Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

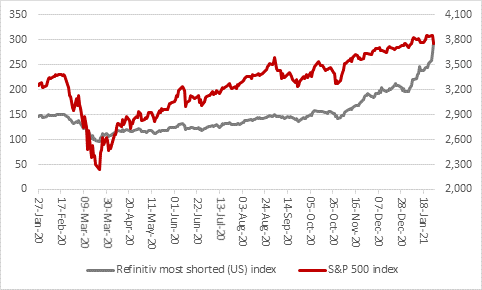

Although the past few days’ frenzied activity in Gamestop is putting hedge funds, shorting and short-squeezes firmly back in the headlights, the most shorted stocks in America (and the UK) have been massively outperforming the wider benchmarks since last November. This suggests that this was a professional hit first – hedge funds forcing other hedge funds out of their positions by squeezing share prices higher – with retail investors cottoning on and piling in second.

Source: Refinitiv data

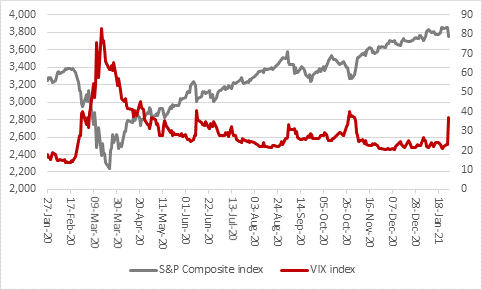

No tears will be shed for hedge funds losing money – they should know and be able to manage the risks – but there are still potential knock-on effects which investors need to consider, especially in light of heavy losses in the mainstream American indices and the 60% overnight surge in the VIX index, or ‘fear’ index. That is a gauge of how much volatility traders expect in the US stock market in the next 30 trading days. The spike suggests that professional market participants are getting ready for a wild ride after a period of calm, especially as surges in the VIX tend to foretell of falls in the wider US stock market.

Source: Refinitiv data

This leaves investors with five questions to consider, especially if they have joined in on the short squeeze which has driven the market cap of Gamestop to $24 billion, or £17.6 billion.

1. What to do with Gamestop now?

Gamestop’s £17.6 billion market cap would, for example, be enough to make it the 30th biggest stock in the UK’s elite FTSE 100 index, just above Associated British Foods, the owner of Primark and British Sugar.

But before the pandemic, ABF was making profits of more than £1 billion a year. Gamestop’s sales dropped by a third from 2015 to 2019 and it lost money in each of 2018 and 2019, even before the pandemic hit (and it was in the red again after the first nine months of 2020).

Investors must decide now whether such a valuation, in relative or absolute terms, is appropriate, given Gamestop’s business model, financial track record and finances – it has net assets of $2.6 billion. They must assess this relative to the upside potential offered by the shares and what downside protection there might be. The shares were, after all, trading at $19 at the turn of the year, $10.47 at the start of November when the wider short squeeze began and $4 a year ago. That’s a long way below the $347 at which the shares closed on Tuesday.

The whole point of the short squeeze was to force the price higher by refusing to sell to shorts who needed to close out but holders of Gamestop now need to sell and find a buyer for them to lock in their profit. Who is going to do that, in the knowledge that the share price has been wilfully ramped, there is hot money looking for an exit and the valuation looks lofty for a loss-making retailer? Booking a profit might not turn out to be as easy as it looks, at least anywhere near the share price peaks.

2. Could there be implications for stock markets more generally?

Wednesday night’s plunge in the Dow Jones Industrials and S&P 500 indices and the spike in the VIX would suggest so.

First, hedge funds on the hook for losses on Gamestop may need to liquidate other positions where they are long to cover their cash needs, especially as they are likely to have been using leverage (borrowing or trading on margin) to try and further goose their returns. This could stoke a cascade of selling that begets other selling and in a worst case create a ‘flash crash.’ Only time will tell how much damage the hedgies have suffered (and to what degree their prime brokers are on the hook – if a hedge fund goes bankrupt because of its losses, then its prime broker has to buy back the shares that the hedge fund borrowed and sold so the shares can be returned to their original owners).

It will also be interesting to see if the ten most-shorted stocks in the UK start to give up some of the gains they have seen, should some air come out of Gamestop’s shares. All ten have risen since the start of November 2020 when the short squeeze in America first began, although much of that could be due to the relief which greeted the first news on the Pfizer/BioNTech vaccine for covid-19 on 9 November, so hedge fund activity will not be the only influence here.

| Share price performance since | ||||

|---|---|---|---|---|

| % of stock on loan | Stock | 01-Nov-21 | 01-Jan-21 | 22-Jan-21 |

| 12.60% | Premier Oil | 62.20% | (7.00%) | (5.70%) |

| 8.50% | Pearson | 70.20% | 27.50% | 21.40% |

| 8.40% | Cineworld | 182.00% | 25.40% | 21.60% |

| 8.20% | Petrofac | 3.90% | (10.70%) | 19.70% |

| 7.90% | Sainsbury | 25.40% | 12.20% | 2.80% |

| 7.10% | Tullow Oil | 36.60% | (7.20%) | (15.60%) |

| 7.00% | Hammerson | 39.80% | (8.20%) | 12.00% |

| 6.20% | Network International | 67.10% | 13.80% | 1.60% |

| 5.60% | Petropavlovsk | 12.40% | (7.70%) | (3.20%) |

| 4.80% | Metro Bank | 93.40% | (16.50%) | (8.00%) |

Source: Shorttracker.co.uk, Refinitiv data

3. Is joining in a short squeeze investing, trading or gambling?

This really depends upon the eye of the beholder but anyone joining in must be aware of the risks as well as the potential rewards and ensure that any purchase or sale they make fits with their overall strategy, target returns, time horizon and appetite for risk. Departing from those key disciplines can lead to trouble, especially as financial markets are often at their most treacherous when making money looks easiest (just think of the peaks in 1999 or 2007).

Fund manager Neil Woodford took a slating after the failure of his go-it-alone money management venture and one reason put forward for the poor returns here was that Mr Woodford had changed his style and approach – he has switched from UK equity income, where his track record at Invesco had been excellent to investing in young growth stocks, an approach that requires a different approach.

If an experienced market practitioner such as Mr Woodford can come a cropper changing styles, then there has to be a big risk that private investors can do so too. It is vital that investors therefore stick to their disciplines and don’t start chasing gains from styles or stocks or asset classes that take them beyond their levels of experiences or risk parameters. Only the individual investor knows what approach works best for them.

Whether that is the case or not, the share price movement has nothing to do with the company’s business model, competitive position or financial strength and performance. As such it is trading at best, gambling at worst and has little to do with investment.

Investment is picking good companies - as defined by their competitive position, business model, financial strength and management acumen – and doing so at the right price. This helps the investor turn time into money, as the companies rack up the profits and pay out dividends that can be reinvested. Picking long-term winners is not easy to do but the rewards can be patiently accrued, either from individual stocks or managed funds.

Trading is trying to time movement of money and second-guess where it will go next. This is no easier. If anything goes wrong, or the hot money simply moves on to the next short squeeze, the lofty valuation of the stock could provide little or no downside protection and leave the trader or investor holding shares in a company they may know little about and that may have flaws in its finances or business. If the shares went up for little or no reason, they could go down in the same way and just as quickly.

4. Are short squeezes market manipulation or just investors outsmarting hedge funds?

There is no law against what has happened, although the co-ordinated nature of the buying via social media could be seen in a worst case as intentional market manipulation and America’s Securities and Exchange Commission is investigating.

What is clear is that some of the hedge funds involved have mismanaged risk and been punished. To be caught shorting stocks where total short positions exceeded the total free float of the target company left them exposed to a squeeze if the fortunes of that firm turned around unexpectedly or what remain bouncy markets started to lift all boats on the tidal wave of liquidity provided for markets by central banks’ ultra-loose monetary policy.

Even so, investors must ponder the degree to which the share price gains at Gamestop reflect changes or improvement in the company’s business model, competitive position or financial strength and performance. On the face of it, the answer may be ‘not very much,’ which does question just how sustainable the share price gains may be. This suggests that Gamestop has been at best a trade, a stock to rent, rather than a long-term investment and one to own. At worst it has been a gamble, with investors just betting the shares would keep rising and those involved just need to make sure this fits with their overall strategy and risk parameters.

5. Are short squeezes a good or a bad sign for markets more generally?

Benjamin Graham, Warren Buffett’s mentor, argued that the best long-term investment returns were reaped by realists who bought from pessimists and sold to optimists. You can argue that the short squeezers were at least buying from pessimists when it came to Gamestop, but you do worry that a few optimists have piled on since, hoping to ride the share price momentum to a quick gain.

Such a devil-may-care attitude to risk can lead to trouble and ultimately, this sort of technical action is not what stock markets are for, either. They are there to provide capital which companies can use to grow and invest and they are there for price discovery, to value companies appropriately and that process of price discovery helps investors to protect or grow their wealth when it is used with appropriate caution.

It does therefore make you worry that we are seeing a repeat of the sort of overheated markets seen in the late 1920s and late 1990s and (to a lesser degree) the mid part of the first decade of this century. They all ended in tears and big market setbacks which hurt a lot of investors, traders and ultimately did damage to the wider economy, as money was misallocated and squandered.

Perhaps we should therefore all be heeding the warning of economist (and stock market investor) John Maynard Keynes when he said, ‘When the capital development of a country becomes the by-product of a casino the job is likely to be ill-done.

These articles are for information purposes only and are not a personal recommendation or advice.