Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“When they are bad, they are awful, but when they are good, they can be amazing and right now investors seem to be unsure as to what to expect from airline stocks, even as EasyJet upgrades earnings guidance for the second time for its current financial year,” says AJ Bell investment director Russ Mould.

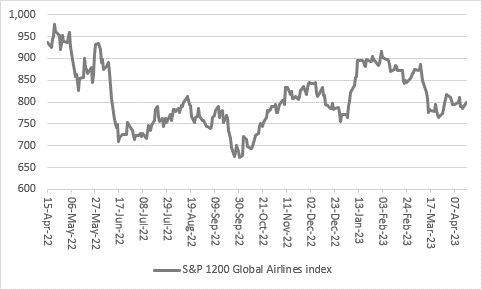

“Even as bookings improve, capacity remains tight and pricing stays firm, investors seem far from convinced that clear skies lie ahead for an industry whose fortunes are notoriously volatile. The S&P 1200 Global airlines index is still down over the past 12 months, even after a big rally from autumn’s lows, and it may be that investors are waiting for greater clarity on oil and fuel prices, wage inflation and the impact of higher interest rates on consumers’ pockets before they really start to trust the upturn.

Source: Refinitiv data

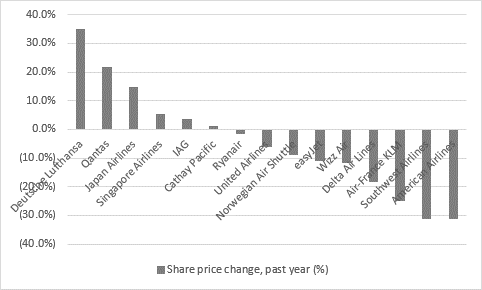

“Among the leading global airlines, only Lufthansa has really shone from a share price perspective in the past twelve months. It seems to be earning plaudits for its cautious capacity expansion and cost-cutting plans, while the German consumer appears to be under less pressure from energy bills than initially feared thanks to government support programmes, a mild winter and a drop in oil prices from 2022’s peak.

Source: Refinitiv data

“Lufthansa is also seen as one of the front runners in a potential bid battle for Portugal’s TAP, which is currently wholly state-owned after 2020’s bail-out. IAG and Air France-KLM are also reportedly interested, and it is possible that investors are looking at ongoing fierce competition between the airlines, given that EasyJet trumpeted its acquisition of eighteen daily slots from Lisbon airport in 2022.

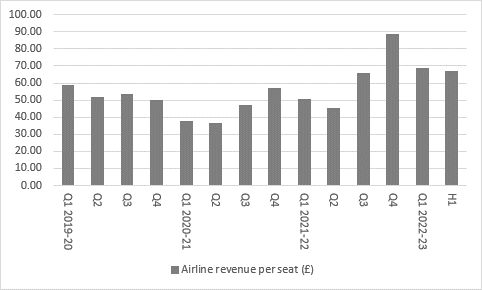

“For the moment however, any signs of competition are not really showing up in prices, at least if EasyJet’s first-half update is any guide.

“The second quarter showed a 43% year-on-year increase in revenue per seat, thanks to increased load factors and ticket sales, a 31% increase in ticket yield and a 16% increase in the yield from the sale of ancillaries, such as food.

Source: Company accounts. Fiscal year to September

“Total airline revenue per seat jumped by £18.85, or 40%, compared to the first half a year ago and the number of passengers surged by 41% to 33.1 million.

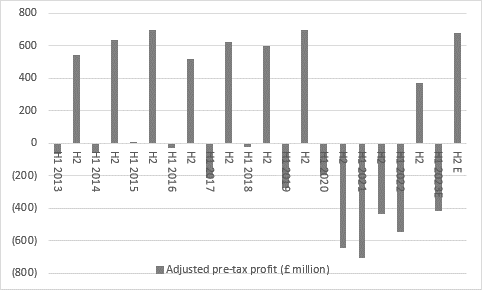

Source: Company accounts. Fiscal year to September

“However, EasyJet still expects to make its customary first-half loss, given the lower load factors seen in the winter season and also a £12.18, or 19% increase total cost per airline seat, in the first half to £77.59. Fuel was a major factor here, as fuel costs per seat surged by 71% to £20.43.

Source: Company accounts, Marketscreener, company guidance for H1 2023, analysts' consensus forecasts for H2 2023. Fiscal year to September

“Even so, chief executive Johan Lundgren expects EasyJet to beat analysts’ forecasts of £260 million in underlying pre-tax income and that implies a second half out-turn of at least £675 million, right up there with the highs of 2015 and 2019.

“This makes the weak share price performance of the last twelve months all the more eye-catching and bulls of the stock will argue that this is where the opportunity lies, given the strong gearing EasyJet offers into any upturn – for every 1% increase in sales, profits will increase faster thanks to the operational and financial gearing in the business and it does seem as if people are keen to travel and get out and about again after three years of being stuck at home, or finding their scope for overseas trips to be very limited.

“Equally, sceptics will point out that airline stocks globally peaked in 2017, well before the pandemic struck. This may have reflected oil prices, but also worries that the global economy had started to sag and slow at a time when competition between airlines remained brutal. Even the shakedown that preceded covid – when firms such as Monarch, Primera Air, Air Berlin, Alitalia and Flybe all failed – may not be enough to help here, especially as state-backed bailouts kept some airlines alive, while others were able to successfully tap debt or stock markets, or even raise cash through the sale and leaseback of assets.

Source: Refinitiv data

“Long lead times from aircraft manufacturers could limit capacity growth and competition to a degree for the next couple of years, especially on long-haul flights, but the trajectory of the global economy and the impact of higher interest rates and inflation may yet be the biggest issue which faces airlines.

“It could be that investors feel 2023’s surge in bookings is a bit of a one-off and the result of three years of lockdowns and other restrictions. EasyJet’s share price peaked in 2015, uncannily enough when its earnings also topped out, and it may be that the airline has to prove it can recapture that high – and then go higher – before investors think of airlines as stocks to rent and trade, rather than something to buy and own.”

Source: Company accounts, Marketscreener, analysts' consensus forecasts. Fiscal year to September

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06