When you open a pension, you can look forward to two main tax benefits. First, your investments will grow free from capital gains and income tax. Second, and more importantly, the government will give tax relief when you pay in, even if you don’t pay tax.

How much pension tax relief you can get depends on your earnings and the amount of tax you pay. Scottish taxpayers also have different bands of tax and different rates to the rest of the UK, which will affect the amount of tax relief you can claim.

How does pension tax relief work?

If you are a UK resident and under age 75, you can get pension tax relief. The maximum you can pay in personally to your pensions and still get tax relief is 100% of your earnings in a tax year. If you have no earnings, you can still pay in up to £3,600 and get tax relief.

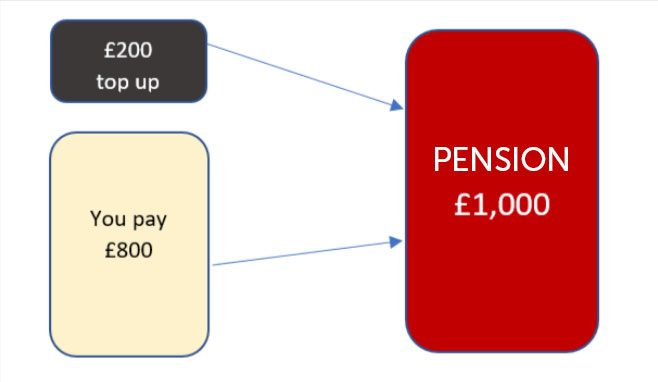

The government will give 20% basic rate tax relief personal contributions and this money also goes into your pension.

If you pay more than 20% tax on some of your earnings – because you are a higher rate taxpayer or a Scottish taxpayer, you can reclaim extra tax relief by completing a tax return or contacting HMRC directly. Any extra relief will be returned to you or reduce your tax bill for the year – it isn’t automatically paid into your pension.

The benefits soon add up as you can see in the table below.

Higher 40% rate taxpayers

| Amount you pay | Government adds 20% tax relief | Total in your pension | Claim extra tax relief of up to | Effective cost as low as |

|---|---|---|---|---|

| £800 | £200 | £1,000 | £200 | £600 |

| £4,000 | £1,000 | £5,000 | £1,000 | £3,000 |

| £8,000 | £2,000 | £10,000 | £2,000 | £6,000 |

| £32,000 | £8,000 | £40,000 | £8,000 | £24,000 |

If you’re a higher rate (40%) taxpayer putting £8,000 into a pension, you'd get £2,000 added to the pot, and be able to claim up to £2,000 extra relief directly from HMRC. This means it could cost you as little as £6,000 to get £10,000 into your pension.

Additional 45% rate taxpayers

| Amount you pay | Government adds 20% tax relief | Total in your pension | Claim extra tax relief of up to | Effective cost as low as |

|---|---|---|---|---|

| £800 | £200 | £1,000 | £250 | £550 |

| £4,000 | £1,000 | £5,000 | £1,250 | £2,750 |

| £8,000 | £2,000 | £10,000 | £2,500 | £5,500 |

Keep in mind that you’ll need to have paid enough tax at the higher or additional rate to be able to claim the full amount of extra relief.

How to claim pension tax relief

Claiming tax relief on pension contributions is easy – your pension provider claims the first 20% (basic rate) pension tax relief directly from HMRC for you and this will be added to your pension.

But if you pay tax at 40% or 45% then you’ll need to claim any extra pension tax relief you’re entitled to. This money does not go directly into your pension but could be up to an extra 25% so is well worth doing.

You can claim the extra pension tax relief as part of your self-assessment tax return. If you do not normally complete a return, you can contact HMRC directly. See here for further information.

When is tax relief added to a pension?

The tax relief payment dates depend on the date you make your own payment and your provider. If we receive your money on or before the 5th of the month, your basic rate tax relief payment will be paid into your pension on the 25th of the following month.

What about the annual allowance?

Although they both are features of pensions, pension tax relief is not the same as the pensions annual allowance.

The annual allowance is the amount you can pay in across all your pensions, per tax year before a tax charge might apply. It includes not only money you contribute yourself, but also the tax relief paid into your pension, as well as anything paid in by your employer. For most people it is £60,000.

You can read more about the annual allowance here.

Important information: Remember that the value of investments can change, and you could lose money as well as make it. We don't offer advice, so it's important you understand the risks. If you're not sure, please speak to a financial adviser. These articles are for information purposes only and are not a personal recommendation or advice. Tax treatment depends on your individual circumstances and rules may change. Pension rules apply

An AJ Bell SIPP gives you complete flexibility on how much you save for retirement, and allows you to decide when and where your pot is invested.

You've saved hard for your retirement, but once you get there, what are your options?

Related content

- Fri, 23/02/2024 - 17:03

- Fri, 23/02/2024 - 16:33

- Fri, 23/02/2024 - 15:28

- Fri, 23/02/2024 - 11:59

- Wed, 21/02/2024 - 08:53