Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

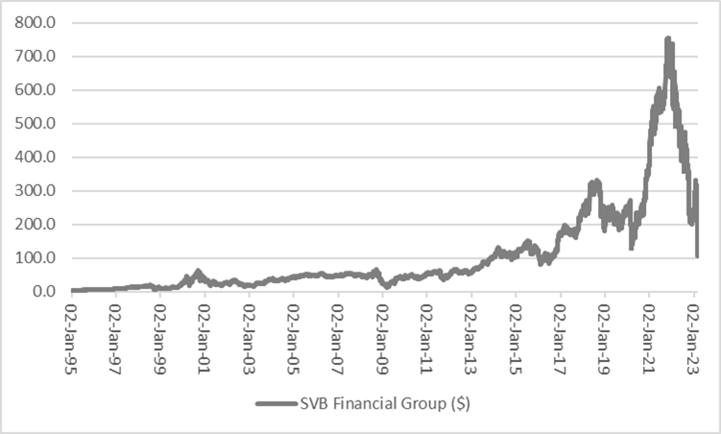

“It was Ernest Hemingway who asked, ‘How do you go bankrupt? Two ways. Gradually, then suddenly.’ Silicon Valley Bank’s share priced peaked in November 2021 and its customers had begun to steadily withdraw their money a year ago before the final dash to retrieve cash last week, so the author’s axiom has proved its worth yet again” says AJ Bell investment director Russ Mould.

“But investors now have so much more to ponder, because in the case of SVB, they are going to be bailed in and therefore lose out, while its American depositors are to be kept whole by a new liquidity scheme, backed by the US authorities and British ones by HSBC’s swoop for the bank’s UK assets.

“There are six key issues still to be addressed.”

1. How much damage can be done by the end of a period of free-and-easy money?

Interest rate increases from central banks the world over – 367 in 2022 and another 40 already in 2023 according to www.cbrates.com – are doing what they are supposed to do, which is cool down the economy and financial markets. Companies’ cost of capital has gone higher and a return to the carefree days of zero-interest-rate-policy (ZIRP) is unlikely, because of the fight against inflation. Firms whose business models relied on an artificially low cost of capital are going to struggle, if not outright fail. Those who survive may need to cut costs. The US move to protect SVB’s depositors, and thus fledgling tech firms’ cash, will prevent immediate closures, but there are still likely to be casualties further down the road. Nor should it be forgotten that SVB boomed during the 1998-2000 technology, media and telecoms (TMT) bubble and then survived the 2000-03 bust (albeit after a major share price collapse). The boom was even bigger in 2000-2021 and it now looks like the fall from grace will be all the harder this time, to perhaps raise questions over other (speculative) asset classes which thrived thanks to the colossal fiscal and monetary stimulus applied during covid and lockdowns.

Source: Refinitiv data

2. Will the valuation of some private equity (PE) and venture capital (VC) funds come under closer scrutiny?

Even as stock and bond markets took a hammering in 2022, owners of private equity and venture capital funds and portfolios remained serene. Valuations generally were not adjusted lower, even as interest rates rose, exits through stock market flotations became harder to achieve (and only then at lower prices) and share prices of already-quoted peers and rivals took a pasting. Again, the end of the ZIRP era means higher discount rates in those discounted cash flow (DCF) calculations often used to value young companies that are loss-making and cash-consumptive today, but potentially very profitable and cash generative in the future. To value these firms, a DCF attempts to put a net present value (NPV) on those future cash flows. The lower the discount rate, the higher the NPV of those future cash flows and the higher the theoretical value of the equity. But the reverse applies, and the higher the discount rate goes (as interest rates rise) and the lower the NPV, the lower the theoretical valuation of the equity and therefore the fledgling firm.

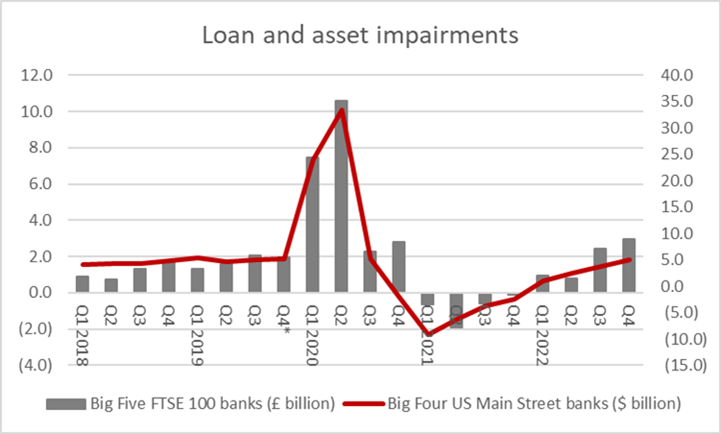

3. Have investors forgotten that higher interest rates are not just about higher net interest margins for banks, but possibly increased bad loan costs, too?

Banking stocks have had a good run on both sides of the Atlantic as investors have warmed to the thought of higher interest rates leading to higher net interest margins on loan books. Net interest margins have indeed gone up at the Big Five in the UK and the Big Four Main Street banks in the USA.

Net interest margin: FTSE 100 banks |

||||||||

|---|---|---|---|---|---|---|---|---|

| Q1 2021 | Q2 | Q3 | Q4 | Q1 2022 | Q2 | Q3 | Q4 | |

| HSBC | 1.21% | 1.20% | 1.19% | 1.19% | 1.26% | 1.35% | 1.57% | 1.74% |

| Standard Chartered | 1.22% | 1.22% | 1.23% | 1.19% | 1.29% | 1.32% | 1.43% | 1.58% |

| NatWest Group | 1.51% | 1.49% | 1.42% | 1.40% | 1.45% | 1.69% | 1.91% | 2.11% |

| Lloyds | 2.49% | 2.51% | 2.55% | 2.57% | 2.68% | 2.87% | 2.98% | 3.22% |

| Barclays UK | 2.54% | 2.55% | 2.49% | 2.49% | 2.62% | 2.71% | 3.01% | 3.16% |

Net interest margin: US Main Street banks |

||||||||

|---|---|---|---|---|---|---|---|---|

| Q1 2021 | Q2 | Q3 | Q4 | Q1 2022 | Q2 | Q3 | Q4 | |

| Bank of America | 1.68% | 1.61% | 1.68% | 1.67% | 1.69% | 1.86% | 2.06% | 2.22% |

| Citigroup | 1.95% | 1.92% | 1.93% | 1.98% | 2.02% | 2.24% | 2.31% | 2.39% |

| JP Morgan | 1.64% | 1.57% | 1.58% | 1.58% | 1.61% | 1.68% | 1.79% | 1.99% |

| Wells Fargo | 2.06% | 2.02% | 2.03% | 2.11% | 2.16% | 2.39% | 2.83% | 3.14% |

Source: Company accounts

But charges for sour loans have started to go up, too. The years 2020 and 2021 were unusual, as the former saw huge loan loss provisions owing to covid and then the latter saw banks write some of those back as the worst-case scenario failed to develop and more borrowers came through the pandemic than expected. But as the combination of higher interest rates and inflation put the squeeze on many borrowers’ those borrowers have struggled to pay interest and service their debt, with the result loans have gone sour. This has forced the banks to take higher bad loan charges on both sides of the Atlantic. Higher rates are not a win-win for banks. The good news is the Big Five FTSE 100 banks trade at or below book, or net asset, value, so this is to some degree priced in. With the exception of Citigroup, the Big Four Main Street and big Two Wall Street banks do not, so their share prices may be more exposed to tougher economic times.

Source: Company accounts

4. Will regulators and ratings agencies come under the microscope again?

SVB met all regulatory and capital adequacy ratios required of it, at least when its assets and US Treasury holdings were valued at par, or book value, and its bonds and debt also held an ‘investment grade’ credit rating from the leading agencies. Shareholders and bondholders should due their own research before they take on the risks of owning shares or owning bonds and accept the profits or losses accordingly. The ratings agencies exist so busy entrepreneurs and executives do not have to do that research and can focus on managing their staff and assets. Just as in 2008, the ratings agencies have been caught out.

Nor have regulators covered themselves in glory. According to the Basel III rules, the Tier 1 Capital ratio is a key measure of a bank’s financial strength and it is measured by dividing a bank’s core equity against its risk-weighted assets (RWAs). RWAs are weighted for their perceived credit risk and the regulations give government bonds a zero-risk weighting, the same as cash. For investors to belatedly remember that bond prices usually go down as interest rates (and therefore government bond yields) go up is proving a nasty shock, but some may question whether the regulations are correct to allocate a zero-risk weighting to Treasuries.

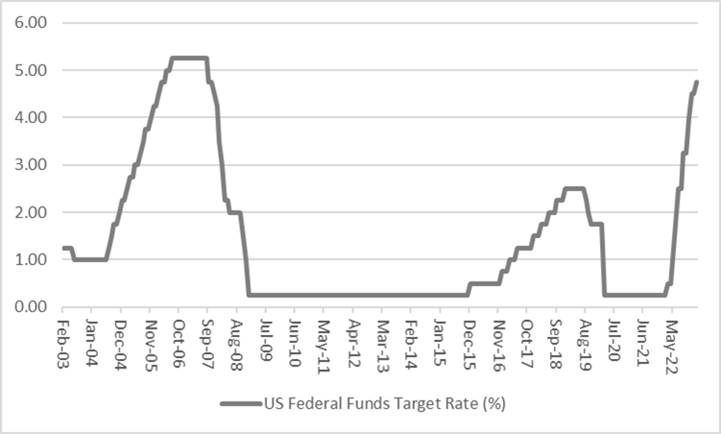

5. Can the Fed keep raising interest rates?

As of Thursday, before the run on SVB, markets were putting a 68% chance on a half-percentage-point rate rise to 5.25% from the US Federal Reserve next week, thanks to tough talk on inflation before the Senate Banking Committee from chair Jay Powell. Markets are now quickly pricing in only a quarter-point increment or even no increase at all on 22 March and the yield on the benchmark 2-year and 10-year US Treasuries is falling quickly.

The Fed may now find itself between a rock and a hard place. It wants to tighten policy to keep a lid on inflation but will now face questions as to whether policy is already too tight, given this nasty wobble in the banking system and the pressure higher rates are already putting on many companies’ cash flows.

If nothing else, this is a reminder that the Fed may not find it easy to extricate itself from more than a decade of record-low interest rates and $7 trillion of Quantitative Easing (around a quarter of US GDP) without something breaking somewhere. Money was cheap and tossed around with abandon as a result of the zero cost associated with it. Now markets are going through a journey once more to discover what is the cost of money, some of that prior reckless abandon could lead to trouble.

For all of the Fed’s efforts to tighten, the Fed Funds rate is still below where it was before the Great Financial Crisis started in 2007 and the central bank may yet struggle to get back there, if the SVB drama is anything like a reliable guide.

Source: US Federal Reserve, Refinitiv data

6. Will investors Buy The Dip or Sell the Rally?

HSBC’s purchase of SVB’s UK assets and the US Bank Term Funding Programme will keep depositors whole on both sides of the Atlantic and this news is likely to be received with relief after the panic at the end of last week. The question now is whether risk appetite has been marred more deeply, as markets fear they are trapped between recession on one hand and inflation on the other, or whether fresh hopes for a pause or even a pivot in interest rates from the US Federal Reserve and Bank of England stoke a fresh rally in risk assets.

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06