Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

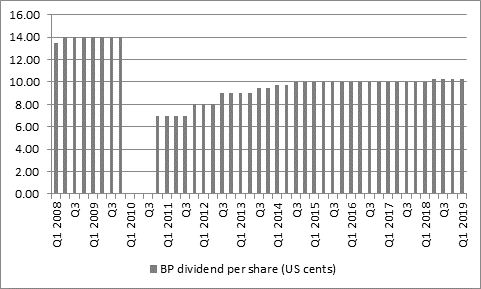

For the fourth quarter in a row, BP has paid a quarterly dividend of 10.25 cents, up from 10 cents a year ago. That year-on-year increase, supported by increased output and this quarter’s increase in the oil price, means the shares are offering a dividend yield of around 5.6% for 2019, which may appeal to income-seekers.

That only ranks the stock the twenty-fourth highest yielder in the FTSE 100, but that is in itself a bit of a back-handed compliment from investors. The shares were among the five highest yielders in the index in late 2015 and 2016, near the 8% mark, as the oil price hit $30 and shareholders feared a dividend cut. BP weathered that challenge and as cash flow gushes once more, investors are happy to accept a lower yield as they feel the risks associated with owning the shares are now much reduced.

BP’s profit were roughly flat year-on-year at $4.8 billion, as the oil price it received was on average 8% lower than a year ago (although gas prices rose by 6%).

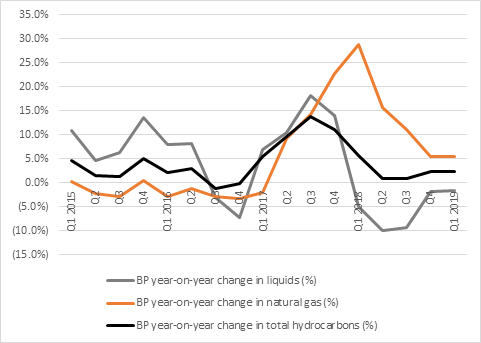

Source: Company accounts

BP managed to counter the effect of the lower oil price with careful management of costs and capital expenditure, as well as an increase in production. Gas output rose 5.5% year-on-year, although a 1.5% drop in liquids held total group growth, including Rosneft, back to 2.4%.

No doubt management will be looking to last year’s $10.5 billion purchase of BHP Billiton’s shale assets in the USA to provide additional impetus here, while they will also welcome the second quarter’s increase in oil prices that has resulted from President Trump’s latest attempts to stop Iranian crude from reaching world markets.

Source: Company accounts

BP’s quarterly dividend of 10.25 US cents is still way below the 14 US cents a share received by shareholders before 2010’s Gulf of Mexico oil spill but income seekers will be grateful for the increase.

Source: BP accounts

BP’s willingness – and ability – to increase its dividend reflects how cash is starting to gush once more. Internally-generated funds comfortably cover the dividend payment, even after capital investment and tax payments.

Operating profit of $5.7 billion added to depreciation of $4.7 billion gives $10.4 billion of cash flow. Working capital soaked up $2.7 billion in cash thanks to an inventory build, while capital investment came to $3.7 billion and tax $1.1 billion, to leave $2.9 billion in the kitty to cover the $1.4 billion quarterly dividend payment.

Source: BP accounts

Highest yielding stocks in FTSE 100

| Company | 2019 E Dividend yield (%) | 2019 E Dividend cover |

|---|---|---|

| Centrica | 10.60% | 0.91 x |

| Persimmon | 10.30% | 1.21 x |

| Taylor Wimpey | 9.90% | 1.13 x |

| Evraz | 9.50% | 1.30 x |

| Vodafone | 9.20% | 0.77 x |

| Imperial Brands | 8.50% | 1.38 x |

| Direct Line | 8.40% | 1.05 x |

| Aviva | 7.80% | 1.84 x |

| Standard Life Aberdeen | 7.80% | 1.00 x |

| TUI AG | 7.70% | 1.59 x |

| Barratt Developments | 7.50% | 1.54 x |

| British American Tobacco | 7.00% | 1.50 x |

| SSE | 7.00% | 1.21 x |

| BT | 6.60% | 1.73 x |

| Phoenix Group | 6.50% | 1.02 x |

| Legal and General | 6.30% | 1.77 x |

| WPP | 6.20% | 1.69 x |

| Admiral Group | 6.10% | 0.98 x |

| HSBC | 5.90% | 1.40 x |

| National Grid | 5.90% | 1.18 x |

| ITV | 5.80% | 1.67 x |

| Royal Dutch Shell | 5.80% | 1.46 x |

| Rio Tinto | 5.70% | 1.67 x |

| BP | 5.60% | 1.32 x |

Source: Sharecast, consensus analysts’ forecasts, Refinitiv data

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 08/05/2024 - 11:46

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01