Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Whether it is down to hopes for a Brexit deal, a further decline in net debt or the increased dividend, shares in British Land are confounding bears of commercial real estate (and the UK economy more generally) by holding firm in early trading,” says Russ Mould, AJ Bell Investment Director.

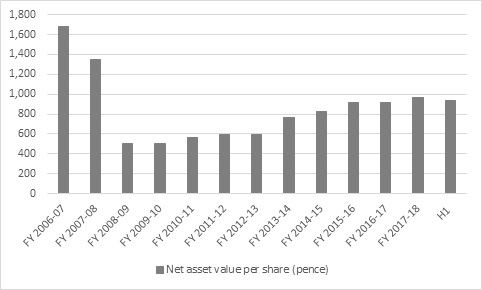

“Value-seekers, who believe the shares are oversold on a 34% discount to net asset value (NAV) per share, will be relieved to see NAV drop just 2.9% in the first six months of the year to 939p. This may at least be an all-too-rare occasion when a share buyback scheme makes mathematical sense, given the valuation, and management is pressing ahead with a £200 million expansion to the initial £500 million programme.

Source: Company accounts. Financial year to March.

“They will also point to how net debt has come down to £3.5 billion and the loan-to-value ratio is down to just 26.7%, helped by disposals, while net rental income jumped nicely to £297 million from £267 million in the first half.

Source: Company accounts. Financial year to March.

“In addition, bulls of the stock will note how office valuations held up strongly, mirroring a trend seen in peer Land Securities’ figures on Tuesday, even if the pressure on retail and leisure sites continues unabated.

| British Land | Land Securities | |||

| Asset class | Change in NAV in H1 | Asset class | Change in NAV in H1 | |

| Offices | 0.70% | London offices | 0.40% | |

| Canada Water | 0.30% | Leisure & hotels | -0.20% | |

| Residential | -3.10% | Central London shops | -2.70% | |

| Retail | -4.50% | Shopping centres | -3.20% | |

| Retail parks | -4.50% | |||

| Other | -4.60% |

Source: Company accounts for the six months to 30 September 2018

“It is also intriguing to see British Land begin to develop its position as a house builder, again mirroring Tuesday’s commentary from Land Securities.

“Land Securities, pending Brexit, has plans to develop sites in NW3 and W12 in London as mixed-used sites, including residential development, in what looks like a new departure for the major commercial property real estate investment trusts. The scheme in NW3 includes over 1,000 homes and that in W12 some 700. Ground could be broken in 2021, while a site in Lewisham is also subject to a feasibility study for a mixed-use development site.

“British Land is looking to develop its Canada Water asset as a Build-to-Rent site, while properties in Bromley-by-Bow, Ealing, Aldgate and Woolwich provide potential for 4,000 to 5,000 units in total, such that residential property could represent some 10% of the firm’s asset mix in over five years’ time.

“Perhaps this is one potential long-term catalyst to unlock value in the REITs’ portfolios and reduce the discount to net asset value, which remains historically high for those companies which have particular exposure to retail, the City of London, major new development projects or a combination of all three.

Source: Company accounts, Refinitiv data. Based on last reported NAV per share figure.

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06