Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“A third straight trading update without a profit warning, work to adapt the business model to boost both digital and print rental sales and the commencement of a £300 million share buyback programme on Wednesday are all giving shares in Pearson a boost today, even if long-term structural challenges still face the business,” says AJ Bell Investment Director Russ Mould.

“Under-fire chief executive John Fallon has bought himself some additional breathing room today by sticking to full-year profits guidance and even narrowing the range toward the top end, at £576 million to £606 million, compared to the £630 million achieved a year ago. Cost savings are helping while the tax charge will now come in at 16% rather than 21% as a further bonus.

“The absence of a warning is luring in buyers, or at least persuading short-sellers to take evasive action and close out their positions – some 4.5% of Pearson’s shares are out on loan according to shorttracker.co.uk.

“However, costs and tax benefits are relatively low quality ways of making or beating the numbers – organic sales and profits increases are much more highly prized by investors and it is here that Pearson still has the greatest number of questions to answer.

- Underlying sales in North America fell 4% in the first nine months of the year, compared to a flat performance in the first half.

- Total group sales fell 2% on an underlying basis against a 1% increase at the first-half stage.

“Trading clearly remains difficult but at least Fallon and his team are now preparing for “tough market conditions in our biggest business to continue over the next couple of years.”

“This is a much more pragmatic and realistic response to the slew of profit warnings issued in late 2016 and early 2017, when the company merely blamed a slowdown in student enrolment numbers and excessive inventories of textbooks in the USA (and management should have seen the latter coming a lot earlier in any case).

“A 20% jump in eBook revenues (on the back of 50% price cuts across 2,000 titles earlier in the year) and the development of a print rental pilot programme both show that Pearson is adapting its business model as best it can to make the best use of the prime educational content that has always been its source of strength.

“However, the rise of Open Education Resources (OER) remains a formidable long-term challenge and Pearson will have to produce several more in-line or better-than-expected trading statements to persuade the bears that its current profit woes are merely cyclical and not structural.

“Universities are now making best-of-breed lecturing and educational materials freely available, so other students and lecturers can copy, use, append and even modify the documents, and cut down on the expense of buying or even renting the sort of textbooks provided by Pearson.

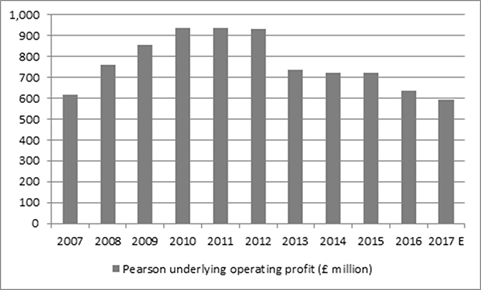

“The near-trend in Pearson’s underlying operating profit shows the company has a lot of work to do if it is to recapture some positive momentum in earnings, even allowing for the disposal in of the Financial Times and its 50% stake in the Economist in 2015 and the sale of a 22% stake in Penguin Random House to Germany’s Bertelsmann this year.”

Source: Company accounts. 2017E based on revised guidance range from Q3 statement on 17 October. Historic comparisons not rebased for disposal of Penguin Random House stake.

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 08/05/2024 - 11:46

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01