Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“While it is a surge in profits from both oil and gas that continues to grab the headlines at BP and Shell, the real secret to their share price success is how they have made the most and rising hydrocarbon prices and then put the bounty to good use,” says AJ Bell Investment Director Russ Mould.

“Both firms have cut costs, reined in capital investment, sold assets and also cut their dividend, in acknowledgement of how serious the situation had become, especially once oil price collapsed in early 2020. Those self-help programmes have boosted cash inflows and above all enabled BP and Shell to pay down net debt. And from a shareholders’ perspective, lower debt means less risk and less risk means a higher share price.

“BP has slashed its net borrowings by 40% from Q1 2020’s peak of $58 billion to $30 billion and Shell has cut its net debt by a third from Q4 2019’s $78 billion high to $52 billion.

Source: Company accounts

“This brings two immediate benefits.

“Net interest costs are lower and therefore earnings are higher. This boosts the ‘E’ in the price-to-earnings (PE) calculation, one important metric for valuing a stock.

“Net debt means less risk and less risk means investors are usually willing to pay a higher multiple to access the company’s profits and cash flow. This boosts the ‘P’ in the PE and the combination of higher rating and higher earnings is a double-whammy which helps to explain why BP’s shares are up 60% and Shell’s are up by 71%, even as the hydrocarbons industry has attracted little but opprobrium.

“There can be few better examples of the old market maxim that ‘you can have cheap stocks and good news, just not both at the same time.’

“And on a forward price/earnings ratio of barely seven times with a yield of 4% at BP and just over eight times with a yield of 3.6% at Shell, according to consensus analysts’ forecasts, neither stock looks expensive now.

“That could quickly change if oil and gas prices reverse course or the companies are clobbered with a windfall tax, and these concerns are reflected by how investors are still unwilling to pay unduly expansive multiples of earnings and are requiring a decent yield to compensate themselves for the dangers associated with owing the shares.

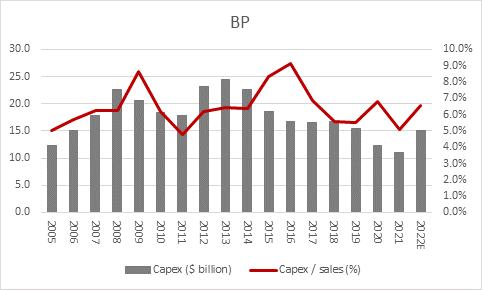

“Yet the firms seem to be sticking to their capital discipline. BP is targeting annual capital investment of around $15 billion a year out to 2025 and Shell is looking to keep spending at the low end of its targeted $23 billion to $27 billion range in 2022.

“Based on analysts’ consensus forecasts for revenues in 2022, both numbers keep spending near historic lows in nominal dollar terms, as well as a percentage of sales.

Source: Company accounts, Marketscreener, management guidance for 2022E, consensus analysts' forecasts

Source: Company accounts, Marketscreener, management guidance for 2022E, consensus analysts' forecasts

“That might make for uncomfortable reading for some, as higher output could be seen as one solution to the high energy prices which are making life so hard for so many in a lot of different ways right now. But Shell and BP are under clear public and political pressure not to produce more oil and they are listening, as they divert spend to renewables and alternatives or simply return cash to shareholders.

“Given the loud pleas not to increase output, the reluctances of banks, insurers and investment managers to back such investment projects, and the threats of windfall taxes on any substantial profits if they do drill and find something, you can see why BP and Shell are not investing as much as they did before and taking the lower risk option of giving surplus cash flow to the owners of the business.

“Shareholders might start to get nervous if both firms were to start ramping up the spending again, lured in by higher oil and gas prices, and nor should they overdo it on the buybacks front either.

Source: Company accounts

“Previous spells of buybacks largesse – 2005-07 and 2014 at BP and 2005-08, 2011-14 and 2018-20 at Shell – have tended to coincide with peaks in the oil price and be followed by vicious slumps in hydrocarbon prices, profits and cash flow.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06