Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“It would have seemed inconceivable in 2020 when oil prices briefly went negative and technology, online and social media giants gave many people something to do during lockdowns, but in 2022 energy stocks are proving to be the big winners and tech stocks the big losers,” says AJ Bell investment director, Russ Mould.

“Even so, financial markets still seem sceptical that this is the new normal. Investors are still placing more faith in tech than they are in oil and gas, which suggests that if hydrocarbon prices stay firm then energy stocks still have the potential to surprise on the upside.

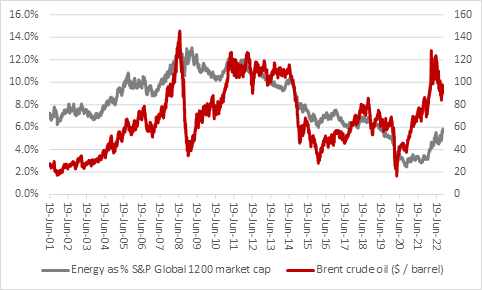

“Using the S&P Global 1200 indices as a benchmark, energy stocks still represent just 5.8% of total stock market value. That shows a big recovery from the post-pandemic lows of 2.5% in 2020 but still trails the 8.2% average since the turn of the century and miles below the 13.9% high that prevailed as oil hit $147 a barrel in summer 2008. This shows three things.

“First, the best time to buy oil stocks has been when the oil price has collapsed and sentiment is firmly against the sector.

“Second, the worst time to buy oil stocks has been when the oil price has been gushing higher and sentiment is firmly with the sector.

“Finally, the markets remain sceptical that hydrocarbon prices will remain elevated, as the globe looks to embrace, alternative, renewable sources of energy and move toward a net-zero world. There is less talk now than there was about oil and gas fields being stranded assets that will prove to be worth less than thought but the relative value of oil and gas equities is not as high as you might think and history would suggest, given the oil currently trades above $90 a barrel and natural gas around $6 per MMBtu.

“Again, the shift toward renewables could indeed dampen demand for oil and gas over the long-term and from an ecological point of view, among others, science clearly states this would be good for us all.

“There are other threats to oil and gas companies, which could weigh in the near-term. A global recession could hit demand for crude and refined products, while governments could seek to impose price caps or more onerous taxes on profits. A peaceful solution to the war in Ukraine could end sanctions on key suppliers and increase available output, while a defrosting of relations with Venezuela and Iran could have a similar effect.

Source: Refinitiv data

“However, there are arguments that near-term factors could be supportive of oil.

“First, demand for energy continues to rise but supply remains constrained, thanks to environmental policies, geopolitical sanctions and oil firms’ response to pressure not to drill.

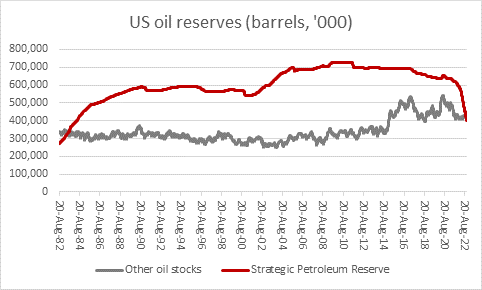

“Second, a rapid solution to the war in Ukraine regrettably seems unlikely and OPEC is refusing to bend to US pressure to increase output (perhaps because the White House is implementing policies that wilfully constrain American output and Riyadh is unlikely to have forgotten how Washington habitually complained in the middle of the last decade when it argued Saudi Arabia was pumping too much oil, as the US sought to support profits, cash flow and investment returns from its then-booming shale oil industry). Second-guessing geopolitics is a mug’s game, but right now the environment seems supportive to oil prices and it remains to be seen whether President Biden comes to regret running down America’s Strategic Petroleum Reserve ahead of the mid-term elections to buy votes with cheaper gasoline.

Source: US Energy Information Administration

“Finally, windfall taxes and price controls have a very poor record of achieving their goals. US President Richard Nixon imposed price controls on oil in 1971 and one of his successors, Jimmy Carter, added a windfall profits tax in 1980. The 1970s were wracked by higher energy prices and it can be argued that cheaper energy only ushered in a new era of prosperity in the 1980s after Carter’s replacement, Ronald Reagan, scrapped both the price controls in 1981 and the windfall tax in 1988. Additional legislation to provide tax breaks and incentivise higher output did the rest.

“Energy could yet therefore surprise on the upside, while Big Tech is having to work very hard not to confound investors on the downside after a series of earnings stink bombs from Netflix, Amazon, Alphabet, Meta Platforms and even Microsoft (which has flagged the strong dollar as an encumbrance). Only Apple has avoided the indignity of a profit warning but only partly because it does not give specific earnings guidance and even the Cupertino-based giant is showing a marked slowdown in earnings.

“As a result, Big Tech is seeing its stock market fortunes stumble. Again, using the S&P 1200 Global indices, the Information Technology sector is now worth ‘just’ 21% of total global market cap down from late 2021’s all-time high of 24.1%.

“However, while energy is still running way below its long-term average, tech is still running way above its long-term average of 14.2% of global market cap. This suggests investors believe tech will bounce back, but that oil and gas will falter once more.

Source: Refinitiv data

“Indeed if you look at the relative valuation of energy to tech stocks, again using the S&P Global 1200 benchmarks, energy is still looking cheap – in this chart when the line goes up, energy stocks’ total global market cap is rising faster than that of tech stocks and vice-versa.

Source: Refinitiv data

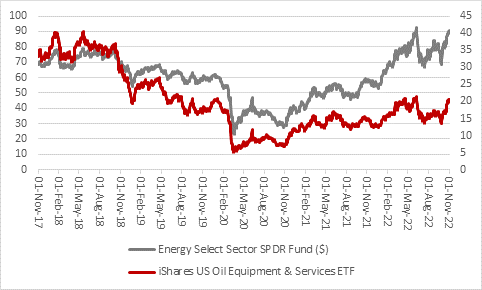

“There are simpler benchmarks to track the fortunes of oil and gas companies and also those of those firms who supply them with the equipment and services which enable them to drill for and produce oil.

“Two US-quoted tracker funds are particularly useful benchmarks here, namely the Energy Select Sector SPDR Fund (ticker XLE:NYSE) and the iShares US Oil Equipment & Services ETF (ticker IEZ:NYSE).

“Environmental campaigners may despair but the price trend in both looks to be gathering momentum, despite wider scepticism over whether oil and gas prices will stay higher for longer.”

Source: Refinitiv data

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06