Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“The pricing power conferred by Croda’s business model and its strong position in its chosen markets shines through the full-year numbers, as sales, profits, profit margins and the dividend are all higher. However, the share prices just does not seem interested,” says AJ Bell Investment Director Russ Mould.

“The latest slide means Croda shares are down by a third from their peak of last December and no higher than they were last summer. This is not the company’s fault. It’s just the result of the stock’s lofty valuation and investors’ ongoing switch away from highly-rated growth stocks at a time of rising interest rates and toward commodity and raw materials plays at a time of rising prices and inflation.”

“Croda is one of those rare FTSE 100 firms that can point to a string of at least ten consecutive increases in its annual dividend. Croda’s streak dates back to 1999 and it is extending that with a 10% increase in its 2021 distribution to 100p a share.

Source: Company accounts, Marketscreener, consensus analysts' forecasts

“Such a dividend streak usually attracts that tagline that this is a ‘quality’ or ‘secular growth’ stock and in Croda’s case such descriptions seem fully merited.

“The specialty chemicals company’s innovations in the areas of personal care (ingredients for skin creams), life sciences (for crop care), high-performance coatings and lubricants mean it provides products upon which its customers rely heavily and for which they are prepared to pay up as a result. That brings pricing power and pricing power in turn brings lofty margins, excellent returns on capital and the sort of cash flow that can fund consistent increases in the dividend.

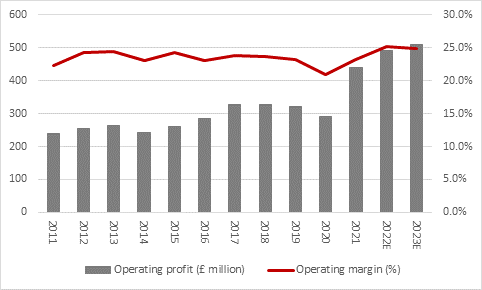

“Analysts expect the dividend growth streak to continue in 2022 and 2023, not least because in 2021 Croda generated a 23.2% operating margin, on a stated basis, and its £438 million annual operating profit equated to a 16.4% return on capital employed.

“Croda achieved those numbers despite ongoing investment for the future and the €915 million sale of the majority of its performance technologies and industrial chemicals operations to Cargill is designed to further hone the group’s skillsets. The sale reduces cyclical exposure and frees up additional resources to invest in the fast-growing life sciences and consumer markets.

“That operating margin has been very consistent over time and reflects Croda’s pricing power, which is carefully described as ‘inflation cost recovery’ by chief executive officer Steve Foots in his outlook statement.

Source: Company accounts, Marketscreener, consensus analysts' forecasts

“So the problem, so far as the share price is concerned, is not operational strategy, or financial performance or the balance sheet; net debt, including leases and pensions, is just £815 million, for a gearing ratio of less than 50%, and operating profit and interest income covered interest expense more than 15 times in 2021.

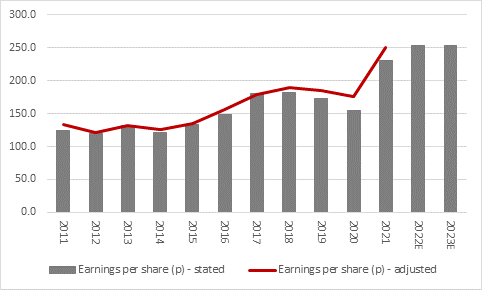

“No, the problem is simply one of valuation. Croda’s £10.4 billion market cap compares to 2021’s net profit of £323 million, a multiple of 32 times. Even though earnings are expected to grow in 2022 and 2023, the price/earnings ratio is still 29 times based on forecast 2022 earnings when the broader FTSE 100 is on a multiple of 11 to 12 times.

Source: Company accounts, Marketscreener, consensus analysts' forecasts

“Yes, Croda is a higher quality businesses than the FTSE 100 overall as its earnings are more consistent, its operating margins higher and its dividend growth record more impressive, but the valuation already factors that in. The earnings figures did not surprise on the upside either and at a time when interest rates are rising Croda’s lofty valuation multiples could work against its share price.

“This is because perceived secular growth stocks like Croda, which have consistent margins and a good trend growth profile thanks to their target industries and market position, are often valued on a discounted cash flow (DCF) basis – the humble price/earnings (PE) ratio is a just a short-hand version.

“A key part of the DCF is the interest rate that is used to discount back future earnings to provide the net present value (NPV) of the equity. The higher the interest rate, the lower the NPV and the lower the theoretical value of the company and thus its share price. It is simply a matter of maths, regardless of how good or high quality Croda is as a company.

“Even good companies can provide less-than-stellar investment returns if investors overpay to access their profits and cashflows and at the moment there remains the risk that Croda’s big price tag could mean this is one such example.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06