Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Having been carried out by online grocer Ocado yesterday short sellers are being bitten by Pets at Home today, as the specialist retailer and provider of veterinary and grooming services reveals stronger-than-expected trading for the third quarter,” says AJ Bell Investment Director, Russ Mould.

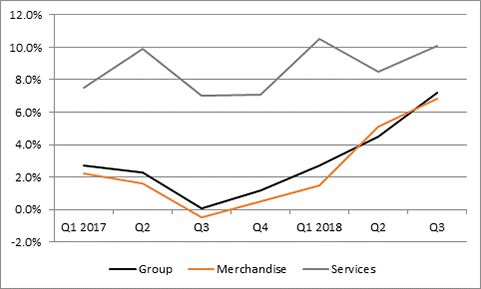

“Shares in the Cheshire-headquartered firm loped 8% higher, making it the best performer in the FTSE All-Share in early trading, as like-for-like sales growth of 7.2% for the quarter represented a marked acceleration on prior periods. Both of the merchandising and services operations put in improved performances.

Like-for-like sales growth at Pets at Home

Source: Company accounts

“This helps to justify management’s decision to lower its prices in 2017, and take a margin hit, even as it invested in its website and digital offering, rolled out its grooming salons and added to its number of veterinary practices.

“Even so there are still plenty of sceptics out there. According to www.shorttracker.co.uk some 10.6% of the company’s shares have been sold short, the highest ever amount following the firm’s 2014 stock market flotation, and Pets At Home still has more work to do if it is to avoid becoming a juicy bone for the shorts to chew on.

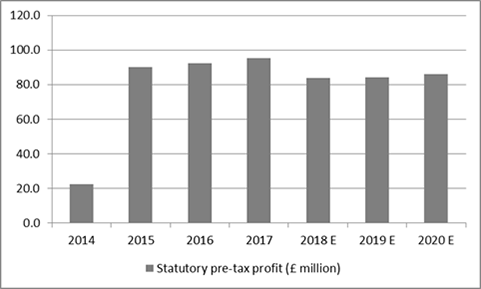

“Even bulls of the stock do not expect pre-tax profits to return to their past highs in a hurry and the stock does show some of the features which tend to attract short sellers, notably its ten-year stint in private equity ownership under Bridgepoint Capital and then KKR, a number of relative quick-fire changes in the chief executive and chief financial officer positions since flotation and the substantial lease commitments on its balance sheet.

Source: Company accounts, Digital Look, analysts' consensus forecasts

“The company has relatively little net debt at £154 million and no pension deficit, so operating profit covers interest payments by some 19 times. However, Pets At Home firm has an annual leasing bill of some £78 million and total lease commitments of over £550 million.

“Debenhams, another widely shorted stock, exited its period in private equity ownership burdened by some onerous leases on its buildings, while Toys R Us accumulated its debts under the stewardship of a consortium comprising Bain, KKR and Vornado Realty Trust.

“Pets At Home’s incoming boss Peter Pritchard will therefore be keen to demonstrate how the company can sustainably maximise returns from a market where demand seems to be relatively insensitive to the economic cycle but competition is picking up and a multi-channel offer is every bit as important here as it is in other areas of retailing.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 08/05/2024 - 11:46

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01