Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“The core business of Ocado Retail is delivering jam to its customers today but after another trading disappointment shareholders in the business are once more left with a story that promises jam tomorrow,” says AJ Bell investment director Russ Mould.

“The Ocado Smart Platforms business still offers undeniable long-term potential, as the company licenses out its warehousing and automation technology, but the core retail model of delivering goods to customers via that online platform is yet to prove it can be profitable.

“The Ocado Retail business continues to add customers but cannot turn this into a profit. This time the problems are higher costs, notably for fuel and dry ice, and customers either trading down through brands or simply fewer items in the face of the cost-of-living crisis.

“A 2.7% increase in Ocado Retail sales is no great shakes when prices are up 5% and a 10% drop in volumes means the average shopping basket’s value is down 6% year-on-year.

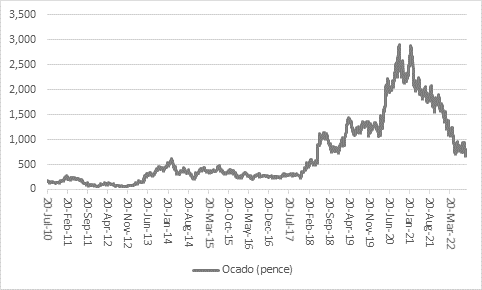

“This is clearly giving patient shareholders pause for thought and the share price plunge suggests their patience may now be wearing thin. The shares are now at their lowest level since May 2018.

Source: Refinitiv data

“Shareholders in Marks & Spencer are unlikely to be pleased either, as its £750 million purchase of a 50% stake in Ocado Retail is still to deliver a tangible return on that investment and quite what licensees of the OSP make of it can only be a matter of speculation.

“Ten firms, including Canada’s Sobeys, Australia’s Coles, America’s Kroger, Sweden’s ICA, France’s Groupe Casino and Spain’s Alcampo are all OSP partners with Ocado and they could be forgiven for wondering whether their online push will be a profitable one.

“Ocado Retail cannot turn a profit in the densely-populated UK and all of those countries are much bigger and so the expense involved in covering distance to deliver the goods is all the greater.

“Shareholders in Ocado plc will be hoping that the overseas revenues from OSP licensing partners start to roll in, because even its much-diminished market capitalisation of £5.6 billion will be hard to justify if not.

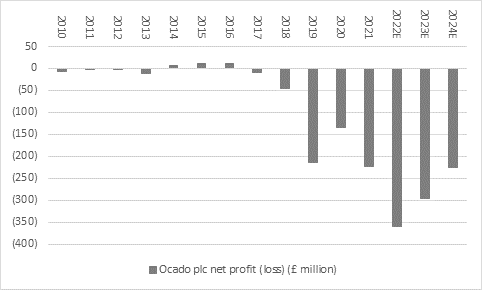

“The business struggled to turn a profit and in aggregate has lost over £600 million after tax since the stock market listing in 2010. Ocado plc has also tapped shareholders three times for cash, in 2018, 2020 and 2022, for more than £1.5 billion, so the money is really flowing the wrong way, from an investor’s point of view.

Source: Refinitiv data

Source: Company accounts, Marketscreener, consensus analysts’ forecasts. Financial year to November.

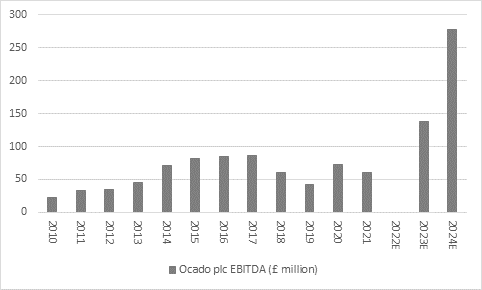

“Nor does Ocado help its shareholders by always referring to earnings before interest, taxes, depreciation and amortisation (EBITDA) as its measure of profitability. This is deceptive because shareholders’ only take their share of net or after tax profit, if there is any.

“Anything above the net interest line is the domain of lenders and bondholders, so they will watch EBITDA very closely. After that, the tax authorities get their slice. Shareholders then own what remains, as per the pecking order of creditors, so for them EBITDA is a meaningless yardstick.

“Ocado does have borrowings – £1.3 billion at the last count – and over £500 million in lease liabilities too, so management will be keen to reassure bondholders, lenders and landlords. But from a shareholders’ point of view, all using EBITDA does is give management the chance to quote a figure that looks less bad because it excludes a number of costs to the business and puts a gloss on the numbers.”

Source: Company accounts, Marketscreener, consensus analysts’ forecasts. Financial year to November

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06