Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“The shares may not be doing much in response to Imperial Brands’ full-year results, but they already stand near five-year highs and the figures contain a lot that is good news (unless you are an ethical investor): cash flow is strong, debt is down and the dividend is up,” says AJ Bell investment director Russ Mould.

“Investors appear to be putting aside their doubts over the long-term future of smoking and how Imperial Brands can adapt in the face of ongoing regulatory pushback by developing its next-generation products, in favour of the relative short-term dependability of demand at a time when the economic outlook is so uncertain.

“In addition, the FTSE 100 firm’s array of key brands, which includes JPS, Davidoff and Gauloises, still confers some degree of pricing power despite regulators’ restrictions on packaging and advertising.

“Pricing power is always valuable, but it is all the more so when inflation is running strongly and firms face margin pressure from rising input costs. Pricing power protects lofty profit margins, lofty profit margins support cash flow and cash flow funds dividends.

Source: Company accounts, Marketscreener, Vuma, consensus analysts' estimates

“The dividend cut of 2020 is now fading from memory, as Imperial increases its dividend for the second time in a row and confirms plans, first flagged alongside October’s trading update, for a £1 billion buyback. Add the two together and, based on analysts’ consensus forecasts of a further small increase in the dividend for September 2023, Imperial is set to return the equivalent of nearly 12% of its market cap to shareholders in cash.

Source: Company accounts, Marketscreener, Vuma, consensus analysts' estimates

“Again, this is possible because of strong cash flow, which comfortably covers the dividend. It even – just – covered the dividend in 2019 before the swingeing cut, but chief executive Stefan Bomhard wisely took the view that long-term investment in the business was a better option than clinging to the millstone of an extremely high yield, for which the firm was getting no credit from investors anyway, judging by how the share price was sliding back then.

| £ million | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Revenues | 7,510 | 7,713 | 7,985 | 7,589 | 7,793 |

| Operating profit | 2,407 | 2,197 | 2,731 | 3,146 | 2,683 |

| Depreciation & amortisation | 1,266 | 1,316 | 910 | 815 | 660 |

| Net working capital | (11) | 50 | 1,042 | -664 | 40 |

| Capital expenditure | (327) | (409) | (302) | (200) | (230) |

| Operating Cash Flow | 3,335 | 3,154 | 4,381 | 3,097 | 3,153 |

| Tax | (407) | (522) | (568) | (820) | (681) |

| Interest | (491) | (473) | (420) | (400) | (358) |

| Pension contribution | (60) | (72) | (88) | (63) | (56) |

| Leases paid | 0 | 0 | (72) | (69) | (68) |

| Free Cash Flow | 2,377 | 2,087 | 3,233 | 1,745 | 1,990 |

| Dividend | 1,676 | 1,844 | 1,753 | 1,305 | 1,320 |

| Free Cash Flow Cover | 1.42 x | 1.13 x | 1.84 x | 1.34 x | 1.51 x |

Source: Company accounts

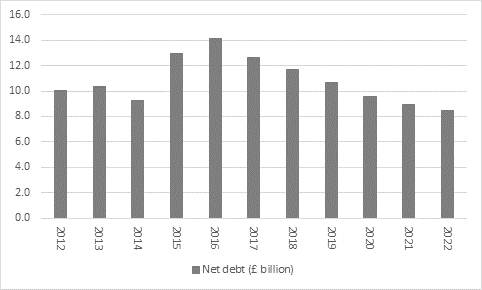

“Cash flow is also helping Imperial to reduce its debts, which had been accumulated thanks to the 2008 purchase of European rival Altadis and 2015’s swoop for Lorillard. Disposals have also helped to cut the debt pile.

“Lower debt means less risk and less risk can mean a higher share price, as investors decide they can pay a higher multiple to access the company’s revenue, profit and cash flow streams. If profit forecasts start moving higher at the same time, then the share price can benefit from a double-whammy of a higher multiple (the ‘P’ in the price/earnings ratio) and higher earnings (the ‘E’).

Source: Company accounts

“As it enters the second phase of Mr Bomhard’s five-year turnaround plan, Imperial Brands is now targeting trend growth in sales at a mid-single digit percentage rate and a mid-single-digit percentage rate of advance in operating profit, on a constant currency basis.

“This might not sound very exciting, but Imperial trades on barely nine times forward earnings and offers a 7% prospective dividend yield (with the buyback cash on top).

“The earnings multiple is a discount to the FTSE 100 and the yield a premium. That at least partly reflects the modest growth trend in profits, regulatory risk and the need to invest in next generation products (NGPs) such as blu, Pulze and iD, and it just may be that, rather like oil and gas, tobacco stays with us longer than many of us would perhaps like it to.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05