Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“The pandemic may be an ongoing boon for online retailers, but Boohoo’s profit warning makes the case for having brick-and-mortar stores and suggests that their days are not as badly numbered as many investors or shoppers might think,” says AJ Bell Investment Director Russ Mould.

“Handling product returns via a physical shop is relatively easy, if a bit disappointing for the retailer. For an online service working to relatively thin profit margins that are supported by high turnover of stock, low costs and seamless logistics, a product return is a much bigger nuisance, as Boohoo’s trading alert makes only too clear.

“The combination of slower sales, increased input costs, investment in brands and distribution and those pesky product returns means that profits are now going to fall in the year to February 2022.

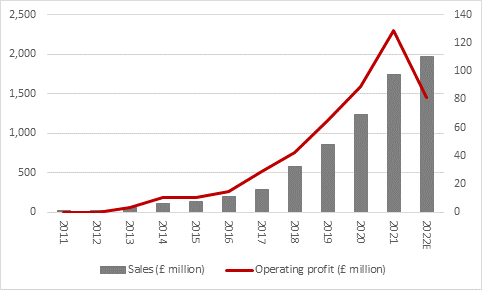

“Chief executive John Lyttle is now suggesting that sales will grow by 12% to 14%, not 20% to 25% as previously expected, and that profits are set to come in below forecasts, too.

Source: Company accounts, Marketscreener, consensus analysts' forecasts, management guidance on 16 December

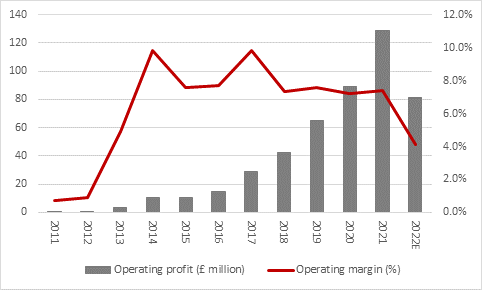

“On Boohoo’s preferred metric of adjusted earnings before interest, tax, depreciation and amortisation (EBITDA), the return on sales will drop to between 6% and 7%. That compares to 10% last year and management’s previously expected outcome of 9.0% to 9.5%.

“Using statutory, rather than company adjusted, benchmarks, that looks to imply a drop in operating profit for the year of 35% to 40%, despite the increase in the top line.

Source: Company accounts, Marketscreener, consensus analysts' forecasts, management guidance on 16 December

“Analysts and shareholders will also still be grappling with the issue of supply-chain management and whether Boohoo’s review of its sourcing will lead to increased costs on a sustainable basis, adding to the near-term pressures created by commodity prices, fuel prices, haulage shortages and product returns.

“This is not to say that physical stores are entirely immune to these woes. They are not.

“But online-only models are based on high volumes and thin margins. Product availability and sourcing issues could challenge the first. Rising staff and distribution and raw material costs could challenge the second. The result could be a lot of financial and operational difficulties for online-only players. If physical stores can offer availability of desirable product in a nice setting at a fair price they could be well and truly in with a chance of luring customers into their stores – at least if the latest covid variant gives them the chance to do so.

“Another burning issue for online stores is warehouse capacity and staff availability. Key rivals such as Amazon are aggressively bidding up wages in their recruitment efforts. Any firms that match them will be taking a margin hit, unless they jack up prices – but that is not what online shoppers are looking for or expecting.

“It may look easy but online retail is not just a matter of someone pressing a button at one end the gear arriving from the other the next day. There is no free lunch. And if distribution centres are struggling to persuade staff to work there - because it is hard work and often situated in out-of-town sites – then who is going to pick and place the product and get it ready for shipping?”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06