Capital gains tax (CGT) is a type of tax charged on gains made when an asset is sold or transferred. The most common example is selling an investment, like shares or a fund, but tax could also be due if you transfer an investment, business assets or even cryptocurrency to another person.

However, there are a few circumstances where you won’t have to pay CGT. First off, any gains you make on investments held in an individual savings account (ISA) or a pension, including a self-invested personal pension (SIPP), are sheltered from CGT. Likewise, any profits made when you sell your main home, and most personal items worth £3,000 or less, are exempt.

Outside of the circumstances where you’re exempt from paying CGT, you’ll also get an annual capital gains tax allowance. But you will need to pay CGT on any gains you make that exceed this allowance each year.

What is the capital gains tax allowance?

Officially called the Annual Exempt Amount, the CGT allowance is the total gains you can make on selling investments or assets in a tax year before they start to be taxed. It’s a ‘use it or lose it’ situation, so you can’t carry it forward to the next tax year if you don’t use your full tax-free allowance.

The capital gains tax allowance is currently £3,000 per person, per tax year.

How does capital gains tax work?

Each year, you’ll usually have to pay tax on any gains you make, outside an ISA or SIPP, which exceed your CGT allowance.

To work out the CGT rates you’ll pay on any gains, you’ll need to know your income for the year. It also depends on the type of investment you’ve sold – capital gains tax on shares and funds differs to the rates you’d pay on property, such as a second home.

For gains on shares and similar investments, any part of the gain (above the allowance) that still puts you within the basic rate band for income tax when added to your taxable income will be taxed at 10%. Gains that sit above the basic rate band will be taxed at 20%.

Any gains from to the sale of residential property, which isn’t your main home, will be taxed at the slightly higher rates of 18% and 28% respectively.

Let’s look at an example:

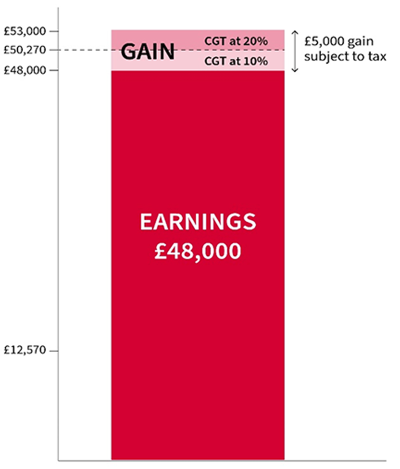

Sarah earns £48,000 a year and has made a gain on the sale of her share portfolio. After deducting her CGT allowance and any costs of selling the shares, her taxable gain is £5,000.

When you add the gain to Sarah’s income, you can see that part of the gain sits below the basic rate band1 of £50,270 and the rest above.

In Sarah’s case, £2,270 of the gain will be taxed at 10%, and the remaining £2,730 taxed at 20%.

1Scotland sets its own rates and band of income tax but for the rest of the UK, the basic rate tax band currently stands at £50,270 and will be frozen until April 2028.

How do I report and pay capital gains tax?

You won’t get a ‘bill’ for the CGT you owe each year – instead you’ll need to report and pay it to HMRC yourself. You can do this on your annual self-assessment tax return or, if you don’t usually complete a tax return, another way to report your gains is using the Government’s ‘real time’ capital gains tax service.

There are different reporting rules and deadlines for paying CGT depending on your individual circumstances. For example, residential property gains must be reported to HMRC within 60 days of completion, rather than other investment gains which have more generous deadlines. Different rules also apply if you’re paying CGT as a trustee or as a personal representative of someone who’s died. Just make sure to check which rules apply to you.

How do I avoid capital gains tax?

We’ve talked about the rules, so what can investors do now and in the future to plan ahead and reduce the tax they might pay? Here are five ways you might be able to reduce or even eliminate any potential capital gains tax.

1) Use or lose the annual CGT allowance

Just be careful if you intend to buy the same holding back outside of an ISA or SIPP. If you do this within 30 days, then you would be deemed to have bought it back at the original cost and not realised any gains. This tax avoidance rule is sometimes known as the ‘bed and breakfast’ rule.

2) Make the most of ISA and SIPP tax-free wrappers

Gains on investments held in ISAs and SIPPs are sheltered from capital gains tax altogether. The ISA allowance is £20,000 per tax year (across all types of ISA) per person.

If you want to make the most of your allowances and keep the same investment(s) then you might consider a Bed & ISA transaction. This involves selling an investment and using the cash proceeds to buy it back within the ISA as quickly as possible. There might be stamp duty and dealing costs to pay but any gains going forward will be completely tax free.

Investments held within your SIPP get the same tax-free treatment – but do keep an eye on the amount you can pay in and keep in mind that you cannot usually access your pension until you reach age 55 (age 57 from 2028).

3) Transfer assets to your spouse or civil partner

These transfers are exempt from CGT as they happen on what is known as a ‘no gain, no loss’ basis.

This is particularly useful where you’re planning to sell an investment and your spouse or civil partner has not used their own capital gains tax allowance. In addition, if they have a lower income than you it could mean that any tax due will be at a lower rate on the gain that exceeds any remaining tax-free allowance.

When you transfer investments to a spouse or civil partner, make sure you keep a note of the original cost to you as this also transfers across to them and will be needed when they come to sell the investment themselves.

4) Use a pension contribution to reduce taxable income

Not only can you invest the cash inside your SIPP free of CGT, but the gross value of your pension contribution also has the effect of reducing your taxable income. Which has a handy knock-on effect of extending your basic rate band when calculating what CGT rate you’ll pay.

Any investment gains that now fall within your (extended) basic rate band when added to your income for the year would then be taxed at 10% instead of 20%.

If you’ve used your pension allowances or cannot make a pension contribution, another way of reducing your taxable income is by donating to charity. And you can claim gift aid on these donations, if eligible.

5) Look out for losses

If you make a loss on any investments you sell, this can be offset against any gains before you deduct the tax-free allowance. If your current year losses exceed your gains, you can carry forward the difference, but you can’t use the allowance first to create a loss.

Any losses you have from previous years can then be carried forward indefinitely, but you should make sure you register the losses with HMRC within four years after the end of the tax year in which you made the sale in question.

Important information: We don't offer advice, so it's important you understand the risks, if you're unsure please consult a suitably qualified financial adviser. Tax, ISA and pension rules apply.

These articles are for information purposes only and are not a personal recommendation or advice.

Our Dealing account is low cost and unlimited. Invest as much as you want, whenever you want.

If you have investments that you would like to transfer into your AJ Bell ISA and you have not used your full allowance for this tax year, then you can use our Bed and ISA service.

Related content

- Fri, 23/02/2024 - 17:03

- Fri, 23/02/2024 - 16:33

- Fri, 23/02/2024 - 15:28

- Fri, 23/02/2024 - 11:59

- Wed, 21/02/2024 - 08:53