Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

"After rising by around a sixth over the past year, Bunzl’s share price stands only a fraction below its all-time high, buoyed by June’s trading update, when chief executive Frank van Zanten raised the company’s guidance for 2022 for a second time. Bunzl now expects ‘very good’ revenue growth, compared to a prior forecast of ‘moderate’ growth, and still believes that the group operating margin will slightly exceed historic averages,” says AJ Bell Investment Director Russ Mould.

"A lot of this may be due to Bunzl’s business model. It is a specialist distributor and supplies the things that other firms need in order to do business, such as coffee cups to cafés and cleaning materials to hospitals. But they aren’t supplying the goods consumers actually buy. The required nature of the products it provides may shelter the firm from the vagaries of the economic cycle, at least to some degree, and also provide Bunzl with pricing power, a key ingredient during inflationary times.

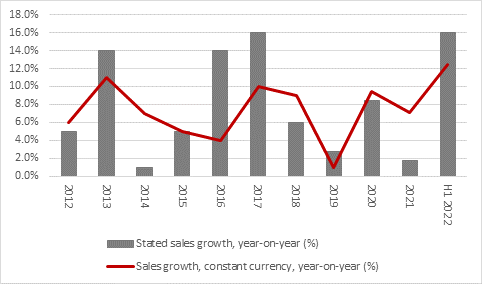

"In July’s second-quarter update, Bunzl revealed 16% sales growth for the first half on a stated basis and growth rate of 12%-13% using constant currencies, albeit with some help from acquisitions. Mr van Zanten flagged inflation as a key driver of sales and noted strong revenue increases in Europe, the UK and USA, where he noted negotiations with one key customer were ongoing, so keep an eye out for any commentary there.

Source: Company accounts

"With this more comprehensive set of figures, analysts will also dig deeper into the regional patterns and after any dissection of the sales mix, analysts will then move on to three more datapoints:

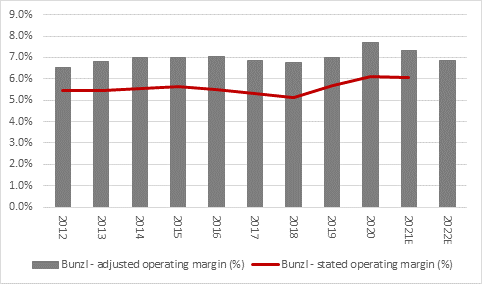

"The first will be operating margin. Bunzl’s return on sales has been pretty stable around the 5.0% to 6.0% level for the last decade or so, on a stated basis (and higher on an adjusted one). Again, Bunzl has suggested that 2022 could come in higher than the long run average.

Source: Company accounts

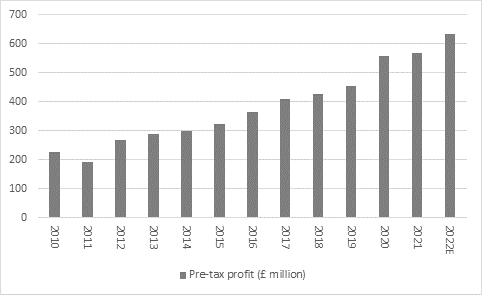

"The second will be the headline pre-tax profit figure. For 2022 as a whole, analysts expect an 11% advance to £633 million. At the interim stage a year ago, Bunzl’s adjusted pre-tax profit figure was £245 million.

Source: Company accounts, Marketscreener, consensus analysts' forecasts

"Finally, shareholders will watch out for the dividend, even if the forecast yield is not the biggest at around 2%. Bunzl’s streak of annual dividend increases, that dated back to 1994, was halted by the pandemic, but the firm quickly got back on track and did offer a catch-up payment. For 2022 as a whole, analysts are looking for a 9% increase to 62p a share so that rate of growth may be a fair benchmark for this interim report. Bunzl paid 16.2p a share to its investors at the same stage last year.

Source: Company accounts, Marketscreener, consensus analysts' forecasts

"More strategically, watch out for an update on acquisitions. Bunzl has traditionally used bolt-on deals to supplement its organic growth and complement its business structure. The firm spent £508 million on 14 acquisitions in 2021 and it has already struck six deals at a cost of £220 million in 2022."

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06