Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

"A profit warning for 2017 and £7 million charge in 2016’s numbers to cover the cost of servicing poorly built houses and compensating the buyers is driving shares in Bovis lower this morning, but a new-found focus on quality of service and customers rather than just growth at any price means the housebuilder is already taking the steps which could help to revive both its stock and reputation in the coming months," says Russ Mould, AJ Bell Investment Director.

“Shareholders, stakeholders and potential buyers of Bovis Homes can all draw encouragement from today’s statement for three reasons, despite admission that 2017 volume completions will drop by 10% to 15%, well below market forecasts, and the subsequent share price plunge.

- “First, Bovis has learnt its lesson from 2016’s disaster. Chairman Ian Tyler and interim chief executive Earl Sibley are putting the quality of the product and customers first, focusing on long-term reputational and financial improvement over short-term earnings numbers and earnings triggers for options and bonuses. The company has put aside £7 million for customer redress after 2016’s unseemly scramble to complete homes too quickly (and meet profit targets) came unstuck, leaving some buyers with shoddy houses, and also decided to slow its build 2017 programme, cutting volume completions so standards can be upheld and customers be sold a better product, while increasing investment.

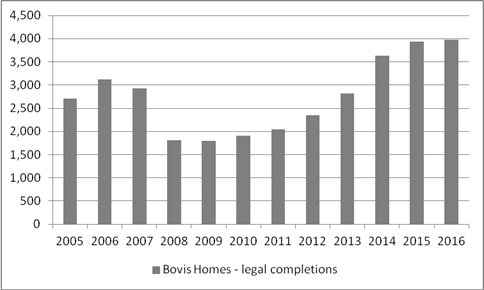

In 2017 Bovis is expected to show its first drop in completions since 2009

Source: Company accounts

- “Second, the company still has a net cash balance sheet. Its cash pile grew to just under £39 million in 2016 and as a result the company increased its dividend payment by 13% to 45p, enough for a 5.8% dividend yield on a share price of 769p. Earnings per share covered the dividend by two times in 2016 and management has stated its intention to hold the payment at 45p for 2017, despite the lower volume sales. Increased house prices will help here – the average selling price (ASP) of the existing land bank of £271,000 compares to 2016’s ASP of just under £255,000.

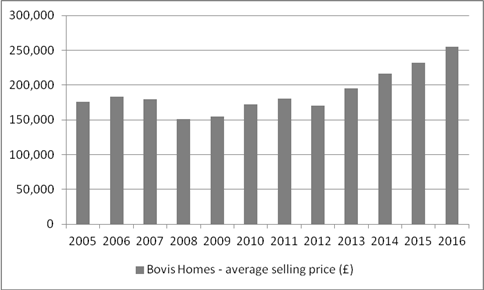

In 2017, Bovis is expecting another increase in selling prices

Source: Company accounts

- “Third, the company’s net asset value per share rose to 757p in 2016 and so the shares trade at barely one times book (or net asset) value. This means the shares are the cheapest among all of the major FTSE 100 and FTSE 250 housebuilders on this metric, which could look good value providing Tyler, Sibley and the eventual permanent CEO move quickly enough to contain the reputational damage done last year.

“All eyes will now be in one the identity of the new, full-time CEO and how his or her pay is structured.

“To really show the company has changed its spots the Remuneration Committee should set triggers for bonuses and stock options that put much greater weight on customer satisfaction ratings and where financial targets are involved they should be long-term and not short-term ones.”

These articles are for information purposes only and are not a personal recommendation or advice.Related content

- Wed, 08/05/2024 - 11:46

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01