Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“A second straight drop in Sainsbury’s general merchandise sales will have knees knocking at investors in Marks and Spencer ahead of its festive update tomorrow but investors in the grocery giant will still be pleased to see an increase in overall like-for-like sales growth, good progress at Argos and a small upgrade to profit forecasts for the full year to March,” says Russ Mould, AJ Bell Investment Director.

“However, boss Mike Coupe and the team at Sainsbury still have a long slog ahead of them, in terms of maximising the cost and revenue benefits from Argos and fending off the competitive threat posed not just by the resurgence of Tesco and Morrisons but also the discounters Aldi and Lidl.

“They continued to gobble up market share throughout 2017, according to the latest industry data from Kantar Worldpanel, which showed how Sainsbury’s market share dropped from 16.7% to 16.4% in 2017.

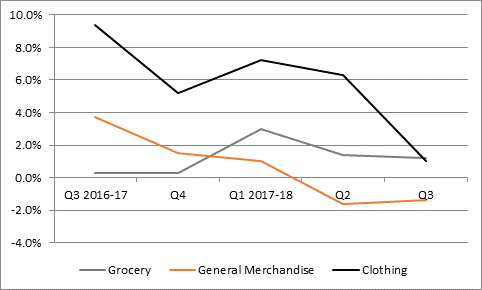

“At least food prices are going the right way so far as the big grocers are concerned, with food price inflation running at around 4% in the fourth quarter, although Sainsbury’s total grocery sales growth figure for the period of 2.3% shows that consumers are being careful with their hard-earned cash and seeking our value where they can find it.

Source: Office for National Statistics

“At least Sainsbury, Tesco and Morrison will be getting some degree of sales uplift from that food price inflation, but that may not be the case with other retailers, as higher prices on life’s essentials could put a squeeze on how much consumers have to spend on discretionary items rather than staple ones.

“That may help to explain the slowdown in Sainsbury’s own general merchandise and clothing sales and the great price sensitivity of consumers flagged by Debenhams, Mothercare and others, even if there are other issues at work there, too, judging by how much better Next and Joules were at generating sales at full price in the run up to Christmas.”

Source: Sainsbury accounts

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 08/05/2024 - 11:46

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01