As interest rates have risen over the last two years, cash products have grown in popularity. Especially Cash ISAs, which allow you to receive your interest tax-free.

But it’s not just cash accounts at the bank which pay interest. Which means it’s perfectly possible to benefit from higher interest rates within a Stocks and shares ISA too.

As with a Cash ISA, your interest in a Stocks and shares ISA is protected from income tax, so you don’t have to hand over any of the return your money is generating to the taxman.

Here are some of the investments available within a Stocks and shares ISA now enjoying better returns because of higher interest rates.

Money market funds

Money market funds saw rising demand from Stocks and shares ISA investors in 2023. These are funds which invest in cash-like instruments that can be converted into cash quickly.

They predominantly invest in short-term deposits with banks, and short-term loans to governments, banks and large companies. Some of these loans take place for as short a period as overnight.

Investors likely chose these funds in 2023 because they’re low risk, and yet were offering very respectable yields as interest rates rose, in sharp contrast to returns in the prior decade.

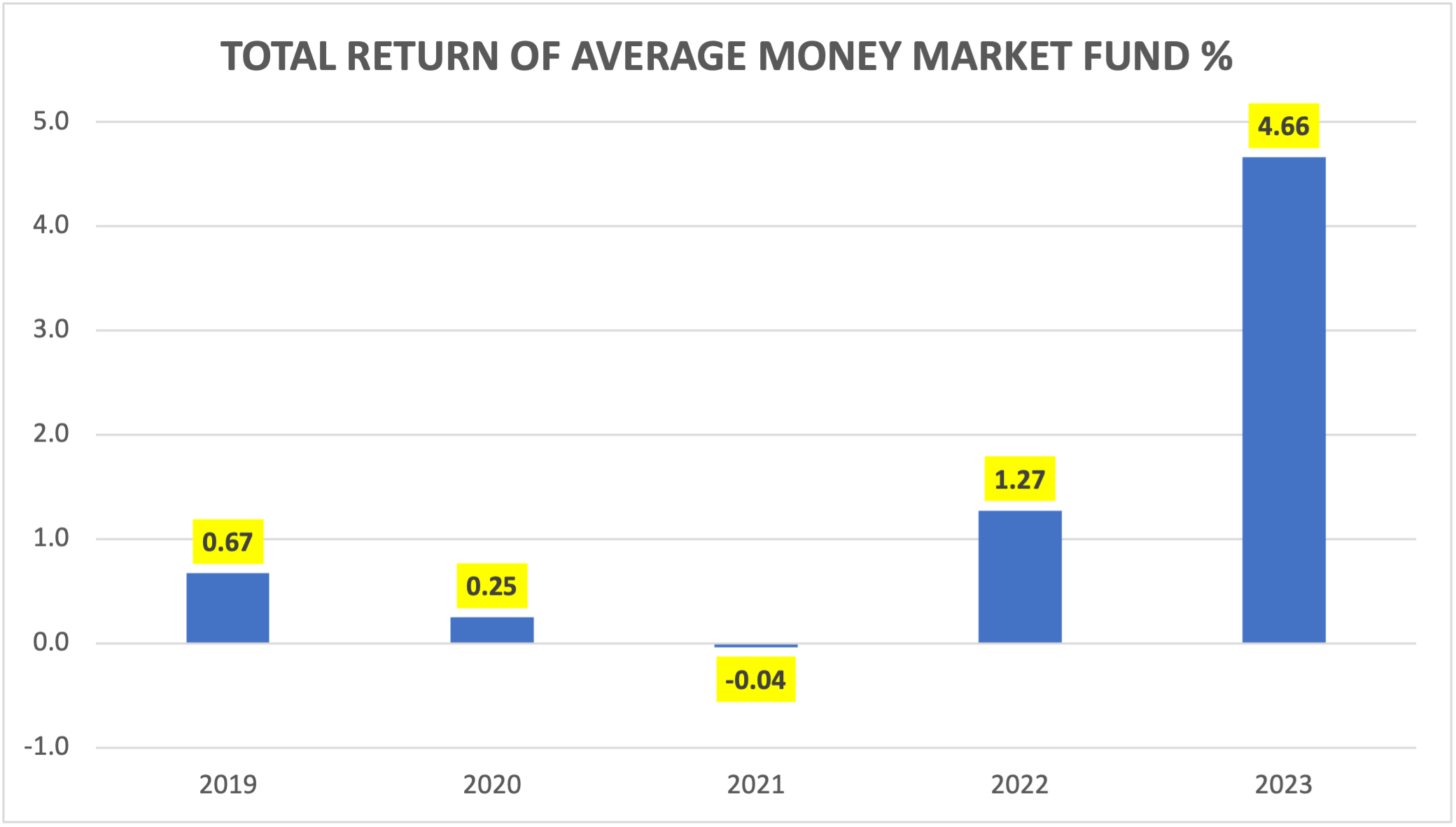

As you’ll see in the chart below, the return from the average money market fund last year was 4.66%. Remember, past performance isn’t a guarantee of future returns. The yields offered by these funds are variable, and depend on short-term interest rates – though rates are much higher than they were in the 2010s.

Source: Morningstar total return

Money market funds typically have low levels of volatility, which might interest more cautious investors.

There are two sectors containing money market funds – called the Standard Money Market sector and the Short-Term Money Market sector. Funds in the latter are required to hold more of their portfolio in short-term assets, in theory making them more liquid and secure.

Over the last ten years, the average money market fund racked up a maximum loss of just 0.1% over its worst period. That was when interest rates were close to zero, so not a great period for money market funds. And because yields were so low, overall returns were heavily influenced by annual fund management charges.

Fund management charges are generally low – on average just 0.16% – but in the days when the base rate was only 0.1%, those charges could easily result in a fund posting negative returns.

Now interest rates are above 5%, charges will still detract from returns, but there’s much more jam left over for investors. Just be aware that these funds don’t guarantee positive returns, and you should consider platform fees for holding the funds, too.

Bond funds

Bonds are essentially an IOU. Investors lend money to governments and companies in exchange for a set rate of interest, with the original face value repaid at a set date in the future.

For many years the rate of interest paid by bonds was uninspiring, causing some to describe government bonds as ‘return-free risk’. But rising interest rates have changed all that, and it’s now possible to pick up more appealing yields from bond funds.

Bond funds can and do fluctuate in value, and if interest rate expectations rise, you can expect to see bond prices fall.

Clearly, fluctuations in valuation do mean there is risk, but bonds can lower the volatility of your portfolio as a whole if you also hold shares. That’s because bonds, especially government bonds, tend to move in the opposite direction to share prices, so if you hold both in your portfolio, you should get a smoother ride.

Some bond funds invest predominantly in government bonds, while others invest almost exclusively in corporate bonds. Strategic bond funds tend to have a fairly wide remit in the areas of the bond universe they can invest in.

You may also come across high yield bond funds, which invest in the debt of companies that have a low credit rating. That makes these bonds riskier, but they usually carry higher yields as a result, which might interest more adventurous income-seekers.

Read more about the bond market

Individual gilts and corporate bonds

If you prefer, you can buy individual government bonds and corporate bonds instead of a bond fund.

Last year saw an uptick in the number of investors using individual gilts to park large sums of money and lock in higher interest rates, presumably as an alternative to moving into cash.

Gilts are loans to the UK government. So it’s near certain you’ll get your loan repaid, along with the interest promised, as there’s a low chance of the UK Exchequer defaulting on its debt obligations.

This is probably why investors with large sums of money have been using gilts, as bank deposits are only covered by the Financial Services Compensation Scheme up to a maximum of £85,000 if the bank goes bust.

Corporate bonds are considered less safe because they’re loans to companies, which are deemed more likely to default on their obligations than the UK government.

The price of bonds fluctuates on the market, but there will be a maturity date for each bond, at which point you’ll get the maturity value of the bond back, unless there’s a default. The maturity value, also called the par value, may be more or less than you paid for it, depending on the price at which you bought.

Many bonds are currently trading at below their par value. That means the return you can expect back between now and maturity is a combination of interest payments and capital gains.

Individual bonds can be a bit tricky to get your head around, so this approach is probably best left to more experienced investors or those who are willing to roll up their sleeves and delve into the nitty gritty.

Multi-asset funds

Multi-asset funds are another potential beneficiary of higher interest rates. As the name suggests, these funds invest across a range of assets, including shares, property, commodities, bonds and cash. These last two asset classes are now offering much higher interest rates: a boost to the managers running these funds.

Many managers running multi-asset portfolios steered clear of longer-dated bonds during the era of ultra-low interest rates, because prices were so eye-wateringly high. Now yields have risen and prices have fallen back, bonds are very much back in the comfort zone for multi-asset funds.

Multi-asset funds come in a range of risk profiles to suit investors with different appetites for volatility, so the amount of exposure you can get to bonds and cash ranges from very low to very high.

These funds might interest investors who want a mix of assets in their portfolio, but also want a professional fund manager to pick and choose what to invest in.

Data for fund charges and performance comes from Morningstar

Remember that investments go up and down in value, and you could lose money as well as make it. How you’re taxed will depend on your circumstances, and ISA and tax rules can change.

It’s easy to go in circles when deciding how to grow your money. Discover how both options can benefit you.

An AJ Bell Stocks and shares ISA is an easy, efficient way to invest. It’s completely tax free, so more of what you make stays in your pocket.

Related content

- Fri, 23/02/2024 - 17:03

- Fri, 23/02/2024 - 16:33

- Fri, 23/02/2024 - 15:28

- Fri, 23/02/2024 - 11:59

- Wed, 21/02/2024 - 08:53