Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Apple’s admission that shipments of the new iPhone 14 could be hit by covid-enforced downtime at plant owned by key supplier Foxconn in China offers the latest test of faith for shareholders in the technology giant,” says AJ Bell investment director Russ Mould.

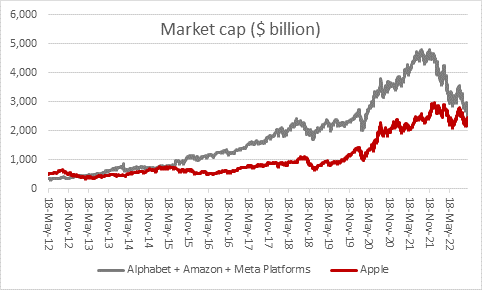

“The company’s its $2.2 trillion market cap could still weigh heavy if profits do disappoint, especially as Apple’s $2.2 trillion market valuation is the same as that of Meta, Amazon and Alphabet combined. Some investors could be forgiven for thinking that either Apple is overvalued or the other three now look too cheap.

Source: Refinitiv data

“Apple’s fourth-quarter results for the three months to September seemed to suggest that the company had largely dodged the worst of the worldwide slump in smartphone, tablet and computer sales.

“The Cupertino-based giant grew its sales and earnings yet again, despite a year-on-year drops of unit shipments of 12% for smartphones, 9% for tablets and a worst-ever 18% for PCs. As a result, Apple stood out like a beacon in the latest quarterly reporting season as it shrugged off a strong dollar and avoided the earnings accidents which befell Amazon, Alphabet, Meta Platforms and even Microsoft.

“iPad sales did stumble once more, but wearables and accessories again performed strongly, and September’s launch of the iPhone 14 helped that revenue stream.

Year-on-year sales growth |

||||||||

|---|---|---|---|---|---|---|---|---|

| Q1 2021 | Q2 | Q3 | Q4 | Q1 2022 | Q2 | Q3 | Q4 | |

| iPhone | 17.2% | 65.5% | 49.8% | 47.0% | 9.2% | 5.5% | 2.8% | 9.7% |

| iPad | 41.1% | 70.1% | 25.1% | 21.4% | (14.1%) | (16.0%) | (12.3%) | (13.1%) |

| Mac | 21.2% | 78.7% | 4.1% | 1.6% | 25.1% | 33.7% | 0.2% | 25.4% |

| Services | 24.0% | 26.6% | 32.9% | 25.6% | 23.8% | 17.3% | 12.1% | 5.0% |

| Wearables | 29.6% | 24.7% | 36.0% | 11.5% | 13.3% | 12.4% | (7.9%) | 9.8% |

| Total | 21.4% | 53.6% | 36.4% | 28.8% | 11.2% | 8.6% | 1.9% | 8.1% |

Company accounts. Fiscal year to September

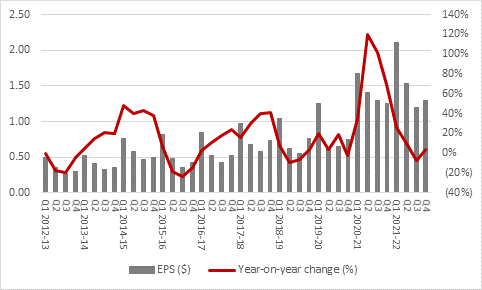

“However, earnings momentum was still modest, as earnings per share grew by just 3% year-on-year.

Company accounts. Fiscal year to September

“Apple has been through several profit cycles over the past decade, driven by new product launches, the economic backdrop, or a combination of the two.

“Given how fiscal and monetary stimulus, coupled with lockdowns, boosted demand for electronic gadgets it is perhaps no surprise to see a slowdown now, just as we are in other areas of consumer expenditure on goods, especially now inflation is taking a chunk out of disposable income and stimulus is no longer on offer from either central banks or governments.

“Apple seem to be coping better than others, at least so far, though again that monster $2.2 trillion market cap suggests that market reaction to any future earnings disappointment could be unforgiving.

“Amazon has lost $940 billion in market cap from its all-time high, Meta some $875 billion and Google’s parent Alphabet some $870 billion. Add in Microsoft’s $930 billion market cap swoon from its high and Netflix’s $180 billion loss and the damage to investor portfolios is clear, especially as Apple itself has shed $680 billion of value.

“Between them the six MAANAM stocks (or FAANG as they once were) may still be worth $6.2 trillion, but they have still lost $4.5 trillion in market cap from their individual highs to teach investors two costly lessons.

- First, valuation always matters (even if you never know when). Overpaying turns even good firms into bad investments.

- Second, there are few worse investments than a growth company that is perceived to be going ex-growth, or at least suffering a major slowdown in momentum. Earnings estimates fall (the ‘E’ in the price/earnings ratio, or PE) and the price that investors are prepared to pay to access those earnings (the ‘P’ in the PE) goes down too, as confidence ebbs, to create a painful double-whammy.

“Even Apple has been derated, through the process of that $680 billion market cap loss, it still trades at a big premium to the wider US market, as does the wider MAANAM grouping. Based on consensus earnings forecasts, the sextet trades on nearly 24 times earnings for 2022 compared to 16 times for the S&P 500 benchmark index.

| Price/earnings ratio (x) | Net income ($ billion) | ||||||

|---|---|---|---|---|---|---|---|

| 2022E | 2023E | 2024E | 2022E | 2023E | 2024E | ||

| Alphabet | 17.7 x | 16.0 x | 14.1 x | 63.4 | 70 | 79.6 | |

| Amazon | neg. | 48.9 x | 28.3 x | -0.8 | 19 | 32.8 | |

| Apple | 22.4 x | 21.3 x | 20.8 x | 98.4 | 103.5 | 106.1 | |

| Meta Platforms | 8.3 x | 9.3 x | 8.0 x | 24.6 | 22 | 25.4 | |

| Netflix | 25.0 x | 24.1 x | 19.0 x | 4.6 | 4.8 | 6.1 | |

| Microsoft | 23.1 x | 19.8 x | 17.0 x | 71.4 | 83.5 | 96.8 | |

| MAANAM total | 23.8 x | 20.5 x | 17.9 x | 261.6 | 302.8 | 346.8 | |

Source: Zack’s, NASDAQ, Marketscreener, consensus analysts’ forecasts, Refinitiv data

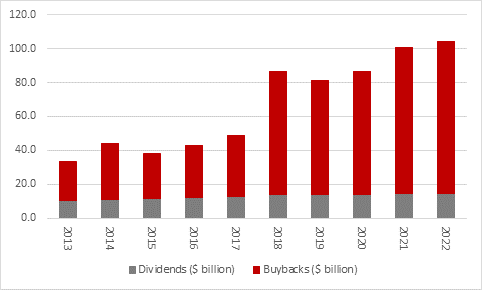

“Just as Apple-holics eagerly await the next product launch, Apple investors may well be prepared to look through any near-term turbulence in trading caused by supply chain issues, especially as Apple is still a phenomenal cash machine.

“In the fourth quarter of the final year just ended, Apple bought back $24.4 billion of stock and paid out $3.7 billion in dividends.

“The firm only began returning cash to shareholders in the first quarter of fiscal 2013 (fourth quarter of calendar 2012). In the subsequent decade, since Apple has bought back $537 billion in stock and paid out $129 billion in dividends for a total cash return of $666 billion – more than the company’s entire $612 billion market cap on 1 October 2012.

Company accounts. Fiscal year to September

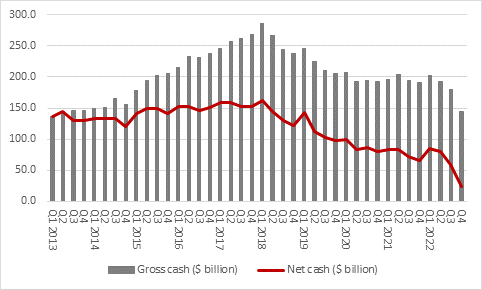

“There is one wrinkle here, however. Apple has whittled its gross cash pile down to a ‘mere’ $144 billion, the lowest figure since 2013, and has used cheap debt to buy back some of that stock. As a result, Apple’s net cash pile is down to ‘just’ $24 billion, so if anything did unexpectedly go wrong it would remain to be seen whether management would be keen to return over $100 billion a year to shareholders.”

Company accounts. Fiscal year to September

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05