Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“IQE’s trading update flagged improved momentum the second half of 2023, TSMC’s fourth-quarter report hinted that the bottom of the semiconductor cycle was in, and Microchip’s huge January profit warning has barely dented the share price, with markets seeming to think silicon chip stocks are primed to sizzle once more,” says AJ Bell investment director Russ Mould.

“The thirty-stock Philadelphia Semiconductor Index, known as the SOX, is surging to new all-time highs and investors will be looking to industry giants such as Texas Instruments, Intel and STMicroelectronics for reassurance this week, when they report quarterly results for the final three months of 2023 and give guidance for the first quarter of 2024.

“Thanks to an unblocking of clogged supply chains, an easing in demand for smartphones and PCs as stimulus programmes and lockdowns end, an increase in supply and sanctions on China, 2023 was a down year for both global semiconductor sales and spending on new chip-making capacity.

“Industry experts such as WSTS, IDC, Gartner and the SIA believe that total semiconductor sales fell by some 10% in 2023, while capex shrank by some 14%, following the boom and all-time highs in both figures in 2022.

“However, global chip sales are seen rising by 13% in 2024. Analysts believe that inventories have been run down, not just at chip makers themselves, but also at distributors and the original equipment makers (OEMs), be they manufacturers of servers, robots, smartphones, cars, smart meters or laptops. Generative AI is also expected to be a driver of demand, especially at the leading edge of the industry and silicon chips, where transistors are now being packed onto wafers at widths of three to seven nanometers (or three to seven one-billionths of a meter) to maximise performance and power.

“NVIDIA’s chips, manufactured on an outsourced basis by Taiwan’s TSMC, are right on this cutting end and the battle between the rival AI models of Open AI, Microsoft’s ChatGPT and Claude.AI, as backed by Anthropic, Google and Amazon, is likely to drive demand as more and more companies and users incorporate AI into their daily activities.

Source: WSTS, IDC, Gartner and SIA

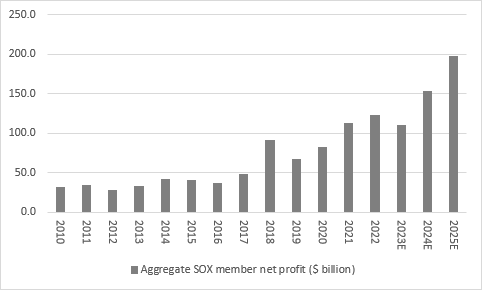

“A bottom-up aggregation of earnings estimates for the members of the thirty-stock SOX index suggests analysts do think better times lie ahead for chipmakers (and chip production equipment manufacturers). Total sales across the SOX are seen rising 19% in 2024 and 15% in 2025.

“Note, however, that NVIDIA and TSMC between them are expected to generate half of the forecast $91 billion jump in total sales from the SOX in 2024 and 40% of 2025’s $85 billion increase.

“As such, sceptics could argue that the SOX index is as reliant upon the AI theme for its meteoric 2023 recovery as the wider S&P 500 American equity benchmark, whose fortunes seem increasingly linked to the Magnificent Seven of Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA and Tesla, all of whom are seen as plays on AI to varying degree.

“At least the SOX’s members are showing much better sales and profit momentum. Total sales rose sequentially in both the second and third quarters of 2023 and analysts will be looking for a further improvement in the fourth quarter.

Source: Company accounts

“They will also want to see a broad-based upturn, especially as NVIDIA and TSMC generated 83% of the second quarter’s sequential revenue increase across the whole SOX and 70% of that made in the July-to-September period.

“In addition, the real test may come in the form of any guidance for Q1 2024 (or beyond). Between them, the expected sales increase of 19% for this year is expected to drive a 39% increase in net profit.

Source: Company accounts, Marketscreener, analysts’ consensus estimates

“First quarter revenues traditionally come in below those of the fourth quarter for seasonal reasons (although sales rose in Q1 2021 and Q1 2022, thanks to the ongoing lockdown-inspired boom for mobile devices and home computing). Guidance here could be telling, especially if inventories take an unexpected lurch upward.

“Microchip blamed a pile-up of unused (or intentionally stockpiled) chips at its automotive customer base for its crunching profit warning in early January, although management also flagged a generally soft economy as a further factor.

“It is quite possible the end customers built up a buffer supply of critical components when supply chains were snarled up and America and China began their tit-for-tat tariff-and-trade war. Chinese firms may have also ordered anything they could lay their hands on before restrictions on their access to US technology were imposed.

Source: Company accounts

“The balance sheets of chip stocks may therefore be every bit as telling as their profit and loss accounts and the guidance management offer for Q1 2024 and beyond.

“Aggregate inventories did surge across the SOX’s members in early 2023 as recession worries took hold and sales of smartphones and computers in particular sagged. The good news is that the inventory days number has stopped going up, although it has not yet come down from what is a high number by recent historical standards.

Source: Company accounts

“A drop here would be welcome news indeed, an increase less so. A reduction would be indicative of renewed strong demand from key markets like wireless devices, computing, consumer electronics, automotive, telecoms networks and industrial robotics. If excess production starts to gather again on balance sheets, then hopes for – and forecasts of – a strong industry recovery in 2024 could prove optimistic.

“The chip industry has wider implications beyond the 30 members of the SOX. By dint of their sheer ubiquity, silicon chips are seen as a good indicator of wider global economic activity and here the consensus view is still that there will be a soft landing in the West, if indeed there is any landing at all. The fears of a recession that dominated 2022, for both chip stocks and wider equity and bond markets, have all but dissipated.

“In addition, chip stocks can be a good proxy for wider investor risk appetite. Semiconductor companies tend to be highly operationally geared, so a 1% change in sales leads to a much bigger change in net profits. As such, earnings can be volatile and difficult to predict, so the companies’ share prices warm to forecast upgrades and positive momentum, and recoil from downgrades and falling profit forecasts.

“The SOX index has in this respect had an uncanny knack of leading the broader S&P index (and where America goes the rest of the world tends to follow, especially now the US represents more than 60% of global market capitalisation). The SOX index peaked before the S&P tipped into a bear market in 2000 and 2007 and bottomed before the wider index cottoned on to how better times lay ahead in 2003 and 2009 and equities began to enter new bull markets.”

Source: LSEG Datastream data

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 22/05/2024 - 09:19

- Wed, 15/05/2024 - 16:51

- Wed, 08/05/2024 - 11:46

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37