Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“You would have thought that WeWork’s spectacular fall from grace would act as a warning to companies about going for growth at any costs and then trying to tart up the results by focusing on self-serving, self-adjusted earnings metrics. However, Uber doesn’t appear to be getting the message, judging by its third-quarter numbers,” says Russ Mould, AJ Bell Investment Director.

“In its dash to try and corner as many markets as possible, rather than focus on excellence in just one, the firm did grow its third-quarter sales by $869 million, or 30%, on a year-on-year basis. That looks impressive until you see that costs grew by $1.2 billion so the operating loss actually got worse, as it reached $1.1 billion, against $763 million in Q3 2019.

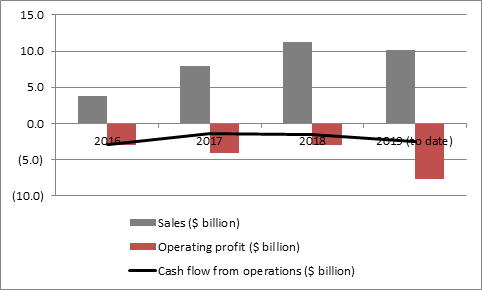

“Uber has lost $7.6 billion at the operating level on $10.1 billion of sales across the first nine months of this year. The company’s operations have also consumed $2.5 billion in cash.

“It is this sort of profitless prosperity – as a dash for customer growth only leads to deepening losses – that did for WeWork’s reputation and Initial Public Offering and it does seem as if the ‘build and they will come’ strategy is beginning to lose its allure for Uber’s shareholders.

“Even though the third-quarter results show a 26% jump in platform users to 103 million and a 31% increase in trips to 1.77 billion, the shares are trading down at $29, more than 30% below May’s $42 flotation price.

Source: Company accounts

“Uber’s management is doing its best to put a gloss on the numbers by referring to its preferred profit metric of ‘adjusted EBITDA.’ CEO Dara Khosrowshahi is sticking to a target that Uber will be in the black using this measure in 2021, encouraged by the third consecutive sequential reduction in losses.

Source: Company accounts

“However the loss still got worse on a year-on-year basis and the ‘adjusted EBITDA’ metric needs to be treated with caution, not least as it excludes no fewer than nine items, most of them expenses, according to the footnotes of the quarterly statement.

| $ million | Q3 2019 |

|---|---|

| Net income | (1162) |

| Redeemable non-controlling interest | 3 |

| Associates | 9 |

| Tax | 3 |

| Net interest income/expense | 90 |

| Other income (expense) | (49) |

| Depreciation and amortisation | 102 |

| Stock-based compensation expense | 401 |

| Legal, tax, and regulatory reserves/settlements | (27) |

| Asset impairment on disposal | 45 |

| Adjusted EBITDA | (585) |

Source: Company accounts

“The exclusion of stock-based compensation in the ‘adjusted’ numbers is probably the most contentious item, especially in light of how Warren Buffett challenged such a practice when he asked:

‘If options aren’t a form of compensation, what are they? If compensation is not an expense, what is it? And if expenses should not go into the calculation of earnings, where in the world should they go?’

“The share price slide suggests that some investors may be tiring of the shuffling around of accounting items, although patient portfolio builders will note that Uber has time on its side, thanks to the proceeds from the May initial public offering.

“The company has $14.6 billion in cash on its balance sheet and a net cash pile of more than $5.3 billion. That liquidity means that Uber can continue to burn investors’ cash for some time to come, even at the rate of $2.5 billion every nine months, and give itself every chance to make its 2021 ‘adjusted EBITDA’ target and prove that it ultimately turn customer growth into actual profits and actual positive cash flow - and the company will have to achieve this at some stage, if it is to justify its $49 billion market valuation.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05