Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

"Over the past 12 months Morrisons shares are up by 26% and Next’s are down by 20% and today’s numbers show why," says AJ Bell Investment Director Russ Mould.

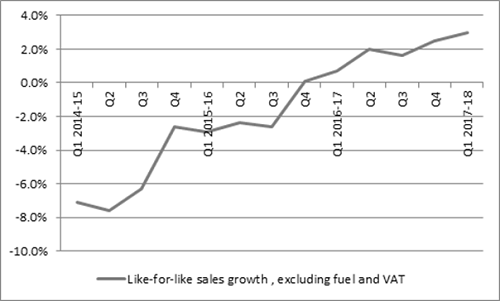

“Morrisons reported like-for-like-sales growth of 3% in its first quarter, the sixth consecutive period of growth and accelerating growth at that.

Source: Company accounts

“By contrast, Next has once more been obliged to shave down its sales growth and profits forecasts for the year.

“After reporting a 3% year-on-year drop in full-priced sales for its first quarter, chief executive Lord Wolfson steered expectations lower, as he cut the mid-point of his full-year sales forecast to -1.5% from -0.5% and full-year profit guidance to £710 million from £730 million.

“That is barely a 3% cut in profit estimates but the shares are down nearly 6%, whereas Morrison is flat, holding on to the strong gains of the past year, after opening some 2% higher.

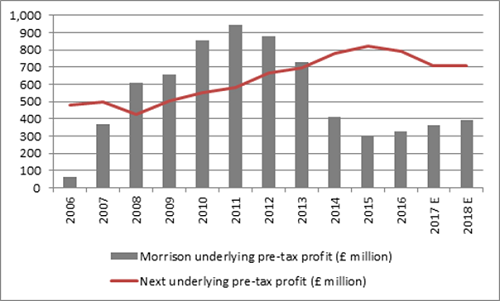

“Analysts are now expecting Morrisons to show earnings growth in 2017 and 2018, after it finally stopped a long string of profit declines in 2016, while Next’s profits are expected to decline in the next two years after 2016 ended a long run of consecutive increases:

Source: Company accounts

“The question investors need to address now is whether Next is sufficiently cheap as to merit portfolio inclusion.

“At its peak of £80 less than 18 months ago, investors were paying 18 to 19 time forward earnings for a stock where profits were expected to grow consistently in 2016, 2017 and 2018, even from what were already record levels.

“Now the stock trades on barely 10 times earnings which are expected to drop for at least three years in a row – so sentiment has turned. Instead of paying high multiples for peak earnings, the market is now paying low multiples of potentially depressed profits.

“This could be an over-reaction, and an opportunity for value investors, if the drop in profits proves transitory and the result of stock management issues, a short-term spike in UK inflation and broader economic uncertainty over Brexit.

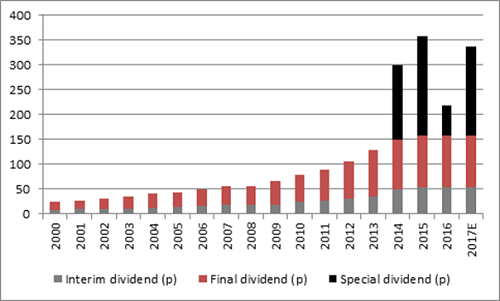

“Value hunters will also point to Next’s ordinary dividend of 158p a share, which equates to a 3.8% yield and is covered by earnings by more than 2.5 times (way above the FTSE 100 average of 1.7 times cover).

“They will also eye up Next’s announcement of a second special dividend for 2017 of 45p a share, to be paid on 1 August. Two more such payments are planned, potentially taking the total dividend to 338p a share for a dividend yield of 8%.

Source: Company accounts, Digital Look, consensus analysts’ forecasts

“What income seekers will then have to weigh up is whether Next’s woes are short-term and cyclical or long-term and structural.

“Potential long-term challenges include the challenge posed by web-based rivals and the battle between ‘bricks and clicks;’ record-levels of consumer debt in the UK; and the concept of ‘peak stuff.’

“The ideas suggest that millennials who share houses, because they cannot get on the property ladder, share jobs or work in the gig economy, may simply buy less material goods as they have no space or spare cash for them, preferring to spend on experiences instead.

“Anyone fearing this trio of tests may still fight shy of Next, as the risk of capital loss could then outweigh the potential benefits of the dividend, although there is no room for complacency for Morrisons shareholders, either, given how fearsomely competitive the supermarket business remains.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 08/05/2024 - 11:46

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01