Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

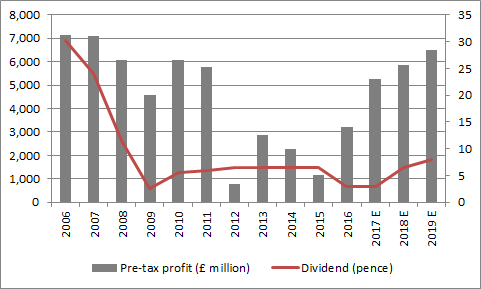

“The sharp rise in Barclays’ shares today reflects management’s optimism on the planned 2018 dividend payment of 6.5p per share, and the future benefits of further cost cuts and changes in the US tax laws, as the messy fourth-quarter numbers themselves offered little to write home about,” says AJ Bell Investment Director Russ Mould.

“Investors may also be cheered by the absence of any further provisions relating to the mis-selling of Payment Protection Insurance (PPI), following the second quarter’s £700 million hit, although the final period of the year still saw £383 million of conduct and litigation expenses hit the profit and loss account.

“Add those to £366 million in loan impairments – including a charge relating to Carillion – and £92 million of restructuring costs and profits were still being weighed down by a number of items which keep recurring.

“Between them, litigation and conduct, restructuring and loan impairments cost Barclays £6 billion in 2017, including the write-down taken upon the sale of the African business, which helps to explain the headline £1.9 billion loss.

Source: Company accounts. Figures in £ million

“The good news is that the African hit will not recur. In addition, Barclays’ profits could shoot higher quickly if it can keep impairment and conduct costs down, but with the whistle-blowing case involving chief executive Jes Staley, the Serious Fraud Office investigation into 2008’s Qatar-backed fundraising and an ongoing fight with the US Department of Justice over allegations of mis-selling mortgage-backed securities there is no guarantee that this will be the case.

“These ongoing clouds may well explain why Barclays shares have done so poorly relative to its UK-quoted and globally-listed banking peers, falling 8%.

“At least that poor performance means the shares look cheap relative to their peers and – at less than one times tangible net asset value per share of 276p (or 263p, adjusting for accounting changes that come into force in 2018) cheap in absolute terms.

|

|

2018E |

|

|

|

P/E |

Price/book |

Dividend yield |

Dividend cover |

13.3 x |

1.34 x |

5.0% |

1.5 x |

|

9.7 x |

1.30 x |

6.3% |

1.6 x |

|

11.2 x |

0.97 x |

3.1% |

2.9 x |

|

14.5 x |

0.90 x |

3.0% |

2.3 x |

|

9.5 x |

0.77 x |

3.1% |

3.4 x |

Source: Digital Look, Thomson Reuters Datastream, analysts’ consensus forecasts. Earnings and dividend yield figures are prospective for 2018, book value is historic and based on last published number.

“For Barclays to become less cheap, it therefore needs to reassure on the big three regulatory issues, cut down on the conduct and loan and asset impairment costs and get its investment bank to perform better.

“The planned increase in the dividend from 3p to 6.5p for 2018, pending regulatory approval, at least suggests management think they are on the right track on all three counts, even if Barclays’ £3.5 billion pre-tax profit for 2017 means it is still nowhere near to returning to the peak levels of income generated before the financial crisis of 2007-09.”

Source: Company accounts, Digital Look, consensus analysts' forecasts

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05