Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“What is good for America is good for Ashtead, as four-fifths of the company’s sales and nine-tenths of its profits are generated Stateside, and a recovery in the US economy looks to be driving a revival in the FTSE 100 firm’s fortunes,” says AJ Bell Investment Director Russ Mould.

“Sales in the final quarter of the equipment hire giant’s financial year rose by 23% and profits more than doubled, with the result that full-year revenues rose 3% and profits barely flinched, despite the pandemic and last year’s sharp recession.

Source: Company accounts. Financial year to April.

“Ashtead’s American Sunbelt operation will benefit from higher economic output in the USA and especially from more activity in key end markets such as construction, while even the oil and gas sector is looking a lot bad than before.

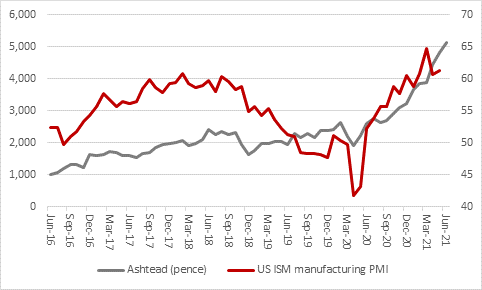

“Given this outlook, it is understandable that Ashtead’s share price seems to respond to the Institute of Supply Management’s purchasing managers’ index (or PMI) for manufacturing:

Source: Refinitiv data, ISM

“A recovery in US housing helped last year, although the US National Association of Housebuilders’ index appears to be flattening off a bit.

Source: Refinitiv data, US National Association of Housebuilders

“That is a trend which may need to be watched, but Ashtead’s management seems confident enough, judging by the decision to launch a £1 billion share buyback in May and supplement that with a sixteenth consecutive increase in the annual dividend.

Source: Company accounts, Marketscreener, analysts’ consensus forecasts

Source: Company accounts, Marketscreener, analysts’ consensus forecasts

“After the ultimately minor dip in pre-tax profit in the year to April 2021, analysts are looking for momentum to continue into the new financial year, when earnings are expected to grow by 11%, although profits are not expected to exceed pre-pandemic levels until the year to April 2023. Any traction for US President Joe Biden’s infrastructure plan could be helpful here.

Source: Company accounts, Marketscreener, analysts’ consensus forecasts

“The tricky bit is Ashtead’s valuation.

“A forward price/earnings ratio of the year to April 2022 of 30 is testament to the resilience of the company’s operating model, its strong cash flow and excellent dividend growth track record, but such a huge premium to the wider FTSE 100 surely means that such positive factors are well known.

“Investors must be careful not to confuse a solid business model with safety, because even a good company can be a poor investment if the investor overpays to access its profit stream and cash flows. Shareholders will be looking for further earnings forecast upgrades and - over time – a gradual increase in that dividend.

“Ashtead’s share price ended 2006 – the year when its dividend growth streak began – at barely 150p. The just-declared full-year dividend of 42.15p looks fabulous compared to that so investors will be looking for further increases in the distribution to drag the share price higher over time. That is what has happened so far and even if the past is no guarantee for the future it does go to show how the stock market can be a terrific ‘get-rich-slow’ scheme when all goes well.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05