Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“At first glance Unilever’s mildly disappointing trading update, which revealed virtually zero volume growth for the fifth quarter in a row, looks unconnected to today’s sharp share price drops at WPP and Publicis – but appearances could be deceptive and Unilever’s cost-cutting drive could have profound implications for the global advertising agencies,” says AJ Bell Investment Director Russ Mould.

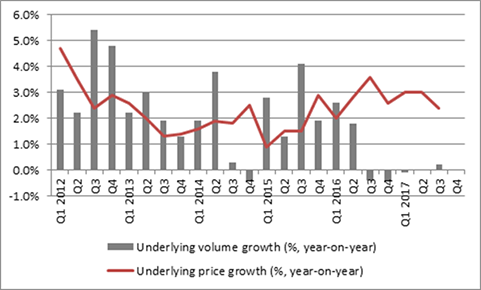

“Unilever’s underlying sales growth figure of 2.6% (or 2.8% excluding the spreads operations which are up for sale) means the Anglo-Dutch food to personal care and hygiene giant has undershot its 3% to 5% sales growth target for the third time in four quarters.

“The company sought to compensate for negligible volume growth by squeezing prices higher – a testament to the power of the group’s awesome range of brands, which includes Knorr, Ben & Jerry’s, Marmite, Persil and Domestos.

“However, price rose at the slowest rate for seven quarters as perhaps even Unilever found that loyal customers can only afford so much and are becoming ever-more price sensitive – a trend to which Reckitt Benckiser hinted yesterday when it flagged increased competition, especially in areas such as home care (Vanish) and laundry.

Source: Company accounts

“This will be a huge source of concern to shareholders, whose long-term support of companies such as Unilever and Reckitt is based on the high margins they generate as a result of the pricing power conferred upon them by their brands – especially as Unilever is being much more careful with its marketing spend, as one means of driving group operating margins toward boss Paul Polman’s 20% target for 2020.

“In 2016, Unilever cut its global spend on advertising for the first time since the recession of 2008:

| € million | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| Sales | 40,523 | 39,823 | 44,262 | 46,467 | 51,324 | 49,797 | 48,436 | 53,272 | 52,713 |

| Sales and marketing costs | 5,055 | 5,302 | 6,064 | 6,069 | 6,763 | 6,832 | 7,166 | 8,003 | 7,731 |

| As % revenues | 12.50% | 13.30% | 13.70% | 13.10% | 13.20% | 13.70% | 14.80% | 15.00% | 14.70% |

| Year-on-year change in spend | -4.40% | 4.90% | 14.40% | 0.10% | 11.40% | 1.00% | 4.90% | 11.70% | -3.40% |

Source: Company accounts

“This is a potentially big challenge for the major ad agencies, such as FTSE 100 member WPP and France’s Publicis, both of whom work with and for Unilever – especially when advertisers are also starting to question what they get out of online advertising, after revelations that many firms’ ads and brands were placed next to unsuitable or inappropriate content on web pages.

“While it is understandably keen to get the best return on its ad spend, and keep a close eye on costs, Unilever cannot cut too deep here. Without investment in its brands those names could begin to lose their lustre with consumers and thus the very pricing power upon which Unilever’s model (and lofty stock market valuation) is based.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06