Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“HSBC’s fourth-quarter and full-year results show very similar trends to those of Barclays, Standard Chartered and NatWest, namely higher interest margins, higher loan losses and higher dividends,” says AJ Bell investment director Russ Mould.

“Nor are the outlook statements particularly different, as further normalisation in loan impairments had already been expected, further improvements in returns on equity are still being targeted and further cash returns are on the table, too. But it is the shares of HSBC and Standard Chartered that are responding most favourably at the moment, as China’s reopening presents them with a potentially helpful tailwind while NatWest and Barclays are more exposed to the UK and the latter’s investment bank suffers a loss of momentum.

“These trends can be seen, to some degree, in the respective relative valuations.

|

2023E |

Q4 2022 |

2023E |

2023E |

|---|---|---|---|---|

Barclays |

5.3 x |

0.59 x |

5.1% |

3.67 x |

Standard Chartered |

7.9 x |

0.73 x |

2.3% |

5.52 x |

HSBC |

7.0 x |

0.99 x |

7.0% |

2.04 x |

Lloyds |

7.3 x |

1.05 x |

5.3% |

2.55 x |

NatWest Group |

6.7 x |

1.07 x |

5.7% |

2.63 x |

Source: Company accounts, Marketscreener, consensus analysts’ forecasts, Refinitiv data

“Barclays trades on the lowest prospective price/earnings ratio and the lowest multiple of historic book value, thanks to the influence upon its earnings stream of the cyclical investment banking operations. Standard Chartered, also more exposed than average to financial markets, is also toward the low end on book value metrics, though this may also reflect its below-average yield, as the bank seeks to rebuild its dividend after 2016’s swingeing cut.

“Lloyds and NatWest seem more highly prized for their cash returns, while HSBC sits in the middle, supported by the power of its wealth management and commercial banking operations in particular, as well as that exposure to Asia, the continent which drives profits like no other at the institution once known as the Hong Kong and Shanghai Banking Corporation.

HSBC 2022 profits, $ million |

||||

|---|---|---|---|---|

|

Stated |

|

|

Adjusted |

Wealth and Personal Banking |

8,533 |

|

Asia |

13,724 |

Retail Banking/Wealth Management |

7,716 |

|

Middle East / North Africa |

1,700 |

Commercial Banking |

5,445 |

|

North America |

1,666 |

Corporate |

2,316 |

|

Latin America |

853 |

|

|

|

Europe |

(415) |

Total |

24,010 |

|

Total |

17,528 |

Source: Company accounts

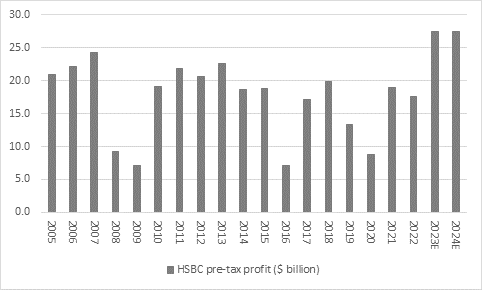

“Expectations of an economic upturn in China will be a major reason why analysts expect a leap in pre-tax income to $27.8 billion compared to $17.5 billion in 2022. If that forecast is correct, then pre-tax earnings would reach an all-time high in 2023, and HSBC management’s target of a 12% return on tangible equity would look very realistic. A series of double-digit returns on equity figures may then suggest that HSBC’s one-times book value multiple would look like good value, although any unexpected setbacks in China, and especially its real estate markets, could yet jeopardise such an optimistic scenario.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts, Refinitiv data

“HSBC is a global bank nonetheless, despite its planned retrenchment in the French and Canadian markets, and it did exhibit similar patterns to the three FTSE 100 banks that have already reported.

“The net interest margin on the loan book rose in Q4 to 1.74% for the fourth consecutive increase, although accusations of wilful profiteering look a little less powerful in light of the full-year figure of 1.48%, the third-lowest figure since the Great Financial Crisis and still below even 2019’s mark.

Source: Company accounts

Source: Company accounts

“While higher interest rates can help net interest margins, they can also tip borrowers over the edge and leave them struggling to keep up with their interest obligations or even meet their final repayments. HSBC is showing an increase in loan impairments and management expects a further increase in 2023 in the cost of sour loans to 0.50% of the average gross annual loan book, from 0.36% in 2022.

Source: Company accounts

“Perhaps the best news of all, though, comes from HSBC’s planned cash returns. The proposed full-year dividend of $0.32 is higher than expected and the bank is already targeting a $0.21 special dividend, and maybe additional share buybacks, for 2023, when analysts are also looking for a hike in the regular distribution to $0.53.

“That $0.53 per share forecast translates into an annual payment worth £8.7 billion, the biggest single company figure for the year from any FTSE 100 firm, according to analysts’ consensus estimates. It also implies a forward dividend yield, which may well tempt income-seekers, while adding on the proposed special takes the payment to $0.74 for a meaty 9.8% dividend yield.”

Source: Company accounts, Marketscreener, consensus analysts’ forecasts, management guidance for 2023E special dividend, Refinitiv data

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06