Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

After October's wobble, global share prices appear to be finding their feet again, while Government bond markets also seem to be enjoying renewed calm, as yields grind lower and prices inch higher once more. Whether this is down to the application of fresh monetary anaesthetic, in the form of Japan's enhanced quantitative easing (QE) programme, a more upbeat view of the economy or hopes interest rates will stay lower for longer remains to be seen.

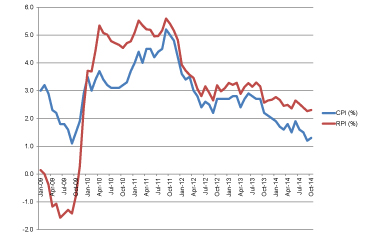

Bank of England Governor Mark Carney's interview with The Australian newspaper, published on Monday (17 Nov) offered featured references to “huge disinflationary forces” and warnings over the implications of soft commodity prices and economic weakness in Europe. On the same day the Old Lady of Threadneedle Street's chief economist, Andrew Haldane, made similarly dovish utterances and Tuesday's inflation figures will hardly have economists dashing to pull forward their forecasts for when the UK will first raise interest rates. A 1.3% year-on-year increase in the consumer price index and 2.3% rise in the retail price index were largely as expected and the bond market is pricing in the first hike in borrowing costs for some time in autumn 2015.

Inflation in the UK remains very subdued

Source: ONS

Such figures highlight how rates could well remain anchored at historic lows for some time to come, a development which could give a boost to stocks and bonds as clients continue their quest for a dependable yield and returns that are any improvement on the paltry nominal and real-terms prospects offered by cash.

The counter to this argument is subdued inflation reflects a lack of global growth and faltering corporate pricing power, trends which could even tip us into deflation. Oil's woes speak loudly here but given the huge size of sovereign debt piles central banks are likely to combat any recessionary fears with faster, looser policy. This scenario leaves clients stuck between a deflationary rock that favours bonds and cash and an inflationary hard place that points to equities, property and commodities such as precious metals, to perhaps emphasise the importance of a properly balanced portfolio.

Devaluation drive

Governor Carney has flagged how the Bank of England's forecasts only get inflation up to the target 2% mark in some three years' time. Sliding oil and commodity prices will have some influence here, although the role of Japan's latest round of QE and the Abe administration's tacit efforts to weaken the yen (seeThe race to the bottom begins again, 7 Nov 2014, here) may have a big role to play in this context.

If Tokyo's game is to deliberately drive its currency lower so it can export more aggressively then any planned price-cutting assault surely has the potential to be deflationary for the rest of the world. Japan's key trade rivals are already feeling the heat if their producer price, or factory gate, inflation indices are any guide. Research from investment bank Morgan Stanley shows that seven of Asia's ten leading economies are already suffering deflation using this measure.

Any trade battle with Japan and its sliding currency could see this exported to the rest of the world, especially if China, Korea or Taiwan for example get fed up with Tokyo and retaliate with policies designed to drive the renminbi, won or Taiwanese dollar lower. After all, Beijing has had to sit and suffer while its currency has risen by some 40% against the yen since 2012 and the risk of tit-for-tat policies designed to move currency markets is a big one as clients prepare their portfolios for 2015 and beyond.

China may not be pleased to see the yen fall much further against the renminbi

Source: Thomson Reuters Datastream

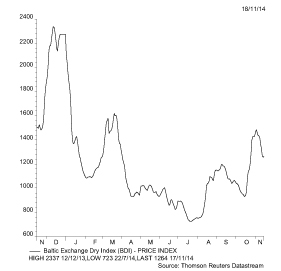

It is to be hoped any moves to loosen monetary policy and weaken currencies has the potential to stimulate global trade, but it is impossible for every nation to have a weak counter and export themselves out of trouble at the same time. For the moment, markets seem relatively unconcerned by this, at least if the Baltic Dry Index is any guide.

This benchmark monitors the cost of carrying commodities such as iron ore and grain by sea and it is finally rallying after a dismal summer.

Baltic Dry index is seasonally strong in the fourth quarter

Source: Thomson Reuters Datastream

Planes and trains and automobiles

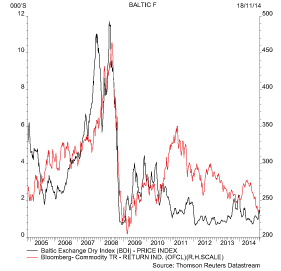

The rise in the Baltic Dry does admittedly look a little odd in the context of raw material price weakness, as a ten-year chart shows how a correlation between the shipping indicator and the Bloomberg commodity index could be breaking down. It may therefore be that the Baltic Dry's latest surge higher is nothing more than a result of the usual seasonal patterns, since October and November are the peak months for dry bulk shipments from the Southern Hemisphere to the North. Last week's commentary from Danish shipping, oil and port services giant AP Møller-Maersk did raise some questions here, as the firm cut its forecast for global container shipping traffic growth from 4% to 5% to 3% to 5% for this year.

Baltic Dry index's latest run tests its correlation with commodity prices

Source: Thomson Reuters Datastream

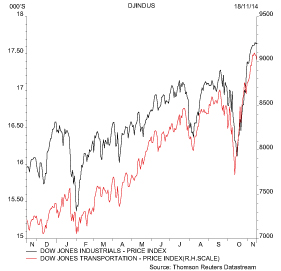

Even so, October's fresh gains in the Dow Transports in particular offer succour to equity market bulls. History shows the better-known Dow Jones Industrials thrives when the Transport index is powering higher. According to Richard Russell's Dow Theory, it must be good news if the share prices of the firms shipping goods around America are doing as well or better than those of the firms making them, as this suggests business is good. If something is sold, it has to be moved on and shipped.

The 20-stock Transport index consists of five airlines, four trucking firms, four rail-roads and three delivery services firms, among others. It continues to push toward new peaks in tandem with the Dow Jones Industrials to seemingly confirm America's economy is in rude health.

Dow Theory is still holding firm

Source: Thomson Reuters Datastream

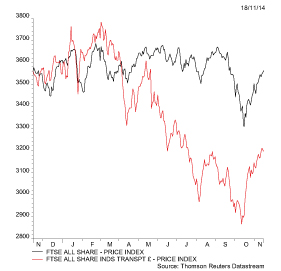

Whether this is grounds for celebration elsewhere remains open to debate, although if the world's largest economy is firing there should be some positive knock-on effect around the globe. Oddly, the UK's FTSE All-Share Industrial Transportation benchmark is performing nowhere near as well, with a year-to-date loss of 9.9%, a showing the leaves it thirty-first in the rankings of the 39 sectors which make up the FTSE All-Share.

Unlike their US counterparts, UK-listed transport plays have listed badly in 2014

Source: Thomson Reuters Datastream

Prince of Denmark

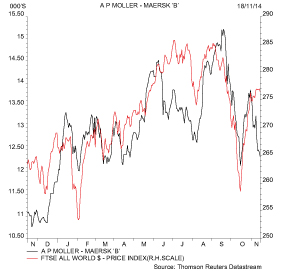

This soggy showing is more consistent with last week's commentary from Danish shipping, oil and port services giant AP Møller-Maersk (11 Nov). The firm cut its forecast for global container shipping traffic growth from 4% to 5% to 3% to 5% for this year, although capacity is still tight, judging by the comment Maersk Line had just one vessel idle at the end of September, against seven at the same time in 2013.

Clients and their advisers need to keep an eye on these trends, since transportation stocks are a proven barometer of economic activity. The correlation between AP Møller-Maersk's share price and the FTSE All-World index is quite uncanny, while the influence of the Dow Jones Transports over the Industrials is hard to deny. The picture in the US looks clear but the gentle rolling over of the Dane's share price merits attention.

AP Møller-Maersk looks like a decent market proxy

Source: Thomson Reuters Datastream

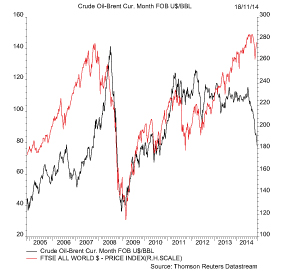

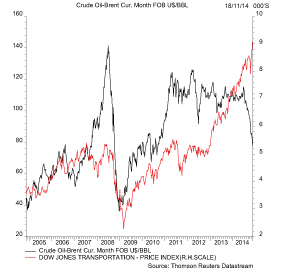

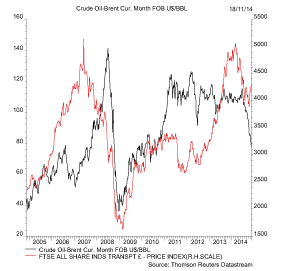

The final piece of this puzzle may be oil. In theory, a sagging oil price is good for consumers of crude, and transport stocks are definitely among those, although the charts do not look to confirm this. Instead, equity markets, and thus by definition the transport sectors, look happier when oil is rising, presumably in the view strong demand for the black stuff means the economy is ticking over nicely. The oil price is still falling yet the transport indices are rising, so something has to give at some stage, if the historic relationship is to be maintained.

The FTSE All World looks to perform best when oil is rising...

Source: Thomson Reuters Datastream

...while the transport in the USA...

Source: Thomson Reuters Datastream

...and UK also seem to do best when crude is rising not falling

Source: Thomson Reuters Datastream

Russ Mould, AJ Bell Investment Director.

Related content

- Wed, 17/04/2024 - 09:52

- Tue, 30/01/2024 - 15:38

- Thu, 11/01/2024 - 14:26

- Thu, 04/01/2024 - 15:13