Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

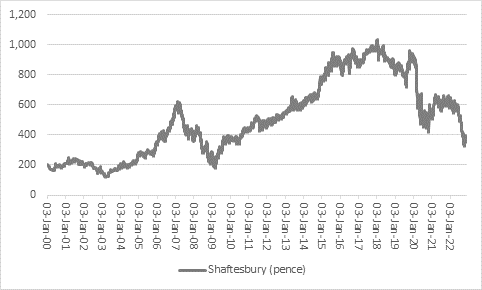

Shaftesbury’s boss Brian Bickell may be seeing a return to pre-pandemic normality in footfall across the Real Estate Investment Trust’s portfolio of prime West End properties, but the FTSE 250 firm’s shares are trading no higher than they did in 2006.

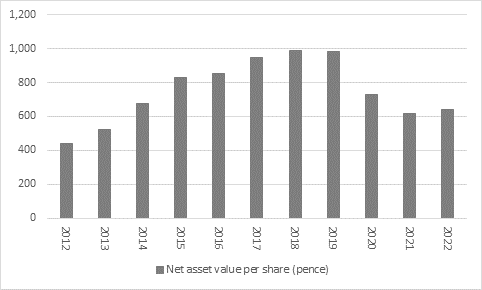

As a result, the shares stand at more than a 40% discount to the stated net asset value (NAV) per share figure. Technically, this means that investors can buy £1 worth of London property for less than 60p, but the market clearly fears that the combination of an economic downturn, the ongoing trend toward working from home post-covid (at least for those that can) and competition from physical stores from online rivals mean asset valuations will remain under pressure.

Source: Refinitiv data

The results do little to assuage such concerns. Yes, NAV per share rose to 641p a share, compared to 619p in September 2021, but book value stood at 679p a share in March, so the value of Shaftesbury’s portfolio declined in the second six months of its fiscal year.

Source: Company accounts. Financial year to September

That is despite a recovery in rental income, a marked drop in vacancies and strong lettings activity across the portfolio, which covers Soho, Covent Garden, Fitzrovia, Carnaby and Chinatown.

Source: Company accounts. Financial year to September

It will be of little consolation to Mr Bickell, the REIT’s board and Shaftesbury’s shareholders, but the firm is not on its own in facing such scepticism.

Analysis of the 28 REITs and property firms in the FTSE 350 show they currently trade on an average discount to NAV of 30%. In addition, the greater exposure a REIT has to office space, retail sites, or major metropolitan areas such as London, the greater the discount to NAV seems to be. Mr Bickell may be seeing a return to normal, but investors do not seem convinced that it will last.

By contrast, investors’ faith in warehousing and industrial sites (thanks to the seemingly inexorable rise of e-commerce), healthcare-related properties, student housing and self-storage facilities seems much stronger. The discounts to NAV are much smaller here and one or two stocks still trade at a premium to book value.

| Stock | Sub-sector | Premium / (discount) |

|---|---|---|

| Safestore | Storage | 15.5% |

| Unite | Residential | 1.1% |

| Primary Health Properties | Healthcare | (5.5%) |

| Supermarket Income REIT | Retail | (6.4%) |

| Sirius Real Estate | Office | (6.6%) |

| Assura | Healthcare | (7.8%) |

| Big Yellow | Storage | (9.5%) |

| LXI | Diversified | (15.6%) |

| Londonmetric Property | Diversified | (20.0%) |

| Urban Logistics | Industrial | (22.4%) |

| Grainger | Real Estate Holdings & Services | (23.2%) |

| Target Healthcare REIT | Healthcare | (29.1%) |

| Warehouse REIT | Industrial | (29.5%) |

| SEGRO | Industrial | (32.9%) |

| Balanced Commercial Property Trust | Diversified | (35.4%) |

| Great Portland Estates | Office | (36.1%) |

| Land Securities | Diversified | (38.3%) |

| Tritax Big Box | Other Specialty | (38.5%) |

| Derwent London | Office | (39.9%) |

| British Land | Diversified | (41.5%) |

| Shaftesbury | Diversified | (43.8%) |

| UK Commercial Property REIT | Diversified | (46.7%) |

| Tritax EuroBox | Real Estate Holdings & Services | (48.3%) |

| Home REIT | Residential | (49.5%) |

| Capital & Counties | Diversified | (49.9%) |

| CLS | Real Estate Holdings & Services | (54.9%) |

| Workspace | Office | (55.6%) |

| Hammerson | Retail | (60.0%) |

| Average | (29.7%) |

Source: Company accounts, Refinitiv data

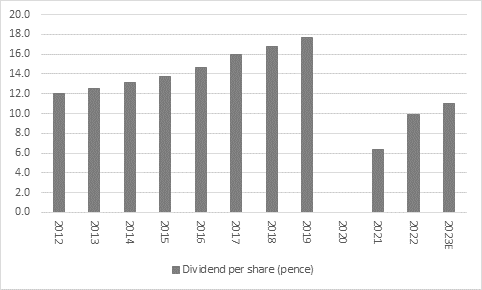

Nor do investors seem convinced that the merger with Capital & Counties is the perfect solution, even if the coming together will presumably enable management to strip costs overlaps. Neither Shaftesbury nor Capital & Counties offers a particularly fat yield either, even though Shaftesbury is starting to rebuild its pay-out. For the year just ended, the REIT declared a total dividend of 9.9p, compared to 6.4p in the 12 months to September 2021.

Source: Company accounts. Financial year to September

That lack of a meaty dividend may be another knock on the stock, especially as more than 20 FTSE 350 REITs offer a higher yield, at least according to analysts’ consensus forecasts.

| Stock | Sub-sector | 2022E Dividend yield | Share price (discount)/premium to historic NAV |

|---|---|---|---|

| Target Healthcare REIT | Healthcare | 8.8% | (29.1%) |

| UK Commercial Property REIT | Diversified | 8.3% | (46.7%) |

| Tritax EuroBox | Real Estate Holdings & Services | 6.5% | (48.3%) |

| Warehouse REIT | Industrial | 6.2% | (29.5%) |

| Land Securities | Diversified | 6.1% | (38.3%) |

| Workspace | Office | 6.0% | (55.6%) |

| Primary Health Properties | Healthcare | 5.7% | (5.5%) |

| Urban Logistics | Industrial | 5.6% | (22.4%) |

| Supermarket Income REIT | Retail | 5.6% | (6.4%) |

| Londonmetric Property | Diversified | 5.5% | (20.0%) |

| Assura | Healthcare | 5.4% | (7.8%) |

| Home REIT | Residential | 5.3% | (49.5%) |

| British Land | Diversified | 5.3% | (41.5%) |

| LXI | Diversified | 5.1% | (15.6%) |

| CLS | Real Estate Holdings & Services | 5.0% | (54.9%) |

| Balanced Commercial Property Trust | Diversified | 5.0% | (35.4%) |

| Tritax Big Box | Other Specialty | 4.8% | (38.5%) |

| Sirius Real Estate | Office | 4.6% | (6.6%) |

| Hammerson | Retail | 4.0% | (60.0%) |

| Big Yellow | Storage | 3.9% | (9.5%) |

| Unite | Residential | 3.5% | 1.1% |

| SEGRO | Industrial | 3.3% | (32.9%) |

| Derwent London | Office | 3.3% | (39.9%) |

| Safestore | Storage | 3.2% | 15.5% |

| Shaftesbury | Diversified | 2.8% | (43.8%) |

| Great Portland Estates | Office | 2.6% | (36.1%) |

| Grainger | Real Estate Holdings & Services | 2.5% | (23.2%) |

| Capital & Counties | Diversified | 1.9% | (49.9%) |

Source: Company accounts, Refinitiv data

A further challenge for all REITs is the trend toward higher interest rates in the UK.

Shaftesbury has a net debt position of £805 million, so higher borrowing costs can impact profits, although the company has a low loan-to-value ratio and no debt that has been drawn down is due for repayment or refinancing until 2027.

In addition, higher interest rates mean higher bond yields. That means property yields have to rise to stay relatively attractive (which usually means asset prices fall) and also that equity yields have to rise to compete with bonds and cash for investors’ favour (which usually means share prices fall).

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05