Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Gold is trying once more to break through, and away from, the $1,800 an ounce mark but it is making heavy work of it and sceptics could be forgiven for thinking the trading price is as inert as the metal itself,” says AJ Bell Investment Director Russ Mould.

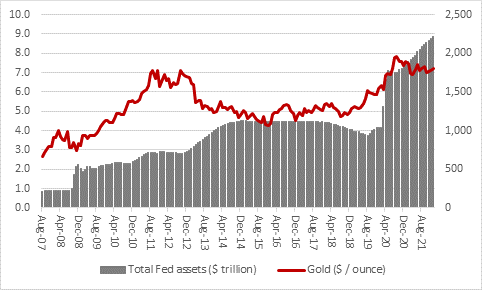

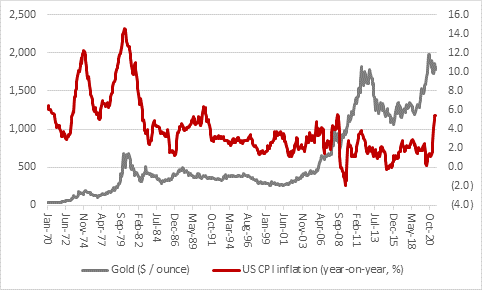

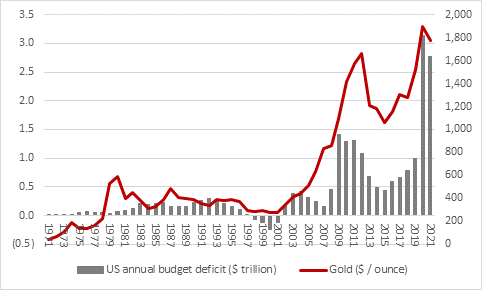

“This is no doubt frustrating for gold bugs as everything seems set for the metal to do well: surging inflation, lofty government debts, swollen central bank balance sheets thanks to Quantitative Easing and even geopolitical uncertainty in Eastern Europe, the Middle East and the South China seas.

“Markets are presumably therefore still of the opinion that central banks are still in control and that with some deft ‘forward guidance’ and a few nimble adjustments to monetary policy they can nip inflation in the bud, keep economies growing, help governments manage their debts and avoid upsetting financial markets.

“For gold to shine, markets may therefore need to lose faith in central bank policies, something which could happen if the economy tips into recession as the combination of global debts and higher interest rates proves too much and policy makers have to return to cutting borrowing costs and adding to QE well before inflation is reined in.

“The clearest sign of this would be if real interest rates – the headline borrowing cost after inflation – remains deeply negative, either because inflation proves persistent or central banks abandon plans to tighten policy and (for whatever reason) elect to loosen it again.

Source: Refinitiv data, FRED – St. Louis Federal Reserve database

“There have been four prior episodes when interest rates turned deeply negative rates in the USA since President Richard M. Nixon closed the gold window and killed off the Bretton Woods monetary system in August 1971.

“In each of 1974, 1979, 2008 and 2010, as real rates began their lurch into negative territory, gold advanced smartly.

“We are now in the fifth.

“Real US interest rates went negative in November 2019 and since then gold has jumped by a fifth. US real interest rates have never been as deeply negative as they are now, which must be of interest to gold bugs.

“However, the prospect of higher interest rates, at least in nominal terms, and a halt to Quantitative Easing appear to be checking the metal in its tracks, especially as chair Jay Powell and the US Federal Reserve are even raising the prospect of Quantitative Tightening and removing some of the US monetary stimulus.

Source: Refinitiv data, FRED – St. Louis Federal Reserve database

“Markets still therefore seem to have faith that the Fed is able, and willing, to act tough and by both raising rates and reining in inflation it can return real interest rates to less negative, or even positive, territory.

Source: Refinitiv data

“Optimists may also argue that a return to growth for the US economy and an end to the pandemic will help the federal government generate more income from taxes while paying out less in welfare and support schemes, with the result that the US annual deficit starts to shrink.

Source: Refinitiv data, FRED – St. Louis Federal Reserve database

“The Biden administration has not yet given up on its desire for a multi-trillion dollar infrastructure bill, however, and any wobble in the US economy could well see the spending taps turned on once more.

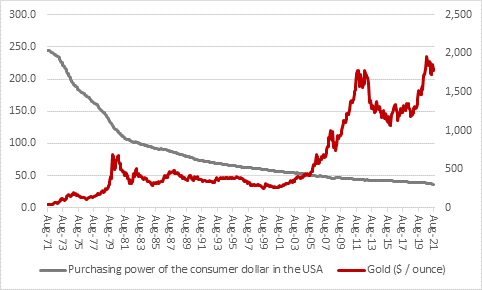

“That might stoke fresh fears of fiscal profligacy and the sort of heavy spending which Nixon sanctioned once he had cast aside Bretton Woods. And the impact of the dollar’s value on that is plain for all to see.

“Since the end of Bretton Woods in 1971 led to a floating dollar in 1973 the US currency’s real terms value has sunk like a stone: gold has gained 4,106% across the last five decades against the buck. Put another way, the greenback has lost 98% of its value relative to the precious metal while 86% of its purchasing power has gone for good measure, thanks to an inexorable rise in the consumer price index (or inflation, in other words).

Source: Refinitiv data, FRED – St. Louis Federal Reserve database

“Mr Powell’s rhetoric may be convincing markets that he is prepared to act tough to rein in inflation. But with interest rates at their lowest ever in real terms, and the Fed’s balance sheet bigger than ever before, policy is still the loosest it has ever been. And if Mr Powell has to quickly abandon tightening because the economy stumbles, the financial markets wobble or both then gold bugs may feel their time as come and that the precious metal will provide a valuable hedge against any wider dislocation.

“After all, the Fed’s latest tightening cycle did not get very far. It managed to drive interest rates to 2.5% and reduce its balance sheet by $700 billion, or 17% between 2015 and early 2019 before the US economy began to slow and the plumbing of the US financial system began to clog, judging by how interbank funding markets began to show signs of distress in the second half of 2019.

“There is so much more debt in the system now than there was then, so the economy, and markets, may be more sensitive to even minor changes in monetary policy.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06