Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

You may well be aware of the extraordinary movement seen over the past month – indeed the past year - in the Chinese equity market. Whether you have any holdings or not, via funds, exchange-traded funds or London-listed Chinese stocks, there are clear lessons which we can all draw from the stunning rise and sudden collapse in the Shanghai and Shenzhen indices, regardless of how our portfolios are constructed.

- You cannot buck the market. China’s market has retreated sharply even though the People’s Bank of China has been cutting interest rates and the government has been doing its best to promote stock market

- Beware central banks trying to create wealth effects. There is no sign of a wealth effect in China now, just restless and unhappy investors and if the market keeps sliding there could be worse to follow. The US Federal Reserve, Bank of England and European Central Bank should all take note, especially given point number one, as one goal of their respective Quantitative Easing (QE) policies is (or was) to drive equity markets higher.

- Stock market swoons may all look different but they really have the same roots. In the end market declines turn into a rout when there is too little liquidity when investors need it and too much borrowing (or leverage) when they shouldn’t be using it.

These lessons can be applied to all global financial markets, not just Chinese equities. Some intrepid investors may now be tempted to look at China again, given the steps taken by the authorities there to stem the selling and prop up the market. Anyone who does so needs to be sure any purchases fit with their overall strategy, time horizon, appetite for risk and target returns and be convinced that the authorities can get it right.

If they do not, caution in required. If they do, then caution is required, as you will be putting a lot of faith in the Chinese authorities. This could be the right thing to do but as Sam Vecht, head of fund management giant BlackRock’s Emerging Markets team wrote in a paper last month: “The belief in policymakers is touching and sweet. We have an enormous amount of confidence in people we cannot name and hardly know.” The chances are you would not buy a company’s shares if you did not know and trust and management team and the same discipline should apply to countries, especially macro- and sentiment-driven ones like China.

If you do feel China meets your criteria and the potential rewards justify the risks then there is a range of investment options available, from funds to investment trusts to exchange-traded funds (ETFs). Here you can go for a pan-Asian fund or one that just targets China. The tables below look at those which focus solely on China rather than those which follow a broader mandate. Note that in the ETF category there are several more funds available but most have a trading history of three years or less, rather than the minimum of five required below. This is especially for the China A shares category, where the instrument tracks stocks via their domestic quote, rather than the H-class shares in Hong Kong.

Best performing China OEICs over the last five year

| OEIC | ISIN | Fund size£ million | Annualised five- year performance | Dividend yield | Ongoing charge | Morningstar rating |

| Threadneedle | GB00B1PRWF12 | 166.5 | 10.5% | 0.8% | 1.11% | ***** |

| Fidelity China Focus Y GBP | LU0457959939 | 3,924.3 | 7.4% | 0.7% | 1.18% | **** |

| Standard Life SICAV China Equities | GB00B5T7PM36 | 698.6 | 6.9% | 0.8% | 0.89% | **** |

| First State China Growth I (Acc) | IE0008368742 | 4,044.1 | 6.7% | n/a | 2.08% | **** |

| Henderson China Opportunities I (Acc) | LU0213068272 | 134.2 | 6.6% | n/a | 1.99% | **** |

Source: Morningstar, for China Equity category. Clean funds only.

Where more than one class of fund features only the best performer is listed.

Best performing Chinese investment companies over the last five years

| Investment company | EPIC | Market cap (£ million) |

Annualised five- year performance * | DividendYield | Ongoing charges ** | Discountto NAV | Gearing | Morningstarrating |

| Fidelity China Special Situations | FCSS | 808.5 | 8.4% | 0.9% | 1.36% | -17.7% | 25% | ***** |

| JP Morgan Chinese | JMC | 136.9 | 6.0% | 0.9% | 1.40% | -15.3% | 13% | **** |

Source: Morningstar, The Association of Investment Companies, for the Country Specialists: Asia categories. Excludes countries other than China. * Share price. ** Includes performance fee

Best performing US large and small cap ETFs over the last five years

| EPIC | Market cap | Annualised five | Dividend | Total expense | Morningstar | Replication | |

| £ million | year performance | yield | ratio | rating | Method | ||

| db x-trackers FTSE China 50 UCITS ETF (DR) | XX25 | 274.0 | 2.8% | n/a | 0.60% | *** | Physical |

| iShares China Large Cap UCITS ETF GBP | FXC | 684.9 | 0.6% | n/a | 0.74% | *** | Physical |

Source: Morningstar, for China Equity category where more than one class of fund features only the best performer is listed.

You could also look toward individual stocks, including China-based concerns which have a London listing, like AIM’s Asian Citrus or the Main Market’s Datang International Power Generation, although many names here have proved disappointing overall. Alternatively you may prefer stocks which have exposure to China, like Burberry or Diageo, where the People’s Republic could provide a growth kicker to an already solid business, assuming the ruling party’s plans to rebalance the economy from building and exports to consumption pan out as planned.

Chinese takeaway

As the local authorities scramble to stabilise the situation, the Shanghai and Shenzhen benchmark indices can still point to healthy gains since the start of the year and on a 12-month view, even after the sharp declines of the past month. Shenzhen tends to focus more on small-to-mid caps, domestic and tech names, Shanghai on more developed, more overseas-facing large caps.

China has still racked up big gains over the past six and 12 months

Source: Thomson Reuters Datastream

Bulls of Chinese equities will argue such advances are justified.

- China is still publishing GDP growth figures of around 7%, a rate which outpaces anything on offer in the West.

- Even if the official numbers are suspect, any slowdown is the result of a sensible policy to rebalance the economy away from construction toward consumption and establish a sounder base for future growth.

- A huge new Silk Road investment programme spans Asia and could help boost Chinese trade

- The Hong Kong-Shanghai Connect scheme is designed to boost stock market flow and overseas interest. Hong Kong-Shenzhen is coming and enhanced liquidity means Chinese mainland stocks may one day end up in the MSCI benchmarks, increasing the amount of cash passive and active funds may commit to the market.

This all sounds quite compelling but the June and July’s torrid events suggest China’s idea of free markets are somewhat different from those of the West. In an attempt to support the leading indices, the China Securities Regulatory Commission and the China Securities Finance Corporation have between them:

- Suspended a range of new company flotations, to limit the flow of new paper into the market

- Encouraged leading broking firms to plough money into the market, lending them the funds so they can do so

- Eased margin lending requirements for retail customers

- Given insurance companies authority to increase the equity weighting of their portfolios

- Permitted firms to suspend trading in their own shares

- Banned listed companies with stakes of more than 5% in listed firms from selling stock

To experienced Asia watchers these last two points will look particularly fishy. Asian firms have a bad habit of buying their own shares in bull markets, to boost their profits, a tactic that can go badly wrong when the market turns down.

Echoes from the past

There has to be a chance a few finance directors are now nervously sat on book losses and that they may treat any sustained rally as a chance to get out (relatively) unscathed in six months’ time, when that ban is lifted. Here, though, lies the problem. When market sentiment turns, investors tend to sell into rallies rather than buy on the dips, especially if they have bought on margin and are now looking to avoid losses to so they pay off their borrowings with as little fuss as possible.

It may therefore take some time before the Chinese market trades on a proper footing and we will only know if and when all of the above restrictions and measures are rescinded. History shows that Government’s efforts to bend the market to their will simply do not work, at least in the long term.

Société Générale strategist Albert Edwards weekly piece reminds us that the Karachi

stock market collapsed as soon as a formal floor to the market was removed in 2008. A 1% daily limit to declines made no difference and after 15 straight drops the restrictions were abandoned when investors stormed the stock exchange building, insisting they be allowed to sell. The fact that Pakistan’s stock market had risen 14-fold since 2001 and that a pull-back of some kind would have been health was apparently lost on the local regulator.

Pakistan failed to stem a market decline in 2008...

Source: Thomson Reuters Datastream

The West has a bad record here, too. In autumn 2008, the Financial Services Authority (as was) forbade the short-selling of financial stocks. The measure proved worthless. The UK’s banks sector fell by a further 70% and the life insurance sector by 65% before they finally bottomed in March 2009, when the market, left to its own devices, ultimately decided what was the ‘right’ price for financial stocks.

...just as bans on short-selling financials made no difference in the West during the financial crisis

Pay attention

These are lessons which the authorities and investors in China and frankly the world must heed. In sum:

- You cannot buck the market. On the face of it, the Chinese authorities have encouraged investors to pile into the equity market. Attempts to blame short-sellers and foreigners have initially come to naught, so more draconian measures have been introduced to deter selling. Even allowing for the recent bounce, this shows the danger of relying on and putting your portfolio in the hands in central bankers and politicians, who may have their own agenda anyway. Markets always need an incremental buyer and you eventually run out of those, which is why industry professionals tend to see hefty retail participation after a massive upward run as a bad sign, as who is left to buy after them? This explains why Joseph P. Kennedy famously sold all of his stocks in the summer of 1929, after a shoe-shine boy started giving him tips.

- Beware central banks trying to create wealth effects. Leaders and monetary policy voting members at both the US Federal Reserve and Bank of England are on record as saying they see higher stock prices as a tool to create a wealth effect. The European Central Bank’s President, Mario Draghi, has said the first thing he looks at every day is stock prices. There is no sign of a wealth effect in China now, just restless and unhappy investors and if the market keeps sliding there could be worse to follow. Markets can only go so far before they become too expensive and collapse under their own weight.

- Stock market swoons may all look different but they really have the same roots. In the end market declines turn into a rout when there is too little liquidity when you need it and too much borrowing (or leverage) when you shouldn’t have it. In the case of the former, everyone overestimates their ability to get out before the crowd – no-one rang a bell on 12 June to call the top when China’s markets peaked and no single event triggered a turn in sentiment. Liquidity is not the ability to simply buy and sell, but to do when you want, in the size you want at the price you want, according to legendary US bond fund manager Howard Marks of Oaktree Capital. During market retreats that final pair of characteristics always prove elusive.

Borrowing to invest is never a good idea as any losses can force selling at most inconvenient and injudicious times. Nor we do have to take China’s experiences on board here. The US stock market has a history of leveraged-fuelled market accidents, including 1907, 1916-17 1921, 1929, 1987, 2000-03 and 2007-09.

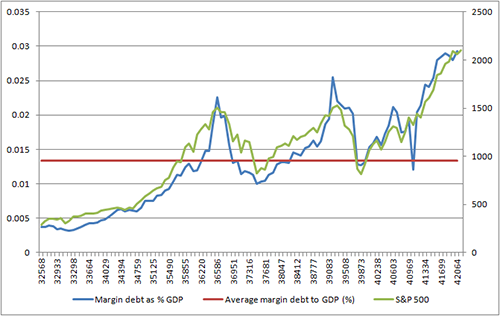

And before you say it couldn’t happen again, the New York Stock Exchange’s database may give pause for thought. It dutifully logs margin debt and the figures show this now stands at record highs in absolute dollar terms (just shy of $500 billion) and as a percentage of GDP (at just on 3%).

US margin debt looks to correlate with the S&P 500...

Source: New York Stock Exchange, Thomson Reuters Datastream, AJ Bell Research

....in absolute dollar and percentage growth terms

Source: New York Stock Exchange, Thomson Reuters Datastream, AJ Bell Research

US margin debt as a percentage of US GDP stands at a record high

Source: New York Stock Exchange, Thomson Reuters Datastream, AJ Bell Research

Margin debt peaked just ahead of the market downturns of 2000 and 2007, while it troughed before the bottom of 2009. Correlation is not causation and this is not a market timing tool – margin debt stayed above its long-term average of 1.5% of GDP from June 1999 to December 2000 and again from December 2004 to December 2008. But it is a signal which should be watched since margin debt could aggravate any future slide in US stocks as any Chinese investor with burned fingers may currently testify.

Russ Mould

AJ Bell Investment Director