Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

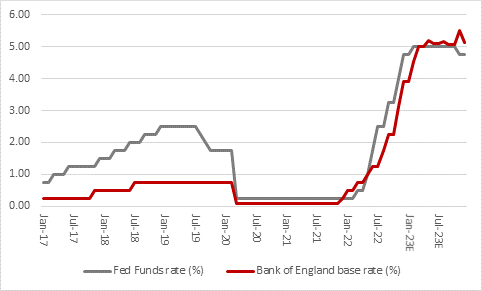

Interest rate increases are seen as a certainty from both the US Federal Reserve and the Bank of England on Wednesday 2 and Thursday 3 November respectively – the only question is the matter of degree.

After that, economists, investors and politicians will look for any indication on the future direction of policy and also any comments on Quantitative Tightening, as central banks look to further tighten the monetary screw in their fight against inflation. Although there is a clear risk that central banks tighten too much and tip heavily indebted economies into recession, right now inflation is their priority.

In the US, the Fed Funds rate is 3.25% yet inflation is 8.2% (the last time consumer price index, or CPI, inflation was that high in early 1982, the Fed Funds rate was 14%).

Source: US Federal Reserve, FRED – St. Louis Federal Reserve database, Refinitiv data

In the UK, the base rate is 2.25%, yet inflation is 10.1% based on the consumer price index (CPI), which was introduced in 1997 and with a backdated history to 1989. The retail price index, or RPI, is no longer an officially recognised statistic but we have data here to 1948. RPI inflation is currently 12.4% year-on-year and it last got there in early 1981 when the Bank of England Base rate was 12%.

Source: Bank of England, Office for National Statistics, Refinitiv data

- There is, therefore, a risk that central banks are moving too slowly to tackle inflation (even if moving too quickly could hurt the economy). It’s a difficult balancing act but for now:

- Markets think the Fed will raise by three-quarters of a point to 4.00% (and that the Fed Funds rate will reach at least 4.75% in 12 months’ time).

- Markets think the Bank of England will raise by one full percentage point to 3.25% (and that the Base rate will reach 5.00% in 12 months’ time).

Source: Bank of England, US Federal Reserve, CME Fedwatch, Refinitiv data

In terms of Quantitative Tightening (QT), the Fed is looking to shrink its balance sheet by $95 billion a month and the Bank of England by some £80 billion a year. The Fed began QT in June and then doubled its pace in September. The Bank of England is due to start in November, although how easy it will find that remain to be seen after its enforced return to buying gilts to support pension management firms and try and calm panicked debt markets after former chancellor Kwasi Kwarteng’s fiscal event in September.

The Fed’s balance sheet carries $8.8 trillion in assets and the Bank of England owns more than £800 billion worth of gilts, so both have a long, long way to go before they really start to sterilise the monetary stimulus provided by Quantitative Easing. This is certainly one possible explanation for the current lofty levels of inflation, even if it is not the only one.

Source: Bank of England, US Federal Reserve, FRED – St. Louis Federal Reserve database

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06