Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

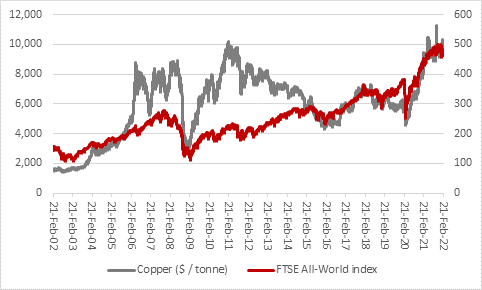

“Copper carries the nickname ‘Dr Copper’ because the malleable and ductile industrial metal is used so widely in so many industries that it is seen as a good guide to global economic health. In some ways investors should therefore be pleased to see copper trading near $10,000 a tonne, although the metal’s recent price strength could also be down to the prospect of sanctions in Russia and input cost inflation at miners like Antofagasta,” says AJ Bell Investment Director Russ Mould.

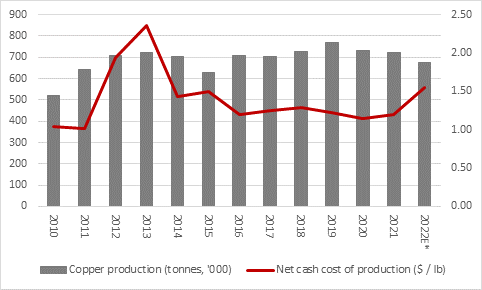

“The Chile-based member of the FTSE 100 is flagging a 30% increase in its net cash cost of production for copper in 2022 as output is expected to drop slightly this year, thanks in part to water usage restrictions.

Source: Company accounts. *2022E output based on mid-point of management guidance given alongside 2021 results.

“With planned production of around 675,000 tonnes in 2022, at the mid-point of management guidance, Antofagasta lags the leading copper miners, Codelco, BHP, Freeport-McMoRan, Glencore and Southern Copper, all of whom produce a million tonnes or more.

“Russian output comes to around 3.5% of global demand at 920,000 tonnes a year, according to the US Geological Survey. A ban on Russian exports could further tighten the market and provide an additional inflationary impetus in industries such as building, autos, electrical goods and even silicon chips, on top of rising input costs.

Source: Refinitiv data

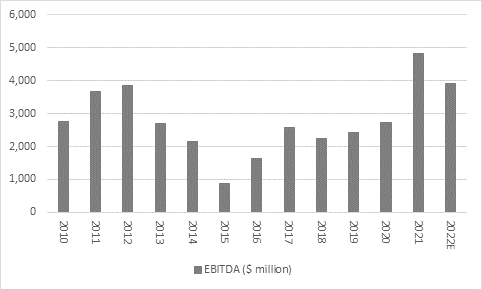

“Antofagasta is riding this price strength as in 2021 it has generated its highest profits in over a decade, based on the company’s preferred metric of earnings before interest, taxes, depreciation and amortisation (EBITDA), after a 77% jump to $4.8 billion.

“Analysts think EBITDA will dip in 2022 thanks to that combination of higher costs and lower output, although sustained copper price strength could yet leave such assumptions looking conservative.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

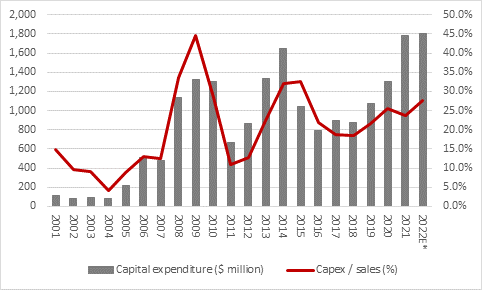

“The Chilean company’s management team seem confident in the future. Capital investment in 2022 is expected to largely match 2021’s all-time figure of $1.8 billion, although that does not match prior peaks on a percentage of sales basis.

Source: Company accounts, Marketscreener, consensus analysts' forecasts. *2022E capex based on mid-point of company guidance.

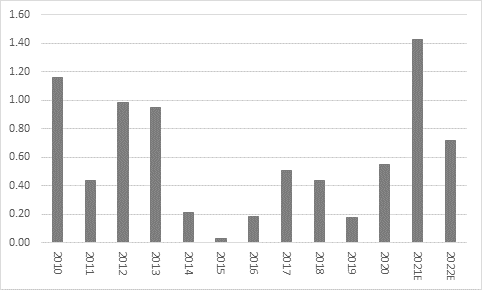

“Antofagasta’s board also sanctioned a huge increase in the annual dividend to $1.4250 a share for 2021, although analysts again expect a dip in 2022, thanks to the assumption of lower profits.

Source: Company accounts, Marketscreener, consensus analysts' forecasts

“Again, firm copper prices could leave those forecasts looking pessimistic and although the opposite also holds true investors are more likely to want to see strong rather than weak demand for the metal, which has over time been an uncanny guide to the global economy and also global equities, as benchmarked by the FTSE All-World index.”

Source: Refinitiv data

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06