Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“The broad-based rally in stock and bond markets since the October lows rests largely upon their conviction that inflation will retreat, the global economy will suffer no more than a shallow recession (or even avoid a downturn altogether) and central banks will be able to start cutting interest rates sooner rather than later as a result. The statement from US Federal Reserve chair Jay Powell to the Senate Banking Committee in Washington on Tuesday challenges this oh-so-cosy consensus and that is why stock markets are stumbling,” says AJ Bell investment director Russ Mould.

“Instead of going for the Goldilocks option so beloved by bond and share prices – namely that the economy will be neither too hot to stoke inflation and force interest rate rises nor so cold as to threaten corporate profits – Mr Powell is saying the US economy is running hot and that interest rates may go higher than expected, faster than expected.

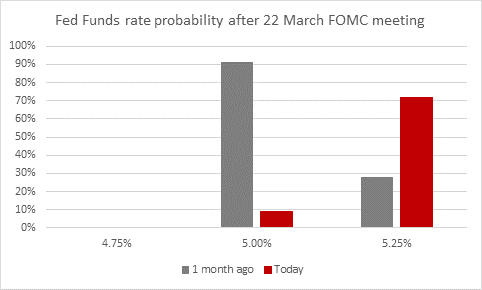

“As a result, according to CME Fedwatch, markets have started to price in:

- A one-half point rate rise on 22 March, rather than the quarter-point hike which was seen as a 91% chance just a month ago.

Source: CME Fedwatch. Federal Open Market Committee (FOMC) increased the Fed Funds rate by 0.25% to 4.75% on 1 February

- A peak in the Fed Funds rate of some 5.75%, still a full percentage point above the level set at February’s meeting of the Federal Open Market Committee (some even think the rate could peak at 6.25%).

- A delay in the first rate cut until Q1 2024, and that from a higher base than expected.

Source: CME Fedwatch. Based on the most likely outcome per month

“This is having knock-on effects upon a range of financial markets:

- Share prices are wobbling as hopes for that hat-trick of a deceleration in inflation, a soft landing and decline in rates start to ebb. Perversely, this currently means that good news for the economy is seen as bad news for markets, as a strong economy means faster growth and higher inflation than expected and thus higher interest rates. And higher interest rates improve returns on cash and bonds and mean investors may not have to take as much risk, in the form of shares, to get a return on their cash (at least in pre-inflation, nominal terms).

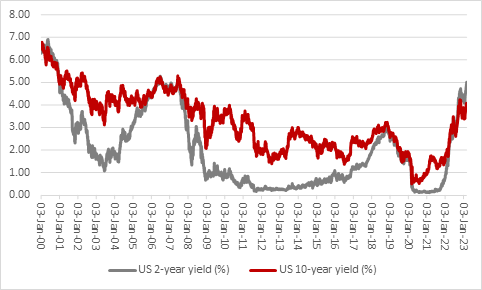

- The US two-year Treasury yield now exceeds 5% for the first time since 2007 and the benchmark US ten-year is back at 4% for the first time since 2010. The higher bond yields go, the lower prices go, so fixed-income investors are being kept on their toes, too.

Source: Refinitiv data

- The dollar is rallying after its late-2022 tumble from 20-year peaks at 114. The trade-weighted DXY index, or ‘Dixie’, is back to 106 having troughed at 101 in February. A strong dollar is traditionally seen as bad news for emerging markets’ equities, bonds and currencies, as many of those nations borrow in greenbacks. A firm buck makes it more expensive to service that debt and those increased interest payments (in local currency terms) drain away cash that could be used for investment elsewhere in the domestic economy. In addition, a bouncy buck is traditionally seen as a negative for commodity prices, too, since all raw materials bar cocoa are priced in dollars and a firm US currency makes it more expensive for non-dollar nations to buy them.

Source: Refinitiv data

- Gold is slipping back toward $1,800 an ounce after its latest failed effort to crack the $2,000 barrier. Higher interest rates, and returns on cash, increase the opportunity cost of holding the metal, which by contrast yields nothing (and also potentially comes with storage costs), and thus decrease gold’s lustre – or so the theory goes.

Source: Refinitiv data

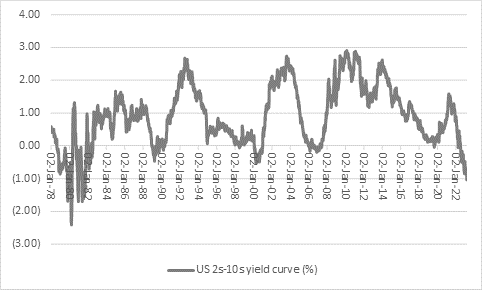

“Markets are therefore hanging on Mr Powell’s every word, although not everyone believes him. US Treasury yields are going higher but the US yield curve is still inverted – two-year paper is yielding more than ten-year paper. This is usually seen as a warning of a recession, because it implies the market is pricing in future interest rate cuts in response to a downturn, and the yield curve is at its most inverted since the early 1980s, when the US suffered two recessions in quick succession.

Source: Refinitiv data

“As such, Mr Powell’s statement may not be fostering as much faith in the Fed’s credibility as he would like.

“The US central bank initially dismissed inflation as transitory, after all, and it has previously declared its support for the view that a soft landing was coming. Moreover, Mr Powell has argued that the Fed would be data dependent (exactly as he did in 2019, just before the FOMC misjudged inflation).

“Changes in interest rates take eighteen to twenty-four months to have an impact but data-dependence implies a reliance upon backward-looking data at worst and concurrent data at best. It also gives less weight than some would like to the rising cost of US government borrowing at a time when America’s government is bumping up against its legislated $31 trillion debt ceiling.

“That raises the risk of policy error and the temptation to suggest the world’s most influential central bank is winging it gets stronger, as Mr Powell and the FOMC look to extricate the Fed from its experiments with ultra-loose monetary policy, and zero interest policies and Quantitative Easing, and return to something akin to ‘normal.’

“History suggests that the Fed will indeed pivot to cutting rates, but only once the economy turns down, the stock market breaks lower or both, and neither is a prospect that investors will welcome if we get a repeat.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06