Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Shareholders in housebuilders have been looking on nervously, as the stamp duty land tax break has ended and the rules for Help to Buy continued to change but Barratt’s trading statement offers welcome reassurance,” says AJ Bell Investment Director Russ Mould.

“The net reservations rate in its new financial year may have dipped slightly compared to 2020 but it has exceeded the level seen at this stage in 2019 by 18%, even though Help to Buy has represented only a fifth of house purchases compared to more than half in the first three months of the last financial year (and just under 40% for the year as a whole).

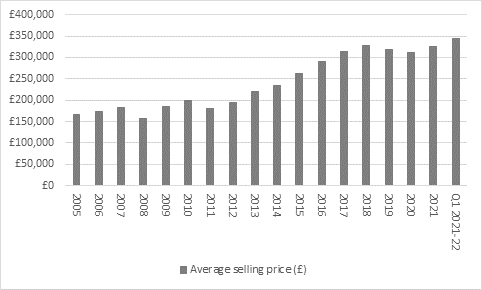

Source: Company accounts. Financial year to June. Q1 2021-22 covers 1 July to 10 October.

“Prices are still rising, completions are still forecast to increase for the current year and management still seems confident in the future as it is stepping up its land-buying activities.

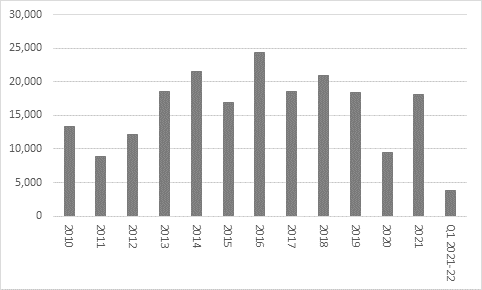

Source: Company accounts. Financial year to June. Q1 2021-22 covers 1 July to 10 October and is based on the forward order book rather than completions.

“Barratt has already snapped up 3,735 new plots of land in the first three months or so of its financial year and is on track to meet its target of approving some 18,000 to 20,000 plots for development over the course of the 12 months to June 2022. That in turn helps to underpin the firm’s plan to complete on 17,000 to 17,250 homes this year (with another 750 on top from joint ventures) as it moves toward its medium-term goal of 20,000 homes a year.

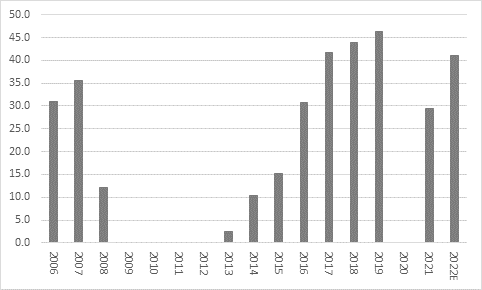

Source: Company accounts. Financial year to June. Q1 2021-22 covers 1 July to 10 October.

“The price increase is helping to mitigate input cost inflation, in the form of labour and raw materials, issues also flagged by building materials distributor Brickability in its trading update. Shrewd land purchases also help Barratt as it seeks to meet its medium-term financial goals of a 23% gross margin (up from 21% last year) and a minimum 25% return on capital employed over the medium term (against 28.3% last year).

“The trading update should also offer comfort to shareholders that the current analysts’ consensus forecast is achievable for the year to June 2022. At the moment, analysts are looking for:

- 6% sales growth to £5.1 billion

- 6% growth in operating profit to £975 million for an unchanged operating margin of 19%

- 17% growth in stated pre-tax profit to £951 million, helped by the presumed absence of further remediation costs relating to cladding and the Citiscape in Croydon

- 41p in dividends per share, up from 29.4p

“That dividend may catch the eye of income-hunters in particular. It equates to a forward dividend yield of 6.2%, a figure which would help shield investors’ purchasing power from the ravages of inflation, should price rises indeed go higher and last for longer than implied by central bankers’ preferred narrative that the increases are down to temporary bottlenecks and merely ‘transitory.’

Source: Company accounts, Marketscreener, analysts’ consensus forecasts. Financial year to June.

“Nor does Barratt look particularly expense on the basis of earnings or book value, either, after the recent pull-back.

“Analysts’ old rule of thumb is that house builders are potentially cheap if they trade on one times book – or net asset – value or less and potentially expensive if they trade on two times or more. Barratt currently trades toward the low end of that range, at 1.3 times book value per share.

| Historic Price/NAV(x) | 2021E PE (x) | 2022E PE (x) | 2021E Dividend yield (%) | 2022E Dividend yield (%) | 2021E Dividend cover (x) | 2022E Dividend cover (x) | |

|---|---|---|---|---|---|---|---|

| Vistry | 1.15 x | 9.5 x | 8.1 x | 4.3% | 5.7% | 2.45 x | 2.15 x |

| Redrow | 1.22 x | 10.1 x | 9.1 x | 2.9% | 3.6% | 3.47 x | 3.04 x |

| Bellway | 1.26 x | 10.1 x | 8.9 x | 3.4% | 3.9% | 2.87 x | 2.90 x |

| Crest Nicholson | 1.11 x | 13.8 x | 10.0 x | 2.9% | 3.9% | 2.50 x | 2.57 x |

| Barratt Developments | 1.30 x | 10.3 x | 8.8 x | 4.3% | 6.2% | 2.29 x | 1.83 x |

| Taylor Wimpey | 1.35 x | 10.3 x | 8.1 x | 5.3% | 7.8% | 1.84 x | 1.58 x |

| Berkeley Homes | 1.63 x | 12.5 x | 11.9 x | 5.3% | 5.4% | 1.50 x | 1.56 x |

| Countryside Properties | 2.25 x | 23.0 x | 13.4 x | 1.4% | 2.7% | 3.00 x | 2.77 x |

| Persimmon | 2.35 x | 10.9 x | 10.1 x | 9.0% | 9.0% | 1.03 x | 1.10 x |

| Average | 1.51 x | 11.0 x | 11.0 x | 5.2% | 6.2% | 1.74 x | 1.69 x |

Source: Company accounts, Marketscreener, consensus analysts’ forecasts, London Stock Exchange

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 08/05/2024 - 11:46

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01