Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“No investor, no politician and no central banker knows what is coming next, and whether inflation, stagflation or deflation will result from the combination of the pandemic, lockdowns and supply-chain chaos on one side, and massive amounts of fiscal and monetary stimulus designed to boost demand on the other,” says AJ Bell Investment Director Russ Mould.

“Going ‘all in’ on one scenario is probably not going to be good idea and portfolio construction will need to address a range of outcomes, as frankly anything is possible (especially given the likelihood of central bank and Government action). But carefully researching five major investment decisions may help investors sense which way the wind is blowing so they can try to obtain the best possible risk-adjusted returns for their portfolios

1. ‘Value’ versus ‘growth’

“For want of a better turn of phrase ‘growth’ has outperformed ‘value’ for the thick end of a decade, thanks to the prevailing, low-growth, low-interest-rate, low-inflation fog which has enveloped the globe.

“If that environment persists, firms which are seen as capable of providing secular trends increases in sales, profits and cashflows (or maybe even just the first one) will remain highly prized. If it changes, and inflation and strong nominal GDP growth take over, then there would be no reason to pay high multiples for secular growth when cyclical growth (or ‘value’) would be available at much lower valuations. Industrials and banks could then lead the charge.

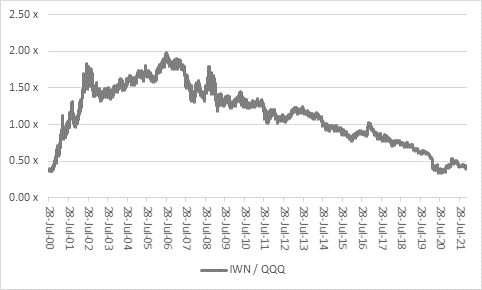

“One way of measuring whether this shift in leadership is happening is by comparing the performance of the NYSE-listed Invesco QQQ Trust with growth, against the NYSE-traded iShares Russell 2000 Value ETF.

“If the line goes up, value is doing better, and vice-versa. Value’s latest attempt for glory is petering out a little, perhaps owing to worries over covid variants and the effects of higher prices and clogged supply chains on economic activity, although the heavy weighting within the iShares Russell 2000 Value ETF of meme stocks such as AMC Entertainment and Avis Budget may not be helping its cause, at least in the near term.

Source: Refinitiv data

2. ‘Developed’ versus ‘emerging’ markets

“Emerging markets dominated for the first decade of this millennium but developed ones have subsequently ruled the roost. Demographics, debt-to-GDP ratios and the possible trend toward ‘onshoring’ in the West are all factors here but it seems reasonable to expect export-driven emerging markets to fare relatively well if global growth rates pick up. Any attempts by China to loosen monetary policy and stoke growth could also help emerging markets, where the Shanghai market has a big weighting.

Source: Refinitiv data

3. ‘Real’ versus ‘paper’ assets

“Looking at the relative performance of the Bloomberg Commodity and the FTSE All-World (equity) index, commodities and ‘real’ assets outperformed between 2000 and 2010 but equities and ‘paper’ assets have dominated since.

Again, this trend could be reasonably expected to continue if we stay stuck in a low-growth, low-rate, low-inflation world. But if inflation (or maybe stagflation) take hold, ‘real’ assets could come to the fore for three reasons: they could be stores of value; central banks may keep printing money but they cannot print oil, gold or property; and investment in new resources finds is dwindling thanks to pressure from politicians, investors and the public alike amid environmental concerns.

“Commodities outperformed in 2021 but nothing like to the degree that ‘real’ assets beat ‘paper’ ones during 2001-02 so if this trade does get traction then there could be a long way to go yet.

Source: Refinitiv data

4. Gold versus Bitcoin

“The subject of ‘stores of value’ and ‘haven assets’ can lead to heated debate. It is hard to argue that Bitcoin is a store of value, given the wild price swings of the last five years, and the same accusation can be levelled at gold. Neither produces a yield. And both trade way above their marginal cost of production.

“Yet rampant deficit creation by Governments and money printing by central banks (in an attempt to effectively monetise and fund the extra debt) do persuade many to make an investment case for one or the other (although rarely both). Gold did next to nothing and underperformed Bitcoin again in 2021. But its role as a haven during times of great uncertainty – when it looks like the authorities are not in control – could come into play if inflation gallops higher. The gold price relative to Bitcoin makes for an interesting chart – gold may have finally started to do better (or less badly) - but the metal may remain dormant if inflation fizzles out.

Source: Refinitiv data

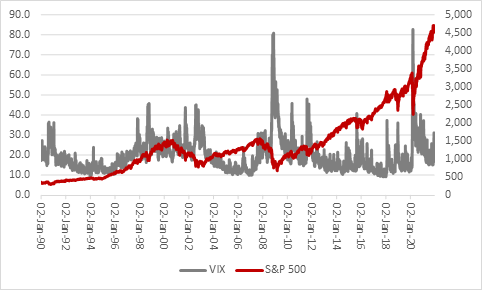

5. Volatility versus peace and quiet

“After a brief foray to 30 on news of the Omicron variant, the VIX, or ‘fear,’ index which gauges future volatility in the US stock market, is trading barely above its long-run average of 19. If markets retain their faith in central bank control, inflation remains subdued and the variant passes by, fear will likely dissipate.

“But if inflation takes hold and confidence in policy makers ebbs, volatility may make its long-awaited comeback.

“This is not necessarily a bad thing. Volatility can provide the chance to sell expensively and buy cheaply, if investors can keep your head while all around them are losing theirs. But it also requires patience and nerve to come through it and building a balanced portfolio that can provide upside potential as well as downside protection is one way of combatting any spike in volatility.”

Source: Refinitiv data

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06