Refinitiv data

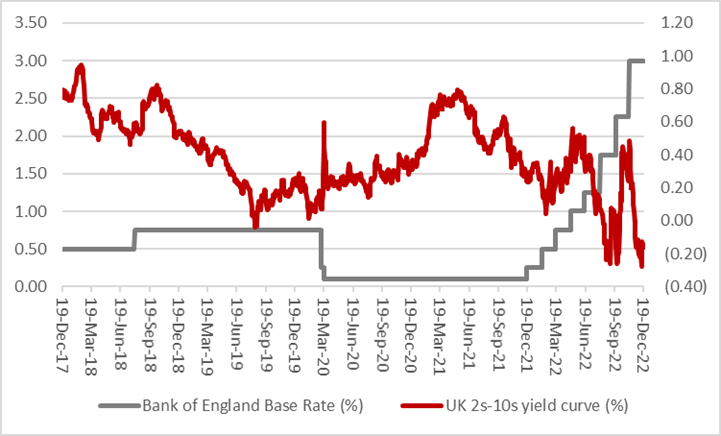

“In the UK, the 2s-10s yield curve for gilts has just inverted. Yields have come down across the board after the panic caused by the nation’s brief flirtation with Trussonomics, but since 12 October the two-year yield is down by 35 basis points and the ten-year by 93.

Source: Refinitiv data

“The yield curve in the UK is not as deeply inverted as before prior recessions but it is inverted nevertheless, and prior inversions in the early and late 1990s and mid-2000s all correctly forewarned of a recession.

“However, stock markets have not really been listening to the warnings of recession, at least until the past week’s slide. Since October, they have focused on the prospect of interest rate cuts instead, since they are designed to make credit cheaper, boost loans, oil the economic engine and fuel a fresh upcycle.

“The theory is that central banks seem to be slowing the rate of interest rate increases, and if rate increases are slowing then they will finally stop, and after they stop then the next logical step is interest rate declines. In sum, this is the argument in favour of a monetary policy pause and then pivot, with the idea being that a recession will help (or force) central banks to stop worrying about inflation and get them to focus on growth instead.

“In effect, markets are calling central banks’ bluff, as they continue to talk tough on inflation and interest rates. You can understand why, given that every major financial market meltdown or economic downturn since the Russian debt default and LTCM hedge fund chaos of 1998 has been met with frantic interest rate cuts and, more recently, dollops of Quantitative Easing (QE).

“But it might not be that simple because the trough in yield curve inversion has had a habit of calling the top in equities – on both sides of the Atlantic.

Source: Refinitiv data

Source: Refinitiv data

“The Fed and the Bank of England slashed interest rates in 2000-2002 and again in 2007-2009 (and launched QE in the latter instance too) and eventually their economies righted themselves and bear markets in shares came to an end – but they key word here is eventually.

“Rate cutting did not initially save investors from a mauling and headline stock indices have tended to top out when the yield curve is at its most inverted and that was because the recession (as predicted by the yield curve) kicked in and took corporate earnings down with it.

“Analysts have now admitted that earnings might fall in the US in 2022 but they are still expecting a rebound in 2023.

Source: Standard & Poor’s research

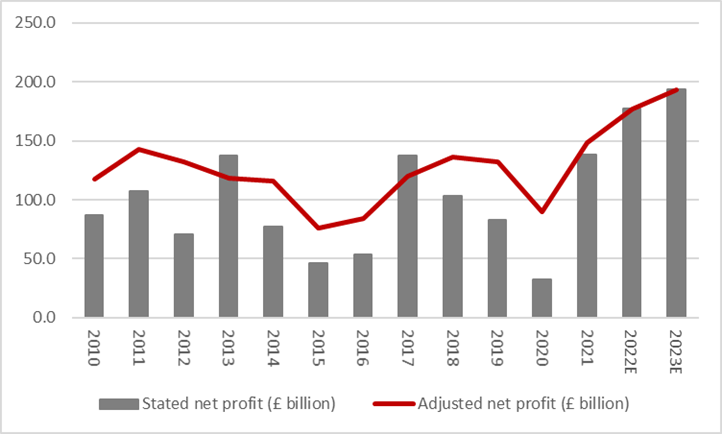

“Consensus forecasts also expect an increase in profits from the FTSE 100, despite the bond market’s conviction that a recession is coming and equally gloomy forecasts from the IMF, OECD and Bank of England, to name but three.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

“The past is no guarantee for the future, but it seems that the battle lines are set: rate cuts (hoped for or real) versus earnings downgrades. At least in the UK’s case, valuation multiples and dividend yields feel like they are pricing in deeper drops in earnings than the US market is currently expecting (and analysts are still forecasting higher corporate profits in 2023 on both sides of the Pond).”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05