Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“When Antonio Horta-Osorio took over as the CEO of Lloyds in March 2011, the bank was in loss, still partially-owned by the state and under pressure from regulators on several fronts, so he will be able to look back at a return to profit, the spin-out of TSB and the development of the lender as a leaner, more digital organisation with satisfaction,” says Russ Mould, AJ Bell Investment Director.

“However, the shares trade at barely half where they were when he took the job, so Mr Horta-Osorio will be looking for a grandstand finish, including perhaps a fresh return to the dividend list, before he steps aside in 2021.

Source: Refinitiv data

“Lloyds was just about the take a £3.2 billion charge to cover claims for compensation relating to mis-sold Payment Protection Insurance when Mr Horta-Osorio took the helm just over nine years ago. Had you told investors then that the bank would have to fork out £28 billion in litigation, conduct and compensation costs, swallow £8.5 billion in restructuring costs and write-down £24 billion in loans and assets over that period then they would have probably wondered what on earth was going to be left.

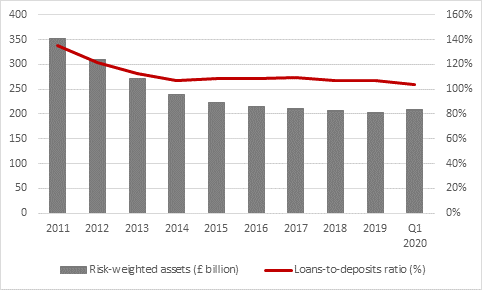

“It is therefore testament to the work put in my Mr Horta-Osorio and his team that Lloyds is still standing and in some ways stronger than ever. It has spun off non-core assets to either reduce complexity or appease regulators (or both) and emerged as a slimmer, more robust organisation. Total risk-weighted assets have fallen to £209 billion from £352 billion, the loan-to-deposit ratio has fallen to 104% from 135% and the common equity tier 1 (CET) ratio has improved from 10.8% to 14.2%, despite that buffeting from payments for past misdemeanours and bad loans during a period of tardy economic growth in the UK.

Source: Company accounts

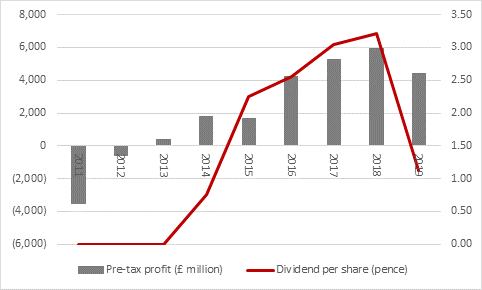

“As a result, profitability has improved and Lloyds has paid out £9.2 billion in dividends. The Government was also able to sell down its stake and fully return the bank to private hands.

Source: Company accounts

“In this context, not all of the poor share price performance can be laid at management’s door. The UK’s modest economic growth record in the wake of the financial crisis has not helped and the bank has also been hampered by record-low interest rates and Quantitative Easing programmes. While they have been designed by the Bank of England to stimulate borrowing and growth, they have made it harder for Lloyds to make a risk-adjusted return on its loan book, and net interest margins have been consistently under pressure. The regulatory call to cancel dividend payments in calendar 2020 also kicked away a big part of the investment case for Lloyds’ shares as the pandemic began to make its presence felt.

“In a tightly regulated, mature, heavily indebted economy growth is going to be hard to come by (at least without taking plenty of risk with the loan book) and so a fat yield is needed to help compensate investors for the dangers associated with holding the equity. That yield is gone, at least temporarily, although analysts are still looking for a fourth-quarter dividend for 2020 to be paid in calendar 2021.

“The bank still has plenty of work to do in other areas, too, so not all of its share price woes are down to external factors. The shares trade at a discount to book value for a reason.

| P/E 2020E | Price/book Q1 2020 | Dividend yield 2020E | Dividend cover 2020E | |

|---|---|---|---|---|

| HBSC | 18.3 x | 0.68 x | 2.5% | 2.22 x |

| Lloyds | 21.5 x | 0.55 x | 2.8% | 1.64 x |

| Royal Bank of Scotland | loss | 0.47 x | 0.2% | n/a |

| Standard Chartered | 18.9 x | 0.47 x | 2.2% | 2.45 x |

| Barclays | 70.1 x | 0.42 x | 1.6% | 0.89 x |

Source: Sharecast, consensus analysts’ forecasts, company accounts, Refinitiv data

“Lloyds continues to face competition from online challengers, so it will have to continue to invest in its digital services, and is yet to prove that its pivot towards wealth management and the bancassurance model of cross-selling other financial services is the right move. Some shareholders may also continue to chunter about Mr Horta-Osorio’s pay packet, especially contributions to his pension, so whoever new chair Robin Budenberg and the board select as the new CEO, they will have plenty in their in-tray on day one, even if the UK will have hopefully emerged from the recession caused by the pandemic by then.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06