Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“The Bank of England is sticking to its script that the current spike in inflation is down to global issues that may well prove temporary. This ignores another explanation, which is that the combination of ultra-loose monetary policy and fiscal largesse from Governments means the economy has been over-stimulated (global semiconductor sales reached an all-time high of $145 billion in the third quarter of 2021, yet record output volumes were not enough?),” says AJ Bell Investment Director Russ Mould.

“Either way, the coming week will see the latest test for that theory, in the shape of the latest UK unemployment and wage growth numbers on Tuesday 16th November and a new set of inflation figures on Wednesday 17th.

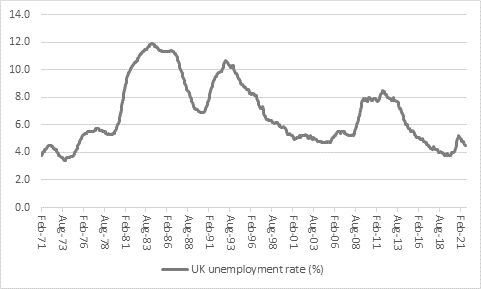

“In theory, the classic inflation cycle starts with higher commodity and raw material prices and then moves on to producer or factory gate prices. We have seen those two stages already. The next leg is higher consumer prices, as companies look to defend margins by pushing up prices. And the final leg is higher wages. That closes the circle, as consumers become accustomed to, and feel they are able to, pay higher prices. It is the third and final stages that investors will be studying this week and – again in theory – the lower unemployment goes and the tighter the labour market becomes, the more bargaining power workers have when it comes to demanding higher pay and the more willing companies are to offer it, as a means of attracting and keeping the talent they want and need.

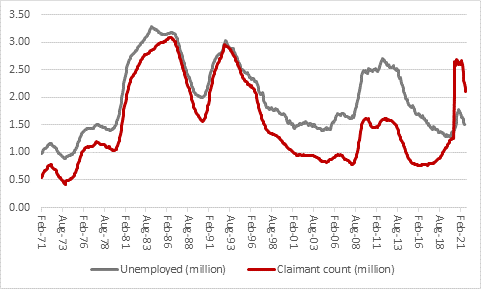

- “In the three months to August, unemployment was 4.5%, a figure seen only rarely since records began in the early 1970s. That meant that 1.51 million were looking for work.

Source: Office for National Statistics

- “However, the number of job vacancies hit a record of 1.1 million

- “And wage growth was 8.3% year-on-year, including bonuses, and 6.3% excluding them

“With unemployment of 4.5%, wage growth of 6%-plus and the Office for Budget Responsibility forecasting GDP growth of more than 6% for 2021 and 2022, you would normally expect the Bank of England to be jacking up interest rates pretty quickly, not holding them steady at a record low of 0.1% (and keeping Quantitative Easing running, too). However, some would argue that those figures are deceptive.

- “The UK claimant count is still 2.1 million, to suggest that a lot of workers and families are still struggling to get by and are in need of extra financial support. And that’s before the recent jump in fuel and heating bills.

Source: Office for National Statistics

“The Office for National Statistics also argues that the wage growth number could be misleading owing to the base effect caused by the now-expired furlough scheme and the effect of the pandemic and lockdowns a year ago.

- “The wage growth numbers will then be benchmarked against the inflation numbers. If wages are running faster, then workers are better off in real terms and more likely to spend or even save for the future. If prices are rising faster than wages, then workers’ ability to spend and desire to save could be crimped. Last time around:

- “The consumer price index (or CPI) rose 3.1% year-on-year, a fraction slower than the nine-year high 3.2% rate of increase in August

- “The Bank of England’s preferred CPIH measure, which includes housing costs, rose 2.9%

- “And the retail price index (or RPI) rose 4.9%, although this is no longer an officially recognised statistic”

Source: Office for National Statistics

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06