Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Investors seem unimpressed that the profits growth for the fiscal year to September 2023 will be weighted toward the first half, between now and March, but management seems confident enough judging by the meaty increase in the annual dividend and the extension of the ongoing share buyback programme,” say AJ Bell investment director Russ Mould.

“More than 40 FTSE members have declared buybacks for their current financial year and Compass Group has become the sixth to line up such cash returns for investors in the next one, alongside Associated British Foods, BAE Systems, Barratt Developments, Diageo and Imperial Brands.

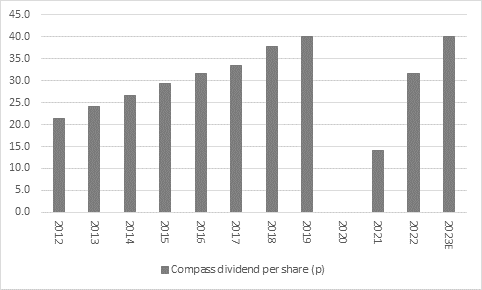

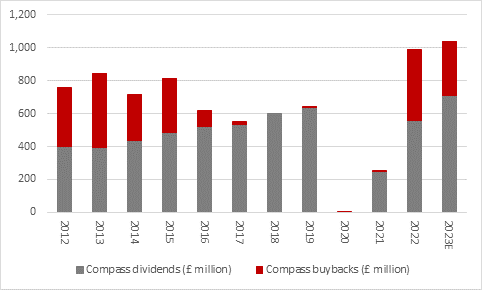

“The hike in the annual dividend to 31.5p a share from 14p took Compass’ total cash payment there to £560 million and the firm is running £750 million in buybacks on top of that.

Source: Company accounts, Marketscreener, consensus analysts' forecasts. Financial year to September

“The catering giant bought back £450 million of the initial £500 million programme in the financial year just ended and will finish that off and top up with £250 million more in the new financial year to September 2023.

Source: Company accounts, Marketscreener, consensus analysts' forecasts, management guidance. Financial year to September

“This is all a far cry from 2020 when covid struck and companies battened down the hatches to preserve cash, cancelling buybacks and cutting dividends as they went.

“Aggregate FTSE 100 buybacks are scheduled to reach £55.5 billion in 2022 and firms have already committed to a further £3.5 billion in 2023, although their plans could yet change if the economy really tanks or something else unexpected happens.

“For the moment, though, the buyback bonanza is due to supplement near-record high total for ordinary dividend payments of £81.5 billion in 2022 and a new record of £87.7 billion in 2023, based on current analysts’ consensus forecasts. Special dividends worth £2.8 billion will also add to cash returns harvested by investors and take the whole lot to £140 billion, or more than 7% of the FTSE 100’s £1.9 trillion market capitalisation.

Source: Company accounts, Marketscreener, consensus analysts' forecasts, management guidance

“The willingness to buy back stock suggests management teams feel their firms are well prepared for anything that may come their way, even the long recession of which the Bank of England continues to warn, while it may also intrigue value-oriented investors as it implies boardrooms think their stock is undervalued (although some may counter by saying no boardroom ever believes its stock is overvalued).

“The total cash return will also catch the eye of income investors as it will help them preserve their wealth from the ravages of inflation, although Chancellor Jeremy Hunt’s cuts to annual dividend allowances will make that fight tougher still from April 2023 onwards. It is rather surprising that the £55.5 billion buyback spree is not catching his eye and perhaps this could be the next fiscal hammer to fall come the budget next year, if circumstances dictate that Mr Hunt’s plans to reduce the annual deficit and then the aggregate deficit as a percentage of GDP are in any way blown off course by events.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05